This post was originally published on this site

The argument has long existed — some bitcoin supporters have touted the cryptocurrency as “digital gold,” a hedge against inflation and a store of value.

But others point out that bitcoin lately has been trading in tandem with sentiment around the stock market, especially during the past few months, as investors adjust to the Federal Reserve’s plans to tighten financial conditions for the first time in nearly two years, and sooner than previously expected.

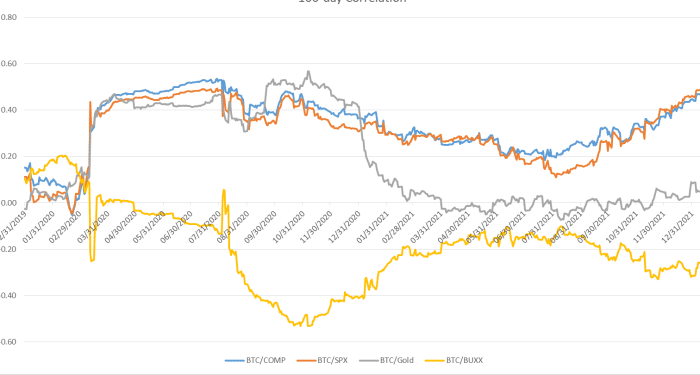

As evidence of that trend, the 100-day correlation between bitcoin

BTCUSD,

and stocks represented by the S&P 500

SPX,

reached about 0.49 on Tuesday, the highest level since July 2020, according to Dow Jones Market data.

What’s more, the 60-day correlation between bitcoin and S&P 500 reached 0.54, the highest since at least 2010, the early days of the cryptocurrency.

Correlation, which refers to the extent to which different assets are trading in relation to each other, ranges in magnitude from -1.00 to 1.00. A positive correlation means assets have been moving in the same direction, while a negative correlation means they moved in the opposite direction.

The larger the absolute value of the coefficient, the stronger the relationship. This chart shows that bitcoin maintained a positive correlation with the S&P and the Nasdaq Composite since February 2020, respectively, meaning that the assets have been moving generally in the same direction. It also shows an upward trend in bitcoin’s correlation with both the S&P 500 and the Nasdaq Composite since August 2021.

Correlation coefficient between bitcoin and the Nasdaq Composite, the S&P 500, Gold, and WSJ Dollar Index, respectively (excluding weekend changes of bitcoin)

Dow Jones Market Data, CoinDesk

Specifically, the 100-day correlation between bitcoin and tech stocks represented by the Nasdaq Composite

COMP,

reached a local high of around 0.47 on Friday, the highest level since October 2020.

The rate-sensitive Nasdaq tumbled in a rough start to the year, ending the first week three percentage points away from correction territory, before recouping significant lost ground on Monday and Tuesday.

Since early 2021, the correlation coefficient between bitcoin and the S&P 500 or the Nasdaq Composite has been much higher than between bitcoin and gold, which has been traditionally seen as a hedge against inflation. Bitcoin and gold, however, had a negative correlation during several periods.

“Towards the second half or end of last year, I think bitcoin really got caught up with the macro environment,” Jason Lau, chief operating officer at crypto exchange OkCoin said. “News about the Fed, news about COVID, news about whatever … especially with the inflation expectations, really fed into sort of that narrative.”

As bitcoin traded lower from its November high, crypto mining stocks posted even larger losses. According to crypto data analytics firm Arcane Research, its market-cap weighted index, consisting of 15 of the biggest publicly-traded bitcoin mining companies, is down almost 50%, in contrast with the 38% decline of bitcoin since Nov. 10, when bitcoin reached an all-time high.

Mining stocks tend to outperform bitcoin in bull cycles and underperform bitcoin when trading in a downward trend, Arcane research noted in a Tuesday report.

With U.S. stocks ended higher on Tuesday, bitcoin also rebounded from Monday losses, trading at around $42,873, up 2.8% over the past 24 hours. Ether

ETHUSD,

gained 5.6% to about $3,242. Bitcoin mining company Marathon Digital Holdings

MARA,

closed 2.2% higher on Tuesday at around $29.58. Crypto mining equipment company Ebang International

EBON,

logged a 9.6% gain at around $1.03.

The Dow Jones Industrial Average

DJIA,

finished up 183 points Tuesday, or 0.5%, at around 36,252. The S&P 500 ended 0.9% higher, while the Nasdaq Composite booked a 1.4% gain.

Read more: Nasdaq leads stocks higher as investors take Powell testimony in stride

Listen to: How crypto is making us rethink money

—Ken Jimenez contributed to this article