This post was originally published on this site

German stocks came under pressure on Wednesday, following the strongest day of the year for Europe’s main index and the best day since March for the DAX, driven by easing pandemic concerns.

The Stoxx Europe 600 index

SXXP,

slipped 0.2% to 479.29, following a roughly 2.5% surge on Tuesday that marked the biggest one-day percentage gain since Nov. 9, 2020. The German DAX

DAX,

led losses with a 0.6% drop, the French CAC 40

PX1,

fell 0.3% and the FTSE 100

UKX,

inched up 0.1%. The biggest heavyweight decliner for the DAX for Wednesday was automaker Daimler, which fell 1.5%.

The euro

EURUSD,

rose against the dollar

DXY,

and the pound

GBPUSD,

which hit low of $1.3173 after a report in the Financial Times said the U.K. will announce fresh COVID restrictions — vaccine passports for big venues and a work-from-home order — to battle surging cases.

Pfizer

PFE,

said Wednesday that three doses — two vaccinations plus a booster — of the COVID vaccine it has developed with BioNTech

BNTX,

appeared to keep the omicron variant at bay, though it stressed the results were from preliminary lab studies.

Technology stocks led the losses in Europe, with Infineon Technologies

IFXA,

dropping over 3% after a downgrade to neutral at JP Morgan, where analysts said semiconductor cycle risks are increasing as inventories normalize. ASML Holding

ASM,

dropped 1%, and ASM International

ASM,

stock slipped 0.9%.

Pharmaceutical names were higher, with Roche

ROG,

up 1.7% and Novo Nordisk

NVO,

NOVO.B,

stock up over 2%.

The most heavily weighted stock on the Stoxx Europe 600, Nestlé

NSRGY,

NESN,

climbed 2% after the Swiss food giant agreed to cut its stake in L’Oréal

OR,

in a sale of $10 billion worth of shares back to the French cosmetics maker.

Wednesday also marked a changing of the guard for Germany, as center-left leader Olaf Scholz became Germany’s ninth post-World War II chancellor Wednesday, beginning a new era for the EU’s biggest economy, also struggling to get its own COVID outbreak under control.

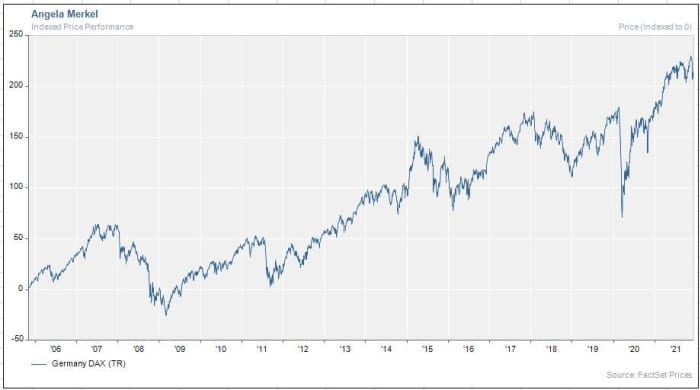

According to data from FactSet, the German DAX gained 220% throughout Chancellor Angela Merkel’s 16-year chancellorship, though analysts stressed that it was tough to extrapolate much from politics. During her 2005 to 2021 leadership, the German market followed Wall Street into the Global Financial Crisis in 2008 and 2009.

German DAX performance under Chancellor Angela Merkel

FactSet

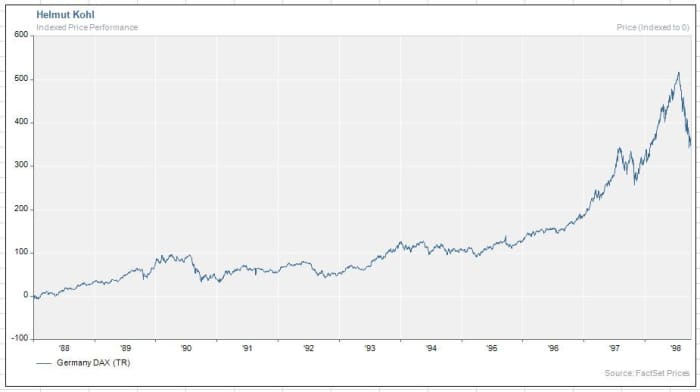

As for her predecessors, the German DAX rose 16% under Gerhard Schröder, who served from 1998 to 2005, but 347% under Helmut Kohl who also served 16 years, according to FactSet data.

The benchmark DAX stock index (1876534) surged 30% between October 1989 and July 1990 with Kohl overseeing the post-reunification boom. The euro’s introduction, and the dot-com bubble were also big influential events for German stocks.

German DAX performance during tenure of Chancellor Helmut Kohl

Uncredited