This post was originally published on this site

On the last trading day before Christmas, stocks are in a festive mood, rising amid a rosier view of the omicron coronavirus variant risks drove solid gains on Wednesday.

If that Santa Claus rally is coming, then it officially needs to start next week (lest we end up with the Grinch). See our chart below for one view on what’s needed from the S&P 500 for that late year/early 2022 run to kick into gear.

Read: Here’s when the stock market is open during the Christmas/New Year’s Eve holidays

In our call of the day, we’re swerving into “what if” land with a note from Doug Kass, president of hedge fund Seabreeze Partners Management. “Like Diogenes with his lantern, I am, again in 2022, a cynic looking for truth — as I engage in my annual assault on the consensus and ‘Group Stink,’” writes Kass.

He shares a list of 15 surprises (highlighted and condensed below), that he stresses aren’t forecasts, but “events that the consensus views as having a low probability of happening (25% or less) but, in my judgment, have a better than 50% chance of occurrence.” Betting folks would call this an overlay, he says.

- Both President Joe Biden and former President Donald Trump fall into ill health, with both out of the current and future White House picture. After a lame-duck takeover by Vice President Kamala Harris, Republican Nikki Haley, Trump’s daughter Ivanka and Democrat Hillary Clinton put their names forward for 2024.

-

Federal Reserve Chair Jerome Powell turns hawkish, but acts too late for rising inflation. Global reopenings help push oil

CL00,

+0.34%

over $110 a barrel, supply-chain problems linger, and wages surge. The economy enters “slugflation” (sluggish growth, sustained inflation) with debt burdens and housing shortages. -

The stock market rolls over after rallying to new high in early 2022. So-called innovations stocks that “performed poorly in 2021, all but collapse in 2022,” with the ARK Innovation ETF

ARKK,

-1.79%

trading under $70 a share. Private and public companies tighten their belts, trimming ad spending, which hits Meta

FB,

+0.25% ,

Alphabet

GOOGL,

+0.54%

and Amazon

AMZN,

+0.03% .

Cryptos are also hit by drawdowns. Later in the year, amid a slowing economy, higher inflation and aggressive Fed, a full-on bear market takes the S&P down 30% from early year highs. -

Amazon also runs into labor and shipping costs, while Tesla’s shipments and market share are adversely hurt by competitive electric-vehicles. Then … “EVs lose their luster and appeal as it becomes clear that the electric grid is nowhere near ready for a mass switch…nor is your home.” This also hurts players GM

GM,

-0.52%

and Ford

F,

-0.55% . -

Elsewhere the bear market forces a Robinhood

HOOD,

-2.39%

sale to JPMorgan

JPM,

+0.68%

for just $2 a share, the same price paid for Bear Stearns in the 2008-09 financial crisis. As for the winners, value shares materially outperform growth stocks and silver becomes a new meme stock. Cannabis names surge as two major players merge and a third gets bought by a U.S. packaging company.

Happy and safe holidays to all, and we’ll be back Monday.

The buzz

Adding to a recent positive news flow surrounding the fight against omicron, AstraZeneca

AZN,

said its COVID-19 booster appears effective against the new coronavirus variant. Similar comments from Novavax

NVAX,

about a study of its COVID-19 vaccine booster is lifting those shares in premarket.

Higher COVID-19 cases force China to lock down 13 million people in the city of Xi’an, the U.K. passed more than 100,000 cases on Wednesday and Spain will reimpose wearing masks outdoors amid record daily infections. The World Health Organization has warned that “no country can boost its way out of the pandemic.”

President Biden said that, provided he’s in good health (and irrespective of Kass’s 2022 “surprise” call), he’ll run for re-election in 2024, in an ABC News interview.

A day after saying he had “sold enough” Tesla

TSLA,

stock, sparking a rally that pushed the electric-car maker back into the $1 trillion market-cap club, CEO Elon Musk sold another 934,000 shares.

Several people have been reported injured after a fire at an Exxon

XOM,

oil refinery in Texas.

A Fed -favored inflation gauge, the PCE index, jumped to 5.7% in November from 5% last month, while consumer spending softened and durable-goods orders rose a stronger-than-forecast 2.5%. First-time weekly jobless claims were unchanged at 205,000. Still to come are new-home sales and the final University of Michigan consumer sentiment index.

China social-media group Tencent

700,

will shed most of its JD.com

JD,

stake, with plans to distribute around $16.4 billion worth to investors via a one-time dividend.

Delivering his annual address, Russian President Vladimir Putin accused the West of “coming with its missiles to our doorstep,” expressing anger at NATO expansion, and saying he’d intervene in Ukraine if needed.

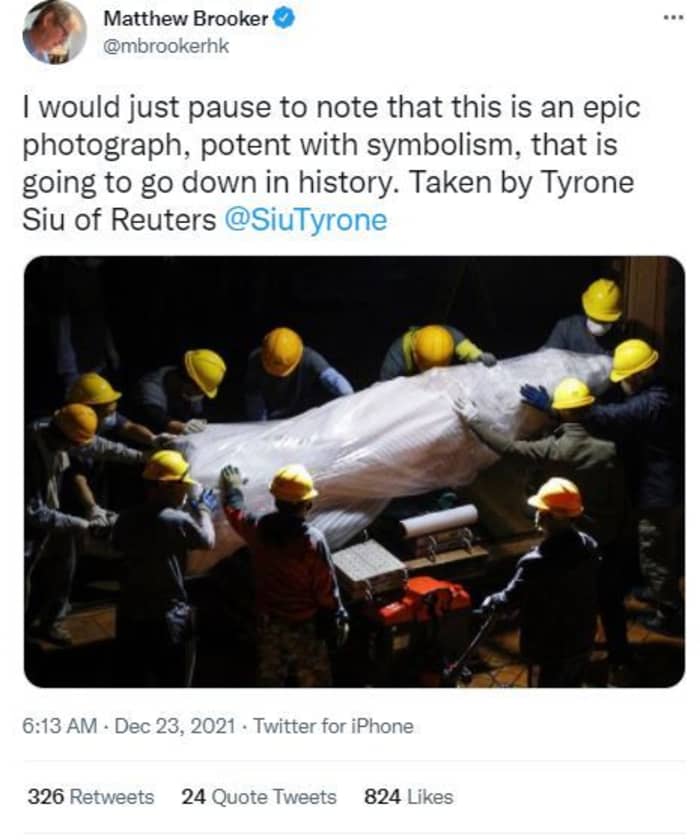

A monument marking the 1989 Tiananmen Square massacre was removed at a Hong Kong university. One photo showing workers taking down that statue is going viral:

The chart

The so-called Santa Claus Rally takes place on the last five trading days of December, and the first two of January. Fundstrat Global Advisors, who provide this hourly chart of the S&P 500 showing a range seen since mid-November, say the broader market needs to recover and show similar strength as that index.

Fundstrat Global Advisors

“Prices are now getting up towards the highs of this pattern, but yet will need to eclipse 4732 to think Santa’s on his ‘merry way.’ Meanwhile, any reversal from here also can’t afford to fall under 4614 which would lead to a break of December lows,” say Fundstrat in a note.

Opinion: Santa Claus gives you attractive odds of a stock market rally

The markets

Stocks

DJIA,

COMP,

are pushing higher, with Asia

000300,

NIK,

markets also climbing and European equities

SXXP,

rising. Elsewhere, the dollar

DXY,

and gold

GC00,

are up, and Treasury yields

TMUBMUSD10Y,

are ticking up.

The tickers

These are the most active tickers on MarketWatch as of 6 a.m. Eastern Time.

| Ticker | Asset |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

DXY, |

U.S. Dollar Index |

|

DJIA, |

Dow Jones Industrial Average |

|

TMUBMUSD10Y, |

10-Year U.S. Treasury Note |

|

NIO, |

NIO |

|

ES00, |

E-Mini S&P 500 Futures |

|

NVAX, |

Novavax |

|

AAPL, |

Apple |

Random reads

Nine days after a deadly tornado in Kentucky, Madix the cat is found alive.

“You smell like beef and cheese”: the hard job of a Santa impersonator.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.