This post was originally published on this site

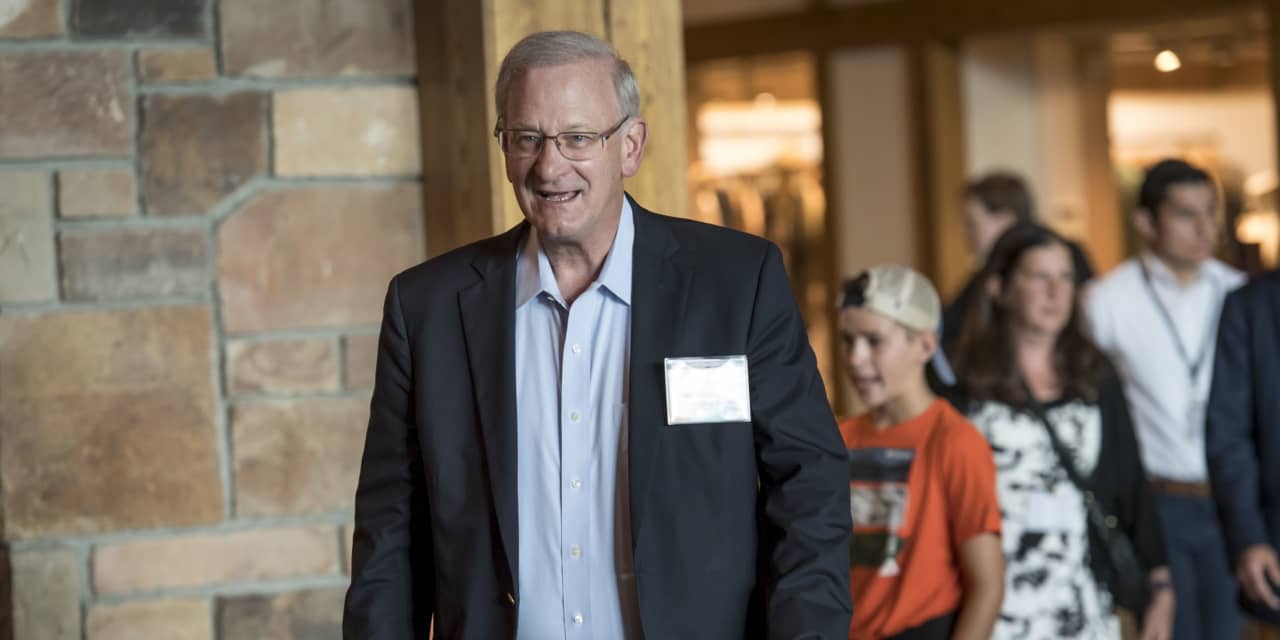

Former Federal Reserve insider Thomas Hoenig thinks the U.S. faces a painful reckoning because of high inflation.

Hoenig was a lone dissenter eight times in 2010, when the Fed voted to pursue a then-novel strategy, known as quantative easing, of buying trillions of dollars in Treasury and mortgage-backed bonds. The goal was to flood the U.S. with money and slash interest rates in an effort to juice up the economy.

The Fed doubled down on the strategy during the pandemic.

Then and now, Hoenig warned the policy could lead to more harm than good. Recently his warnings have gotten more attention. He was the subject of a large magazine profile in Politico and he was a guest on comedian-commentator Jon Stewart’s podcast.

Here are some of the excerpts from a Barron’s live interview with Hoenig, the former president of the Kansas City Federal Reserve Bank.

On the economy …

“It’s going to be a very difficult couple of years for the U.S. economy and the Federal Reserve. If they raise rates to bring inflation down, then the hard part begins. Because when that happens and the economy begins to slow, they’ll worry about recession. There’ll be a likelihood they ease policy again even while inflation remains four to five percent.”

““It’s going to be a very difficult couple of years for the U.S. economy and the Federal Reserve.””

On the cost of inflation …

“People are if nothing else sensitive to high inflation. They know what it is doing to them. They know they are losing ground across the board. When you go to the grocery store, you see the inflation and that is what people are paying attention to.”

On interest rates …

“I expect a modest in interest rates this year. Maybe a 1/2 point the first time [in March], depending on what inflation does from here. Then a quarter point for two or three times following that. Beyond that, I am not sure.”

On Fed’s balance sheet …

“I think they will be very slow in shrinking their [$9 trillion] balance sheet. It would affect the housing market because they buy a lot of mortgage-backed securities … they don’t want to do it too quickly … we’re probably talking about a decade to get the balance sheet back to any kind of balance. The thing is, it won’t come without pain.”

On asset ‘inflation’ …

“I was worried [quantative easing] would encourage a significant increase in asset values through the stock market, housing, real estate, all of which happened.”

On rich getting richer …

“If you own an asset, you win just from the inflationary effect … Usually it’s the upper middle [income] and wealthy who are in that position … If you’re a wage earner you’re going to fall behind … you have to borrow more or commit more of your income to housing.”

On the stock market …

“The value of the stock market

DJIA

SPX

will be under pressure as we have already seen … there’s more perhaps to come … I don’t necessarily think it has to collapse … it will grow more slowly … getting used to modest or no increases in asset values will be difficult.”

On what investors should do …

“I wish I had a magic answer to that.”

On the Fed persevering …

“If the economy starts to slow, I think the Fed will back away from a tightening policy until inflation becomes such an issue that it forces their hand. If we back away too soon from a higher interest rate environment, it will just delay our reckoning.”

On Chairman Jerome Powell …

“I think he can lead [the central bank] through this, but it won’t be easy. He needs the help of Congress. They really do need to deal with their spending. The Fed has basically enabled the government to borrow at will at very low rates.”