This post was originally published on this site

The U.S. stock market’s correction isn’t likely to end until more market timers throw in the towel — and stay that way for more than a day or two.

We’re not there yet, even though in several trading sessions over the past month the market-timing community became excessively bearish. While this is positive from a contrarian standpoint, many timers turned bullish at the first sign of any rally. Their eagerness significantly weakened the strength of the contrarian stock-buying signal.

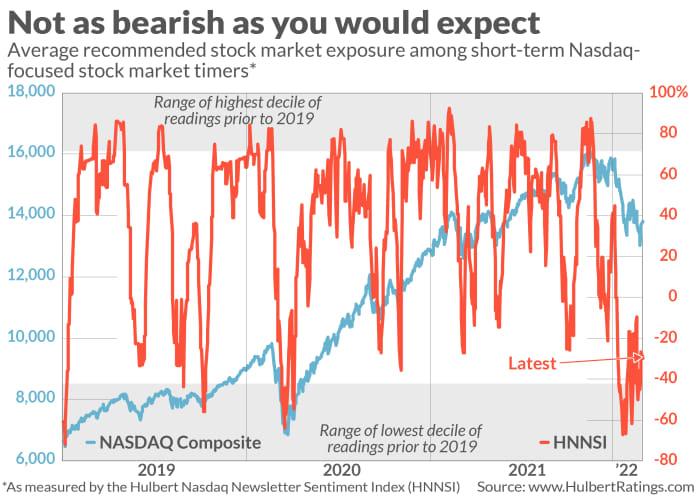

Consider the average recommended equity exposure among the Nasdaq-focused market timers that my firm monitors on a daily basis. (This average is what’s represented by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.) This is my most sensitive measure of stock market sentiment.

In late January the HNNSI average dropped to minus 67.2%, indicating that the average Nasdaq-focused market timer was recommending that two-thirds of clients’ equity trading portfolios be short the market. That was an aggressively bearish bet, suggesting to contrarians that surprises would be to the upside. Over the subsequent two weeks the Nasdaq Composite Index

COMP,

rose 5.2% while the S&P 500

SPX,

tacked on 4.3%.

Many market timers became more bullish during this period, with the HNNSI rising 57 percentage points. Though it has fallen back in recent sessions, it currently stands well above its late January low — at minus 29.7% versus minus 67.2%. The current reading puts the HNNSI at the 15th percentile of the historical distribution, above the 10th percentile which is the upper edge of the zone that in previous columns I have considered to represent excessive bearishness. (See the chart below.)

It’s amazing that the HNNSI is higher today than a month ago. Imagine being told in late January that the coming month would experience Russia’s invasion of Ukraine, Russia putting its nuclear forces on high alert, oil prices soaring to an eight-year high and U.S. inflation spiking to a 40-year high. I for one would have guessed that the HNNSI would fall even further — not jump more than 30 percentage points.

Where are the bears?

Contrarian investors would be more willing to bet that the correction is coming to an end if the market timers were more stubbornly bearish.

Given the volatile geopolitical situation right now, contrarians must acknowledge that it’s even harder than usual to forecast the U.S. stock market’s near-term direction. The market undoubtedly will rally in a big way if there’s good news from Ukraine. But if it does so before bearishness grows, that rally will be built on a shaky sentiment foundation, and therefore more suspect.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Plus: If you’re worried about a ‘black swan’ event sinking stocks deeper, here’s how to manage the risk