This post was originally published on this site

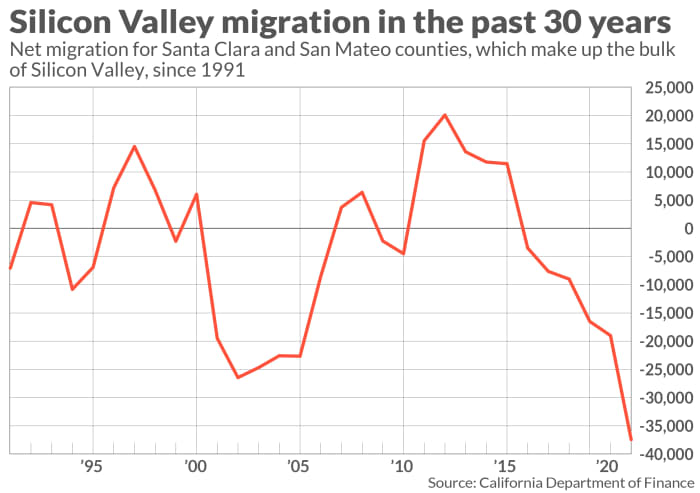

Silicon Valley lost 40,000 residents in 2021, the largest exodus since the dot-com bust, driven in part by a steep drop in migration into the area, according to an annual temperature check of the region.

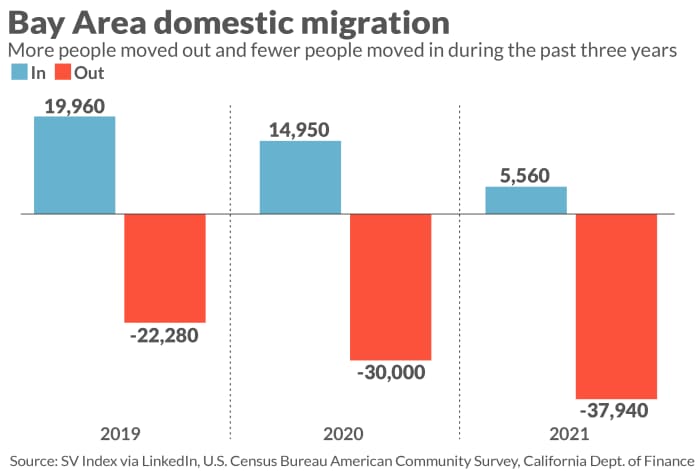

Only 5,560 people moved to Silicon Valley in 2021, nearly three times less than the year before, and a 72% decline from 2019. That big drop in people moving in was greater than the 70% increase in people moving out of the valley from 2019 to 2021. But about 65% of those who left the tech capital remained in the San Francisco Bay Area and California, according to the annual Silicon Valley Index.

The net effect was that “Silicon Valley’s population has declined for the first time in more than a dozen years,” Russell Hancock, chief executive of Joint Venture Silicon Valley, said this week in a news briefing detailing his group’s annual report.

The decline did not affect the money flowing into the region, nor the growth of its core industry. Other highlights of the index’s findings include a record-low unemployment rate of 2.9%, 15,000 new jobs and gains in tech wealth in the region, as well as record highs in venture-capital funding ($95 billion) and tech company market capitalization ($14 trillion).

Despite the tech industry’s resilience in the face of the coronavirus pandemic, the population estimate for the region — which comprises 39 cities in four different Bay Area counties — is now about 3.07 million, compared with about 3.08 million in 2020. Rachel Massaro, director of research for Joint Venture’s Institute for Regional Studies, said revised numbers from California’s Department of Finance combined with some other data sources led to a clearer picture from the one the index painted last year about the population of the valley.

For the index released last year, despite some out-migration, the data showed a slight increase in population in 2020. For this year’s index, the updated data and other factors show net population declines in the past three years when taking in-migration and out-migration into account: More than 2,300 in 2019, more than 15,000 in 2020 and more than 32,000 last year.

According to the index, factors in the net population decline include the lowest birth rates since 1979; a higher death rate that was partly driven by COVID-19, which accounted for 9% of the deaths in the region last year; and foreign immigration at its lowest level since 1991.

The foreign immigration decline — only 2,997 foreign immigrants moved to Silicon Valley in 2021, a 64% drop from 2020 and an 89% decline from the highest number reached in 2001 — can be attributed to “COVID and changes to immigration policy during the Trump administration,” Hancock said.

Outside the state, the top destinations for Silicon Valley residents who moved last year include Austin, Seattle, New York, Denver and Portland, according to the index, which cited data from LinkedIn. None of those cities attracted more than 3% apiece of those who left Silicon Valley, who overwhelmingly remained in California.

Massaro said it’s tough to tell who is leaving the valley. But she can make an educated guess when she considers other findings from the index, such as an ever-widening wealth gap and income inequality, the continuing increase in housing prices and where some of the defectors are moving.

“Higher-income people are coming in, lower-income people are going out,” she said. “Maybe they can’t afford to buy in Silicon Valley but they can be homeowners just outside the center of the region.” As more people can work from home, that might explain the 28% of the departures who moved to other parts of the Bay Area, and the 37% to other parts of California.

Hancock mentioned that four tech companies, Palantir Technologies Inc.

PLTR,

HP Enterprise Inc.

HPE,

Tesla Inc.

TSLA,

and Oracle Corp.

ORCL,

relocated their headquarters last year, but pointed out that a bulk of the workforces of Tesla and Oracle remain in Silicon Valley.

“Silicon Valley is losing some of its workforce to other places, but Silicon Valley companies are growing in other places,” he said. “Whether or not this is something we need to fret about is still an open question.”

Joint Venture is a nonprofit organization with ties to the public and private sectors in the region. Its Institute for Regional Studies releases reports and analyses about the people, companies and economy of Silicon Valley, which it defines as encompassing Santa Clara and San Mateo counties, plus three cities in Alameda County (Fremont, Newark and Union City) and one city (Scotts Valley) in Santa Cruz County.