This post was originally published on this site

Shares of Robinhood Markets Inc. bounced sharply Friday off a record low, as some analysts saw the trading app’s disappointing fourth-quarter results as a temporary negative ebb to coming flow of “notable positives.”

The stock

HOOD,

tumbled as much as 14.4% to an intraday low of $9.94, before reversing course to close up 9.7% at $12.73. What helped fuel the bounce, a federal judge in Florida has thrown out a negligence lawsuit over the company’s handling of the “meme stock” trading frenzy last year.

Don’t miss: Opinion: Robinhood is about to not celebrate a very unhappy anniversary.

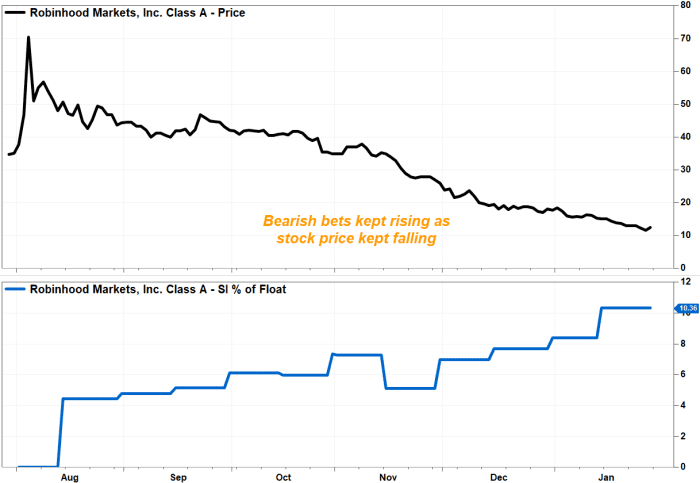

Despite the bounce, the stock, which went public six months ago, has closed at record lows 10 times in January, and has was about 67% below its $38 initial-public-offering price.

Meanwhile, the stock’s short interest, or bets that the stock would fall, has roughly doubled in two months to 38.8 million shares as of mid-January, to lift the short interest as a percent of the public float of share to 10.36%. That compares with the percentage for “meme stocks” GameStop Inc.

GME,

of 14.89% and AMC Entertainment Holdings Inc.

AMC,

of 18.94%.

FactSet, MarketWatch

The company reported late Thursday a trifecta of misses, as losses were wider than expected, sales rose less than forecasts as trading volumes fell, and as first-quarter sales guidance was well below Wall Street’s projections.

No less than eight of the 15 analysts surveyed by FactSet who cover Robinhood followed by cutting their price targets. That knocked the average target down to $22.31 from $38.38 at the end of December, but the new average target still implies about 75% upside from current levels.

There were five analysts who were bullish on the stock and eight others who were neutral, while only two were bearish.

FactSet, MarketWatch

KeyBanc Capital’s Josh Beck was one of the bullish ones, as he reiterated on Friday the overweight rating he’s had on the stock since it went public, but chopped his price target by 40%, to $15 from $25.

Beck said he has “meaningfully” cut his estimates, given that “trading volumes meaningfully slowed in recent months as the growth/crypto/meme craze faded.”

However, he now feels that 2022 is “de-risked.” At a stock price of $10, Beck said about 75% of the company’s value is represented in cash, which he believes creates a “floor” for the stock. As a result, “we see intrinsic value amongst the highly engaged [20+-million] user base,” Beck wrote in a note to clients, “thus recommend investors build positions.”

Analyst Devin Ryan at JMP Securities, who is the biggest Robinhood bull on the Street, cut his price target to $45 from $58, but the target still implies more than 250% upside.

Ryan said the quarterly results were “mediocre,” and he still sees “plenty to be excited about.” He said his confidence that Robinhood can diversify its business further beyond just a trading offering is actually higher heading out of the results.

“The company said it well, that its ‘growth comes in waves’ and the brokerage business has inherent ebbs and flows that we appreciate can drive volatility in sentiment, though we believe the revenue highs are moving much higher and the lows much higher as the scale and breadth of the platform has increased tremendously, which will increasingly manifest in results in the coming quarters,” Ryan wrote.

Mizuho’s Dan Dolev kept his rating at buy and his price target at $20, saying that the stock’s weakness Friday was just a “knee-jerk reaction” to the numbers that missed expectations, and ignored some “notable positives” in the report.

“Most notably, we are seeing early signs of stabilization in MAUs [monthly active users], where the rate of declines appears to be abating,” Dolev wrote. “Moreover, ARPU [average revenue per user] was surprisingly stable, barely changing vs. the 3Q’s levels.”

Meanwhile, Deutsche Bank’s Brian Bedell kept his rating at hold, while cutting his price target to $12 from $15. He said that while the results provided an “encouraging step forward,” they showed there was a still a while to go to achieve sustainable profitability.

“[W]e think sustainable profitability is still at least a year away, and investors will likely want to see tangible progress before warming back up to the stock,” Bedell wrote. “Thus we see the stock trading in a wide range near current levels and reiterate our hold rating.”

The stock has dropped 63.6% over the past three months, while the S&P 500 index

SPX,

has slipped 3.8%.