This post was originally published on this site

The threat of a devastating European ground war hasn’t done much to rattle financial markets so far, but investors still appear likely to snap up traditional safe-haven assets should Russia attack Ukraine, market watchers said.

In that event, the “typical kind of conflict responses” would likely be in play, including moves into long-duration Treasurys, as well as a spike in prices for oil and European natural gas, Garrett DeSimone, head of quantitative research at OptionMetrics, told MarketWatch. Such moves would likely prove short-lived, he said.

Talks continue

Top U.S. and Russian diplomats met Friday in Geneva. The discussions appeared to make little progress, but saw officials pledge to continue talks in an effort to defuse the crisis.

Read: U.S. and Russia agree to continue talks aimed at defusing Ukraine standoff

Moscow has moved around 100,000 troops near Ukraine in response to what it says are threats to its security from the North Atlantic Treaty Organization and Western powers. The move has stoked fears of a Russian attack.

While a direct military response from the U.S. and its Western allies is seen as off the table, President Joe Biden has vowed hard-hitting sanctions. Russia, a key supplier of energy to Europe, is seen likely using those resources as leverage in response to Western sanctions.

Uncertainty around the response was heightened, however, after Biden, in a Wednesday news conference, said a “minor incursion” by Russia into Ukraine would prompt a fight between the U.S. and its allies over what actions to take. On Thursday, Biden moved to clarify his remarks, saying, “If any assembled Russian units move across the Ukrainian border, that is an invasion” and that if Russian President Vladimir Putin “makes this choice, Russia will pay a heavy price.”

All about energy

Russia’s annexation of Ukraine’s Crimean peninsula in 2014 created bouts of volatility, but nothing that knocked global markets out of their stride, noted Steve Barrow, head of G-10 strategy at Standard Bank, in a note. Investors, however, can’t count on a similarly subdued reaction in the event of a full-scale invasion, he said.

Russia’s role as a supplier of natural gas to Western Europe means that energy prices could spark bouts of volatility across other financial markets. A conflict between Russia and Ukraine would likely cause natural-gas prices to spike, even if its only a knee-jerk reaction, Barrow said.

“Presumably other energy prices would spike in tandem and this could unnerve financial asset prices in a way that proves far more significant that we saw in 2014,” he said. “Safe-haven demand would likely increase for assets such as Treasurys, the dollar, yen and the Swiss franc.”

Read: Tensions between Russia and Ukraine aren’t fully priced into commodities

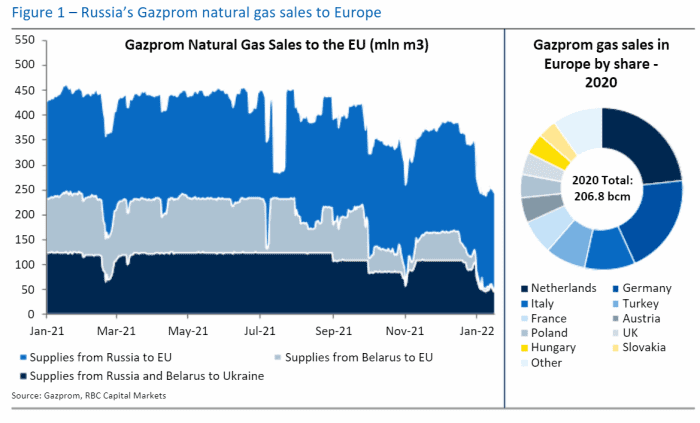

Washington policy makers have signaled they would attempt to exempt energy from a crippling package of financial sanctions currently being prepared, but “there is a clear expectation that Moscow would look to weaponize energy exports in order to change the decision-making calculus in Western capitals,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a Wednesday note. (see chart below).

RBC Capital Markets

That’s created a scramble to secure additional gas supplies for Europe to compensate for a steep reduction in Russian exports, she said, though the question is “where to find those additional volumes.”

While liquid natural-gas cargoes can be diverted from elsewhere, U.S. LNG export capacity was in the 90% to 95% utilization range so far in January leaving limited additional capacity available, and globally, she wrote.

A combination of factors, including jitters over Ukraine and curtailed Russian pipeline flows, have been blamed for a surge in European natural-gas prices this winter. Dutch natural-gas futures have risen more than 13% in the year to date after more than tripling in 2021.

Dollar positive

Energy-related volatility would likely translate into gains for the U.S. currency versus the euro

EURUSD,

wrote strategists at ING, in a Friday note.

“Any escalation should be a clear dollar positive — on the view that Europe’s dependence on Russia’s energy exports will be exposed even more,” they said.

Meanwhile, gold, which is holding on to a weekly gain, could also benefit from haven flows, said Standard Bank’s Barrow, “though its path is harder to call and will likely depend on the strength of the dollar, he said. That’s because a soaring dollar, which can be a negative for commodities priced in the currency, would leave the yellow metal struggling to get a lift from the conflict.

Financial markets have seen a volatile start to 2022. U.S. stocks were headed for another losing week, with the tech-heavy Nasdaq Composite

COMP,

having already slipped into correction territory as it fell more than 10% from its November high. The Dow Jones Industrial Average

DJIA,

has retreated to a level last seen in early December, while the S&P 500

SPX,

was trading at a roughly three-month low.

Geopolitical or macro?

The move lower for stocks has been attributed largely to shifting expectations around the Federal Reserve rather than geopolitical jitters. The Fed is expected to be much more aggressive than previously anticipated in raising interest rates and otherwise tightening monetary policy in response to inflation.

Indeed, a Fed-inspired Treasury market selloff has sent ripples through other assets as yields, which move in the opposite direction of price, rose sharply to begin 2022. In the event of a geopolitical flare-up that stirs a classic flight to quality as risk-averse investors seek shelter, yields would be expected to fall sharply.

The 10-year Treasury yield

TMUBMUSD10Y,

which hit a two-year high near 1.9% on Wednesday, pulled back Thursday and Friday to trade near 1.75%, though the renewed buying interest was tied to technical factors and also seen as a response to the deepening equity selloff rather than haven-related buying.

Notably, near-term futures on the Cboe Volatility Index

VX00,

have moved above later-dated contracts, inverting the so-called futures curve — a move that signals investors see heightened risk of near-term volatility, said DeSimone at OptionMetrics, but noted that move also likely reflects Fed-related concerns as well.

Meanwhile, the VanEck Russia exchange-traded fund RSX is down more than 13% so far in January and has dropped over 30% from a more-than-nine-year high set in late October. The Russian ruble USDRUB is down more than 3% versus the U.S. dollar in January.

Past lessons

When it comes to equities, the takeaway from past geopolitical crises may be that it’s best not to sell into a panic, wrote MarketWatch columnist Mark Hulbert in September.

He noted data compiled by Ned Davis Research examining the 28 worst political or economic crises over the six decades before the 9/11 attacks in 2001. In 19 cases, the Dow was higher six months after the crisis began. The average six-month gain following all 28 crises was 2.3%. In the aftermath of 9/11, which left markets closed for several days, the Dow fell 17.5% at its low but recovered to trade above its Sept. 10 level by Oct. 26, six weeks later.