This post was originally published on this site

The Federal Reserve every quarter produces what’s called the financial accounts of the U.S., and on Thursday, the central bank released the latest edition, which is 205 pages of dense statistics on the assets and liabilities of households, businesses and governments.

James Knightley, chief international economist at ING, put a positive spin on the latest report. From the low point of the first quarter of 2020, household wealth has surged by $35.5 trillion. Combine this wealth rise with employment growth, and wage gains, and the U.S. consumer looks to be in good shape. The “further massive accumulation of wealth only adds to the potential spending ammunition of the household sector, which gives us more confidence that the U.S. economy can expand by more than 4% in 2022,” says Knightley.

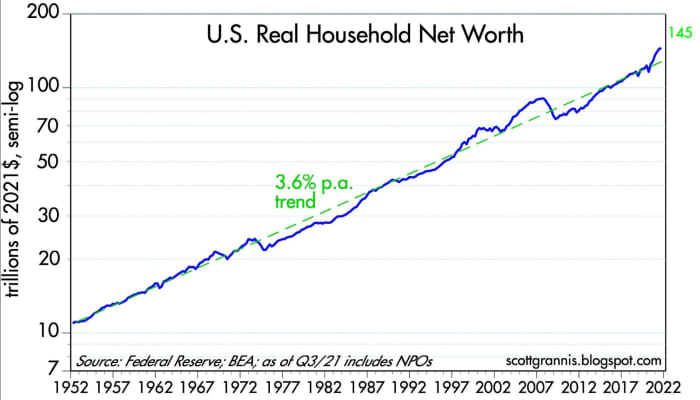

Scott Grannis, author of the Calafia Beach Pundit blog and former chief economist for Western Asset Management, had a different interpretation. He pointed out that while liabilities of households have grown 21% from their 2008 peak, net worth has more than tripled. After adjusting for inflation, household net worth has increased 11 fold over the past 70 years.

Another way to look at it — adjusting for inflation and population growth, net worth per capita has soared from $72,000 to $432,000 over the last 70 years.

Both charts, he noted, are running ahead of their long-term trend line. “This could be a replay of what we saw in 2000 and 2007, when some markets got very overextended. By that I mean that for the next several years a mere reversion to trend would mean very modest returns for investors,” he said.

Those low returns could materialize from inflation. “It would not be surprising to see net worth fall below its long-term trend, as it did during the high-inflation 1970s,” he said. With inflation running at 7%, the average interest rate on federal debt at about 2%, the real value of federal debt is falling by about 5% a year.

“In other words, inflation is subtracting over $1 trillion of the real value of federal debt outstanding every year at the same time inflation is boosting government revenues and nominal GDP. This means that the private sector is effectively paying an additional $1 trillion per year in taxes to the federal government (aka the inflation tax),” he said.

The buzz

The key report of the day is the November consumer-price index, due at 8:30 a.m. Eastern, with expectations for a 0.7% monthly rise to take the year-over-year reading to 6.7%. There’s also the preliminary University of Michigan consumer sentiment index for December due for release.

CEO Elon Musk continued selling shares in Tesla

TSLA,

taking his sales to nearly $12 billion, though his exercise of options has meant his overall stake in the electric-vehicle maker has risen.

Oracle

ORCL,

shares jumped 12% in premarket trade, after the database giant beat earnings and sales estimates and authorized a $10 billion stock buyback.

Costco Wholesale

COST,

topped earnings expectations as it reported 15% comparable-store sales growth.

Shares in enterprise software company Everbridge

EVBG,

lost a third of their value in the premarket after the sudden resignation of its chief executive, David Meredith.

Online pet food seller Chewy

CHWY,

reported a wider-than-forecast loss for the fiscal third quarter.

Getty Images said it will merge with special-purpose acquisition company CC Neuberger Principal Holdings II

PRPB,

in a deal valuing the photo service at $4.8 billion, or 15.2 times estimated 2022 adjusted earnings before interest, tax, depreciation and amortization.

The markets

After the first down day in four sessions, U.S. stock futures

ES00,

NQ00,

advanced.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.51% ahead of the CPI data.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Top tickers

Here are the top tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

TMUBMUSD10Y, |

U.S. 10-year Treasury |

|

DXY, |

U.S. dollar index |

|

DJIA, |

Dow Jones Industrial Average |

|

LCID, |

Lucid Group |

|

ES00, |

E-mini S&P 500 futures |

|

NIO, |

NIO |

|

AAPL, |

Apple |

Random reads

A U.K. court has sided with the U.S. on whether WikiLeaks founder Julian Assange can be extradited, in a ruling likely to be appealed.

These religious leaders in Texas live in lavish, tax-free estates.

Hard to know what’s the headline — that there’s $66 million in prize money for a camel beauty contest, or that some of these camels receive illicit Botox injections.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.