This post was originally published on this site

Welcome to another edition of ETF Wrap. Wednesday was a good day for Google parent Alphabet as much as Thursday is turning out to be a terrible one for Meta Platforms, the social-media company formerly known as Facebook Inc.

FB,

which is having its worst day on record and that has implications for a host of exchange-traded funds. We’ll discuss how that is playing out.

We also chatted with the folks at Grayscale Investments, which launched a future of finance ETF, and it may have come at an inopportune, with PayPal Holdings Inc.

PYPL,

in free fall.

Send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn, as some of you are wont to do, to tell me what we need to be covering.

The good

| Top 5 gainers of the past week | %Performance |

|

ARK Fintech Innovation ETF ARKF, |

12.3 |

|

ARK Innovation ETF ARKK, |

11.7 |

|

WisdomTree Cloud Computing Fund WCLD, |

11.5 |

|

ARK Genomic Revolution ETF ARKG, |

11.2 |

|

iShares MSCI Russia ETF ERUS, |

11.2 |

| Source: FactSet, through Wednesday, Feb. 2, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Top 5 decliners of the past week | %Performance |

|

Aberdeen Standard Physical Silver Shares ETF SIVR, |

-3.6 |

|

iShares Silver Trust SLV, |

-3.6 |

|

iShares MSCI China A ETF CNYA, |

-2.3 |

|

KraneShares Bosera MSCI China A 50 Connect Index ETF KBA, |

-2.1 |

|

Xtrackers Harvest CSI 300 China A-Shares ETF ASHR, |

-2.0 |

| Source: FactSet |

Faceplant for ETFs?

ETFs are still the best way, and cheapest, way to gain exposure to a sector or theme in the market that was once only accessible to deep-pocketed investors, but there are risks to investing in ETFs, just as there are with any investment.

The decline of Facebook owner Meta Platforms highlights the perils of buying funds that might have outsize exposure in any one company.

Notably, Facebook shares were down around 25%, at last check on Thursday, which would mark the worst daily percentage drop on record, if the decline holds through the close, according to Dow Jones Market Data. There are more than 300 ETFs that offer exposure to Meta, with XLC, the Communication Services Select Sector SPDR Fund

XLC,

possessing the biggest exposure, according to ETF.com.

As Barron’s reports the XLC, referring to the ETFs popular ticker has a 23% weighting in Meta. The roughly $13 billion ETF was down over 5% on Thursday, at last check, but is mostly flat on the week, because it also holds a sizable stake in Google parent Alphabet Inc.

GOOGL,

GOOG,

which is up over 10% so far this week.

The Facebook owner’s shares represent about 17% of the smaller $3 billion Vanguard Communications Services ETF

VOX,

and Meta was one of the fund’s top 5 sales, 96 million shares, recently, according to FactSet data. The Vanguard ETF’s shares are down over 4% on Thursday but looking at a modest 0.8% weekly advance, with its 22% stake in Alphabet helping to offset its decline.

Meanwhile, the $309 million Global X Social Media ETF

SOCL,

is down 6% on Thursday and marginally for the week, with Meta its top holding, representing nearly 13% of the fund, ahead of Tencent Holdings Ltd.

700,

There are perhaps two important takeaways from the composition of these ETFs: 1) A clear benefit is that diversity can help buffer weakness in other parts of a fund; 2) it is important to know the weightings in your ETFs; 3) and not all assets that we think of as tech are classified in the same way. Facebook and Google are both considered communication services, along with companies such as Verizon Communications

VZ,

and AT & T

T,

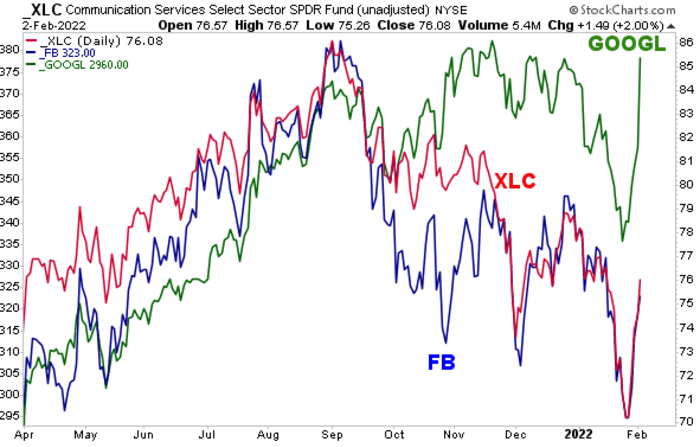

Visual of the week

Instinet’s market technician Frank Cappelleri says that Facebook’s Meta and Google have been moving in lockstep with the XLC:

Instinet

“From there, FB’s troubles began and haven’t stopped. As GOOGL recovered and made new highs, FB continued lower, pulling XLC along with it,” he wrote in a Thursday note.

Grayscale’s future of finance

It isn’t a spot bitcoin ETF but the folks at Grayscale Investments say that they are expecting strong appetite for its Grayscale Future of Finance ETF

GFOF,

which kicked off Wednesday.

The timing for the fund, however, is unfortunate as one of its largest constituents, PayPal suffered a 24.6% plunge on Wednesday, marking the worst percentage decline in its history.

Yes, GFOF is off to a lackluster start, down 1.7% on Thursday, but it has longer-term aspirations. The fund tracks the investment performance of the recently launched Bloomberg Grayscale Future of Finance Index, comprising companies representing the “Future of Finance,” including asset managers, exchanges and wealth managers, financial infrastructure companies and financial-focused data processing outfits.

“This is not a bitcoin replication product. This is a brand new theme we are defining,” David LaValle, the newly appointed global head of ETFs at Grayscale, told ETF Wrap.

Lavalle said that Grayscale is continuing to pursue its ambitions to convert its bitcoin

BTCUSD,

fund, the Grayscale Bitcoin Trust

GBTC,

or GBTC, into an ETF.

Our ETF efforts are “running in parallel to achieving [a conversion of] GBTC,” he said. “We have a rule filing in front of [the Securities and Exchange Commission]…and that expires in the first week of July,” he explained.

Revenge of the ARK

ARK is having a mini moment this week. Several of the ARK Invest’s funds, which have been battered and bruised since February of last year, were rising this week, highlighted by flagship ARK Innovation

ARKK,

(see attached table). ARK funds have a long way to go, with many having lost at least half of their value in the past 12 months.

However some folks are waxing more opportunistic on the speculative investment portfolios run by Cathie Wood.

TV personality Jim Cramer on CNBC recently said he likes most of the ARK Innovation ETF’s top holdings after the meltdown in many of the so-called unprofitable tech companies that populated its funds. ARK funds have been underperforming the broader market, including the Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the technology-laden Nasdaq Composite Index

COMP,

“These growth stocks have come down enough that they’re tempting enough to buy right here—then you can buy a little more at lower levels if they keep going lower,” he said.

Russian roulette?

As tensions rise in Russia, MarketWatch’s Phil van Doorn writes that an easy way to get exposure to the region is through the $512 million iShares MSCI Russia ETF ERUS, which tracks the MSCI Russia 25/50 Index.

He said investing in Russia means investing in oil and natural gas. And with demand for both rising as the world economy recovers from the coronavirus pandemic, a play on Moscow may serve investors well, despite the conflict over Ukraine.

That said, it is worth noting that Russian stocks have pulled back significantly over the past three months, but the decline has been based almost entirely on investors’ sentiment—the forward earnings estimates have hardly budged, he wrote. Factoring in the long-term nature of conflict between Russia and Ukraine, and how animosities have settled previously, this might be an excellent buying point for investors with an appetite for risk, van Doorn said.

The iShares MSCI Russia ETF is up 1.4% so far this week but down 10% in the year to date. It carries an expense ratio of 0.59%, which translates to an annual cost of $5.90 for every $1,000 invested. The larger $1.3 billion VanEck Russia ETF

RSX,

is up 1.6% on the week and down 11% in the year to date. It has an expense ratio of 0.67%.

Engine No. 1’s new fund

Activist shop Engine No. 1, an investment firm that drives performance by tying companies’ social and environmental actions to economic outcomes, launched what it describes as its first thematic ETF, the Engine No. 1 Transform Climate ETF

NETZ,

The new fund is actively managed and aims to invest in companies that will drive and benefit from the energy transition.

“While most climate-focused funds avoid so-called ‘brown’ legacy companies, we believe there is no way to decarbonize the planet without these companies transforming, and there is no time to lose,” said Chris James, Founder of Engine No. 1, in a statement.

The firm kicked off its first ETF in June, the Engine No. 1 Transform 500 ETF

VOTE,

which trades under the ticker “VOTE.”

Engine No. 1 garnered attention last year when it successfully pushed for change at Exxon Mobil Corp.

XOM,

The monthly flows

Are the ETF inflows cooling in 2022?

Morningstar data show that ETFs collected $36.3 billion of new money in January, which would have ranked as the lowest monthly total of 2021, a record year for the segment of the market. Fixed-income ETFs surrendered $5.9 billion to withdrawals—their first month of outflows since March 2020.

Morningstar reported that portfolio’s fixed-income allocation fared better but still declined last month. Vanguard Total Bond Market ETF

BND,

and Vanguard Total International Bond ETF

BNDX,

lost 2.06% and 1.38%, respectively, the data provider noted.