This post was originally published on this site

Gasoline prices are headed higher this spring. U.S. motor gasoline supplies have posted gains for the last five weeks in row, but some motorists are expected to pay $4 a gallon or more, on average, in the coming months.

Right now, it’s “the calm before the storm,” said Patrick De Haan, head of petroleum analysis at GasBuddy.

“March through May will see 10-cent to 25-cent per gallon increases every month,” which would put the national average in the range of $4 a gallon by Memorial Day in May. And there’s a good chance for the national average to reach $4 nationally, which would mean areas of California — the state that often pays the most — can “easily hit $5 a gallon,” De Haan said.

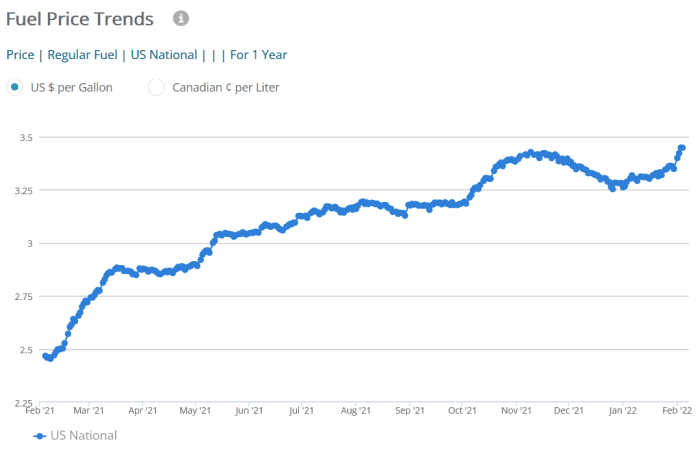

On Friday morning, the average price for regular unleaded stood at $3.469 a gallon, according to travel and navigation app GasBuddy. That is about $1 above the year-ago average price.

The highest recorded national average stands at $4.103 from July 16, 2008, GasBuddy data show. In California, the average was at $4.656 Friday morning, not far from the state’s highest recorded average on Nov. 23 of last year at $4.746.

Nationally, gasoline prices have been up for five straight weeks, “albeit a slow but steady rise, as omicron fears have tapered and geopolitical threats have emerged,” said De Haan.

GasBuddy

“Gasoline demand looks pretty weak,” which isn’t unusual for this time of year, contributing to the climb in gasoline inventories, he told MarketWatch. U.S. motor gasoline supplies rose by 2.1 million barrels for the week ended Jan. 28, marking a fifth consecutive weekly rise for the fuel, according to data from the Energy Information Administration.

But the gasoline stockpiles have a “shelf life” and will be purged by April, said De Haan, and total gasoline stocks stand just below their five-year average, so “right on par with normal builds and weak demand.” The EIA pegged motor gasoline supplies last week at about 2% below the five-year average for this time of year.

Tom Kloza, global head of energy analysis at the Oil Price Information Service, however, said there are several reasons to believe that “many U.S. motorists will face the highest prices of their lives this spring, as inflation continues to rear its ugly head in transportation costs.”

““Many U.S. motorists will face the highest prices of their lives this spring, as inflation continues to rear its ugly head in transportation costs.””

Among them, he points out that the crude-oil market has lost some players during the pandemic, particularly companies that once acted as “circuit breakers” for the market, so several exploration and production firms have said they won’t hedge in futures. “Fewer participants translate into more volatility” in the oil markets, said Kloza.

U.S. refinery capacity has also declined — to 18.1 million barrels per day, from a peak just shy of 19 million barrels per day in 2019 and 2020, he said.

Meanwhile, gasoline demand is “lumpier than ever,” and there will be some weeks from May through September when consumption surpasses 9.5 million barrels per day, Kloza said. The “U.S. gasoline distribution system is not built for peak summer demand.”

The EIA currently expects average 2022 gasoline consumption to approach 9.1 million barrels per day.

Overall, gasoline prices have remained elevated because there is “faith that supplies will be tight as the ‘perishable’ gasoline is purged to make way” for the spring and summer’s more difficult-to-make grades of gasoline, which are more environmentally friendly, Kloza said.

Virtually all of the roughly 250 million barrels of U.S. gasoline inventory is of the winter grade, he said. “Think of it as bananas. They will be brown bananas and useless for distribution in the second quarter.”

February gasoline inventories are “meaningless,” said Kloza. The key is how much summer-grade gasoline we have in April.