This post was originally published on this site

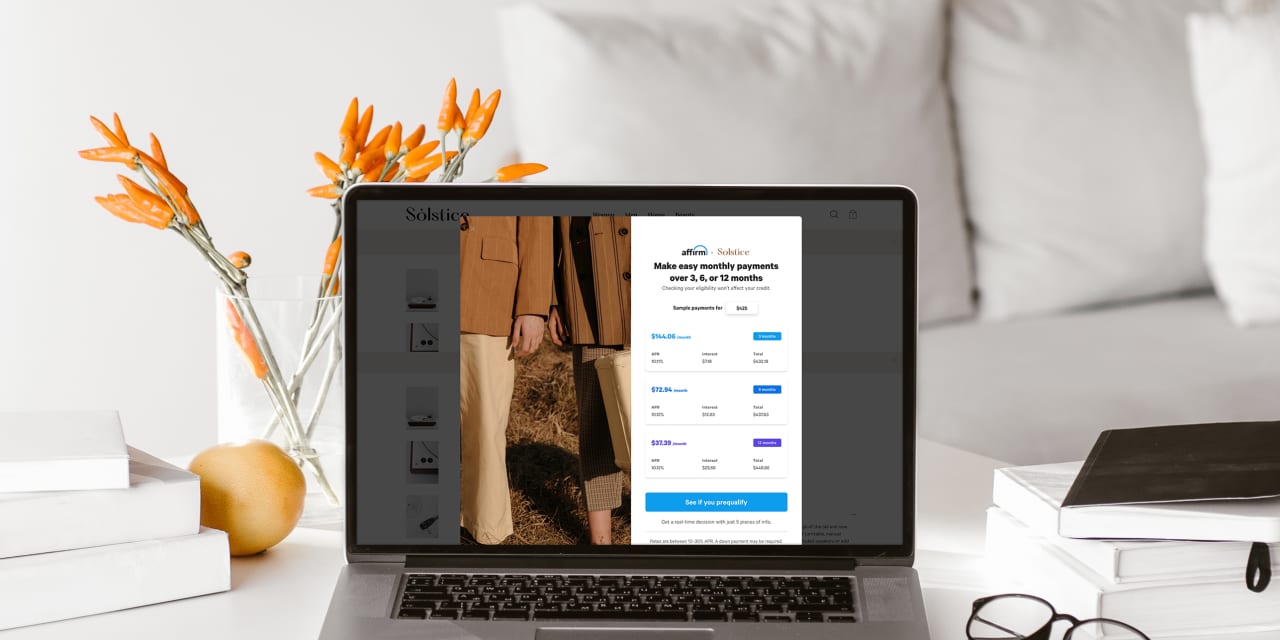

The buy-now-pay-later craze is continuing to steam in the U.S., prompting regulators to take a look at the hot payment option, which lets consumers split purchases into installments.

The Consumer Financial Protection Bureau announced Thursday that it has launched an inquiry into the payment option, which is also known as BNPL. The CFPB asked Affirm Holdings Inc.

AFRM,

Afterpay Ltd.

AFTPY,

APT,

Klarna, PayPal Holdings Inc.

PYPL,

and Zip Co.

Z1P,

to provide information that will allow it to “report to the public about industry practices and risks” around BNPL, CFPB Director Rohit Chopra said in a press release.

Shares of Affirm slid 11% on Thursday, while U.S.-listed over-the-counter shares of Afterpay, an Australian company in the process of being acquired by Block Inc.

SQ,

formerly known as Square, declined 4%.

The buy-now-pay-later wave: Afterpay, Klarna, Affirm and rivals hope to take U.S. by storm

The CFPB is interested in exploring various issues related to BNPL, including the ability for consumers to accumulate debt and the data-harvesting practices of BNPL operators. “The Bureau would like to better understand practices around data collection, behavioral targeting, data monetization and the risks they may create for consumers,” according to the release.

An Affirm spokesperson said the company would work with regulators: “We welcome the CFPB’s review and support regulatory efforts that benefit consumers and promote transparency within our industry. For nearly a decade, Affirm has been advancing its mission to deliver honest financial products that improve lives, and we have never charged a late or hidden fee, ever.”

Affirm Chief Executive Max Levchin said at the company’s September investor event that he was “fairly pro-regulation when it comes to these new financial products,” calling attention from regulators “positive so long as it is rooted in understanding of the product” and its intent.

A spokeswoman for Afterpay said that the company “welcomes efforts to ensure that there are appropriate regulatory protections for consumers in the diverse BNPL industry, and that providers are meeting high standards and delivering positive consumer outcomes while protecting their data.”

She also called Afterpay’s offerings more transparent and affordable than traditional credit.

A PayPal representative said that the digital payments giant is reviewing the CPFB letter and will work with the agency to provide information. “Our customers trust us to be transparent, and we take this responsibility very seriously,” the spokesperson said.

“Zip is keen to cooperate with the CFPB and explain what we do, address any concerns and, crucially, how we treat consumers responsibly,” said the company’s director of corporate affairs, Matthew Abbott.

Representatives from Block and Klarna didn’t immediately respond to MarketWatch requests for comment.

Subscribe: Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter.

Barclays analyst Ramsey El-Assal wrote that the CFPB inquiry represents “primarily headline risk, for now,” noting that the companies are due to submit their responses by March 1, which suggests that, if any regulatory action follows, it wouldn’t take place until later in 2022.

“At a high level, we think BNPL is generally superior to revolving credit,” El-Assal wrote.

Still, he acknowledged that “the industry could face headwinds if providers are required to implement more stringent underwriting standards (thereby rejecting more potential borrowers, though this would be antithetical to the goal of expanding credit access), and report all loans to the credit bureaus, which could result in borrowers not being able to take on multiple loans at once.”