This post was originally published on this site

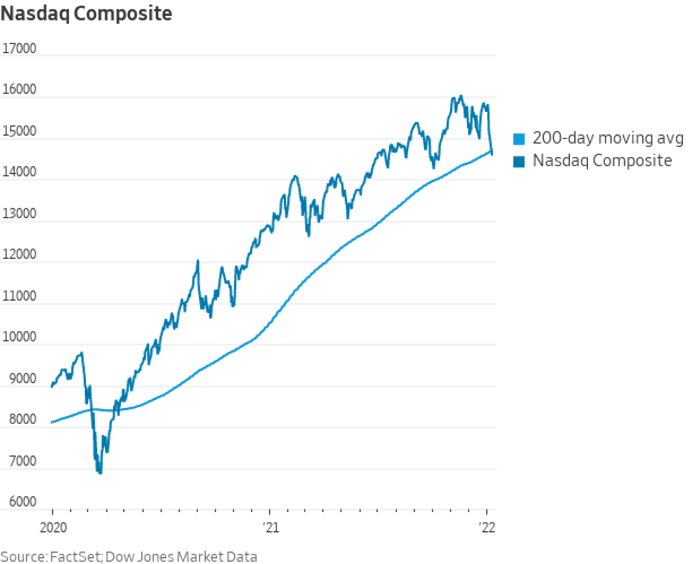

The Nasdaq Composite Index was facing its fifth straight decline on Monday, which was putting the index on the verge of closing below its long-term 200-day moving average for the first time in about 20 months.

At last check, the Nasdaq Composite

COMP,

was trading down 2.7% at around 14,536, with its 200-day moving average at 14,688.73. The technology laden index hasn’t closed below its 200-day MA since April 21, 2020, FactSet data show.

Dow Jones Market Data

Pressure on the Nasdaq Composite also was pushing it perilously close to a correction, commonly defined as a decline of at least 10% from a recent peak. The index needs to stay above 14,451.69 to avoid a correction from its Nov. 19 record close peak.

Many market technicians watching moving averages to help gauge short-term and long-term trend lines in an asset.

Rising benchmark yields for government bonds, such as the 10-year Treasury note

TMUBMUSD10Y,

have been rising and putting pressure on yield-sensitive assets.

Yields have been rising as investors anticipate tighter policy from the Federal Reserve and as many as three interest-rate increases in 2022 starting possibly in March. Goldman Sachs analysts, in a recent research note, estimate that there could be as many as four interest rate increases this year.