This post was originally published on this site

Fear is in the air, with global equities bouncing around and havens on the rise as investors enter a decisive week that could bring a war or regional conflict to Europe, if Russia can’t be persuaded to back off a Ukraine invasion.

Wall Street is off to a mixed start, but a losing day would carry on what was seen late Friday, when investors appeared to reach a breaking point over geopolitics, multidecade high inflation, 10-year yields at 2% and fears the Federal Reserve will make a policy mistake.

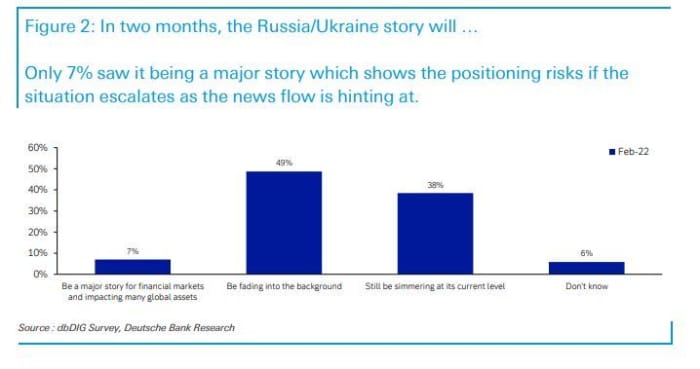

Judging by this chart from Deutsche Bank, from a survey completed before Friday’s meltdown, investors hadn’t quite been pricing in Ukraine worries.

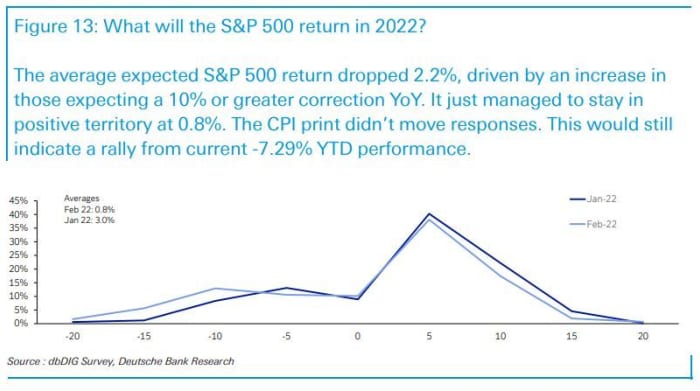

Here’s another chart that shows where those 430 global respondents to Deutsche Bank’s February survey see stocks ending this year — that is, barely positive, but still a rally from here:

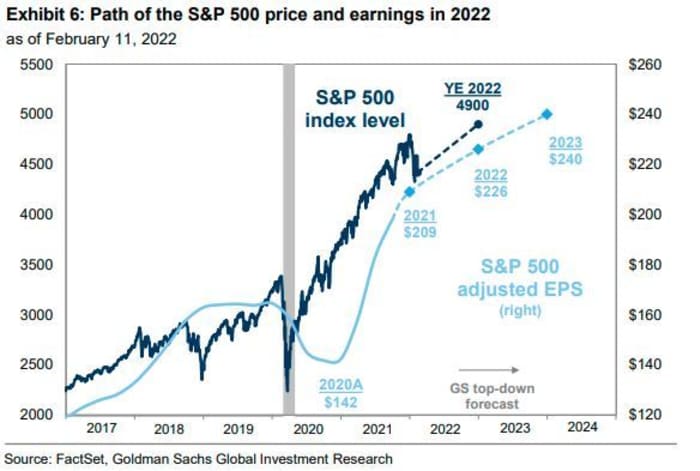

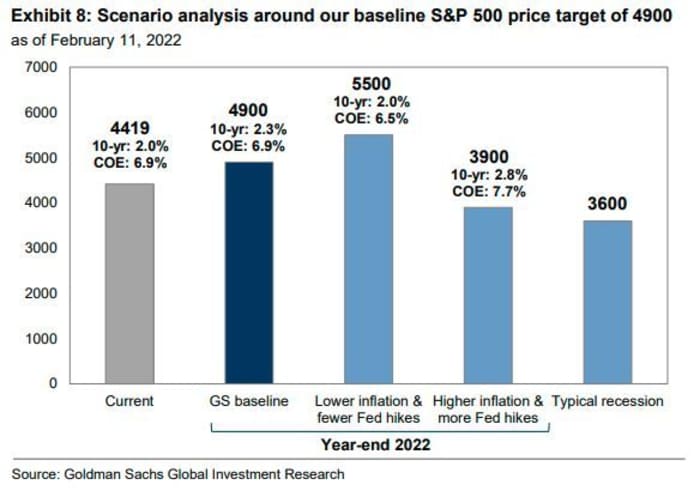

Over the weekend, Goldman Sachs rolled out its own fresh S&P 500 year-end forecast, dropping that to 4,900 from 5,100, which is still 11% higher than where prices closed Friday.

“The macro backdrop this year is considerably more challenging than in 2021. However, we continue to expect that equity prices will rise alongside earnings and reach a new all-time high in 2022,” said a team led by chief U.S. strategist David Kostin, in our call of the day.

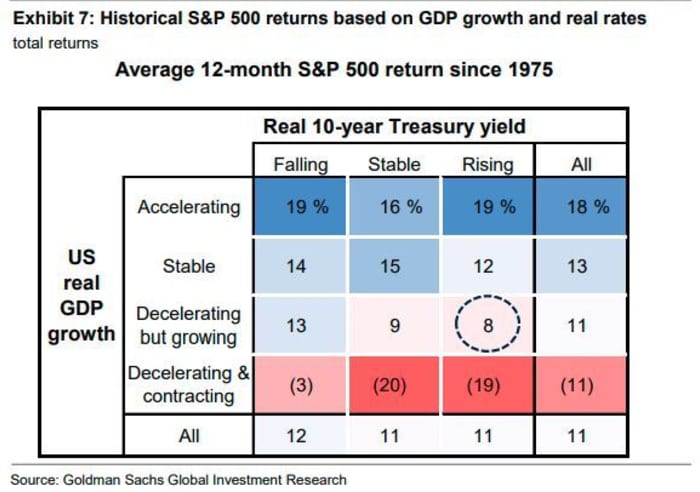

Over the last 50 years, a “Goldilocks” environment of rising gross domestic product and stable real yields has led to a 16% return for the S&P 500, the Goldman team noted. But when growth is slowing and yields are rising, that gain is pared to 8%. The team’s new forecast implies a 4% return for 2022 — “modestly below the historical average.”

There are caveats here though, as the team admitted “uncertainty abounds regarding the path of inflation and Fed policy.”

Kostin and the team see two-sided risks to their baseline S&P 500 forecast, but “with a larger downside tail,” and offered up three alternative scenarios for stocks apart from that baseline view:

- Inflation remains high and prompts continued Fed interest-rate increases, lifting the terminal funds rate beyond the market and Goldman’s own expectations. As a result, “the cost of equity would rise on net and the S&P 500 would decline by 12% to 3,900.”

- Inflation recedes by more than expected, meaning fewer Fed hikes, bringing down the cost of equity and sparking a rally for stocks that would take the S&P to 5,500, a 24% gain from Friday’s close.

- The U.S. tips into a recession, triggering the typical 24% recession peak-to-trough price decline that would take the S&P to 3,600.

As for sectors they like, Kostin and the team expect cyclical sectors, led by energy, to see continued margin recovery. Industrials and consumer discretionary may see margin expansion, but are at risk from supply-chain problems and a tight labor market. Technology and communications services will see margin contraction in 2022, with companies having to shell out on hiring and retention, research and development, and other operating expenses, they said.

Read: What a Russian invasion of Ukraine would mean for markets, as Biden warns Putin of ‘severe costs’

The buzz

Some optimism has crept into markets after Russian Foreign Minister Sergey Lavrov reportedly suggested that diplomatic talks continue to President Vladimir Putin who reportedly said: “All right.” That’s as Ukraine’s president was pleading for calm, while German Chancellor Olaf Scholz is headed to Kyiv and Moscow to diffuse tensions following inconclusive weekend talks between President Joe Biden and Russian President Vladimir Putin.

Splunk shares

SPLK,

are surging on reports of a $20 billion takeover offer from Cisco Systems

CSCO,

for the data analytics software company.

Billionaire George Soros’ investment fund took a more than $1 billion stake in electric-truck maker Rivian Automotive

RIVN,

according to a Securities and Exchange Commission filing.

NIO

NIO,

shares are falling, after Chinese data showed a drop in sales, with Tesla

TSLA,

stock also down after that update.

This week’s data highlights include retail sales, import prices and housing market updates, while St. Louis Fed President James Bullard will appear on CNBC at 8:30 a.m. Eastern. San Francisco Fed President Mary Daly warned Sunday against “abrupt and aggressive action” on interest rates. Kansas City Fed President Esther George said the central bank should consider asset sales but wasn’t convinced of the need for a 50-basis-point rate hike in March.

While COVID-19 restrictions ease up globally, New Zealand and Hong Kong are being overwhelmed by cases, and scientists are warning over what the next mutation could bring.

A crucial U.S.-Canada border crossing reopened late Sunday, after being closed for nearly a week due to protests over COVID-19 restrictions.

Arbitrators ruled Russian teen skating star Kamila Valieva can continue competing in the Winter Olympics, despite a failed drug test.

The markets

Stocks

DJIA,

COMP,

are mixed, with Europe

SXXP,

having a worse day, as oil prices

CL00,

BRN00,

bounce around and natural-gas prices

NG00,

stay elevated on both sides of the Atlantic amid Russia–Ukraine worries. Bond yields

TMUBMUSD10Y,

are climbing and the dollar

DXY,

is up, especially against the ruble

USDRUB,

which is under pressure. Asian stocks also saw a fairly sharp selloff led by the Nikkei

NIK,

The chart

Could Cathie Wood’s ARK Innovation Fund

ARKK,

work as a leading indicator for high-beta asset selloffs or rallies? Investor Louis Navellier is watching the exchange-traded fund closely.

While he doesn’t see much upside potential for the fund, if it rallies past last week’s high of $77.56, we are further away from the January bottom and there is likely more upside for the stock market. But he doesn’t see a rally past the high $80s and thinks “the recent bottom at $64.35 is on soggy ground.”

Top tickers

These were the top stock tickers on MarketWatch as of 6 a.m. Eastern Time.

Random reads

Tributes are pouring in for the late Ivan Reitman, director of comedy classics such as “Ghostbusters” and “Animal House.”

Remember your ex on Valentine’s Day by lining a cat-litter box with their name. For charity, of course.

Super Bowl commercial winners — it was all about star power and nostalgia.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.