This post was originally published on this site

Stock splits usually work, and the 20-for-1 split by Google’s parent company Alphabet may spark a wave.

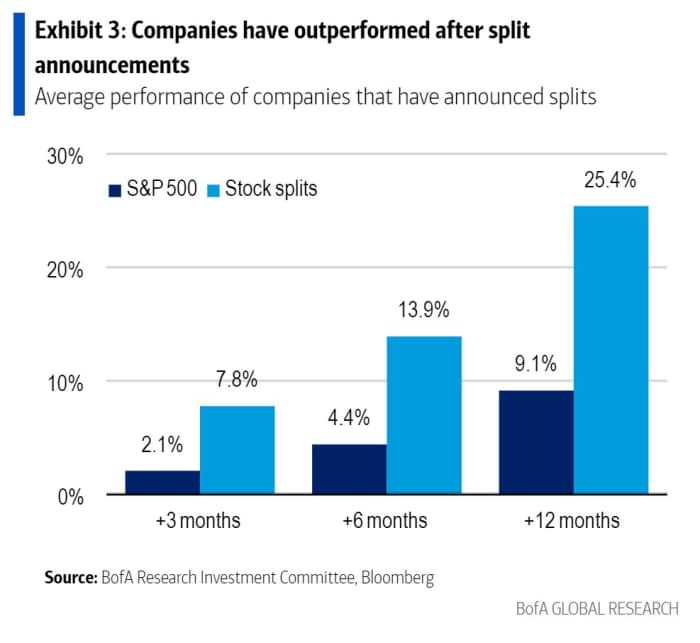

That’s according to analysis from Bank of America, which found that companies that have announced stock spluts have outperformed the market.

S&P 500

SPX,

stocks that have split, on average, have gained 25% over the next 12 months, compared to the 9% gain for the broad index.

“Some of the outperformance is likely due to momentum. Companies that announce splits have likely seen sustained market outperformance and expect that outperformance to continue,” say the Bank of America analysts. “Underlying strength in the company is a primary driver of elevated prices. Once the split is executed, investors who have wanted to gain or increase exposure may start to rush for the chance to buy.”

They’re becoming rarer, however, at just 28 over the past five years, compared to the peak of 346 between 1996 and 2000.

On Alphabet

GOOGL,

GOOG,

in particular, BofA analyst Justin Post says the split, and more aggressive stock buybacks, are suggestive of a management team becoming more shareholder friendly. “If more corporate managers adopt shareholder-friendly postures, it could spark a wave of splits and bring more investors flows into the market, proving support for embattled growth companies,” he adds. Read related commentary on the Alphabet split.

Some $6.6 trillion in market cap, or 17% of the S&P 500, trades above $500 per share.

The analysis however does not mention the growing proportion of brokers offering fractional ownership, which makes the high cost of a single share of stock less of an issue for retail investors.