This post was originally published on this site

That was a quite one-two punch that caused a 652-point nosedive in the Dow Jones Industrial Average

DJIA,

on Tuesday.

First there was Moderna’s

MRNA,

chief executive saying the omicron variant of coronavirus might really put up a tough fight versus its COVID-19 vaccine. Then Federal Reserve Chair Jerome Powell stunned markets — and the traders who read his dovish-sounding opening remarks the night before — with what has been described as a hawkish pivot, as he threw the word ‘transitory’ to the dustbin of history, said the central bank is likely to accelerate the pace of tapering and cast the new variant as an inflationary risk.

“The takeaway is simple: the Fed has changed their tune very significantly, and realized that in the last month there was plenty of evidence that they were far behind the inflation curve. The shift in view then has some conviction behind it. It would be no surprise to see the markets quickly price in at least three 25bp hikes for 2022 (instead of the two we currently have), if the main downside risks as related to omicron are ruled out,” said Alan Ruskin, macro strategist at Deutsche Bank.

Thomas Kee Jr., the president and chief executive of Stock Traders Daily, agreed that Powell made a pivot, and suggested the pace of tapering may double to $30 billion a month. But he said the driving force behind equity infusions is the European Central Bank, not the Fed.

The ECB is also battling inflation — prices in November surged by the fastest in 30 years — but central bank officials there are wary of repeating the mistake of premature tightening. The ECB has to decide whether to let the €68 billion ($77 billion) a month Pandemic Emergency Purchase Programme expire as planned in March and whether to increase the Asset Purchase Programme as it offers its first staff inflation forecast for 2024.

“Ultimately, the ECB is the wild card, and the decision of the ECB comes in just two weeks,” said Kee. Liquidity will remain robust, and that will keep the “bid in equities that exists now going.” The free money, he said, hasn’t dried up yet.

The buzz

It’s a big day on the economics front: the ADP estimate of private-sector employment, the Institute for Supply Management manufacturing report, and the Fed’s Beige Book of economic anecdotes are due for release as auto makers release their monthly sales reports. Powell and Treasury Secretary Janet Yellen go before the House Financial Services Committee to discuss the same topic as Tuesday, the pandemic response at their respective agencies.

The White House is set to announce increased testing requirements for international travelers. Conservatives are trying to force a shutdown Friday over the Biden administration’s vaccine mandate, Politico reported.

The Jerusalem Post cited a local television report as saying the Pfizer

PFE,

COVID-19 vaccine, which is used in Israel, had 90% effectiveness versus omicron versus 95% versus delta in preventing infection.

Dow component and tech giant Salesforce.com

CRM,

offered fourth-quarter guidance below expectations as it also named Bret Taylor to be its co-chief executive alongside Marc Benioff.

Hewlett Packard Enterprises

HPE,

beat earnings expectations but just missed revenue estimates, as its high-performance computing and artificial-intelligence unit recorded sales growth of just 1%. Information security firm Zscaler

ZS,

raised its revenue outlook for the year.

The market

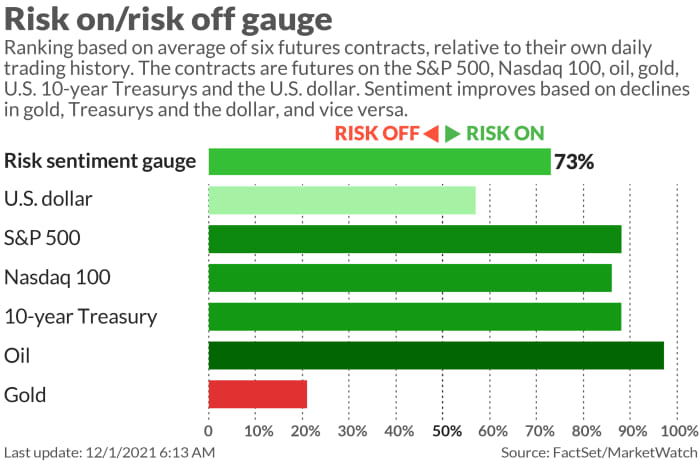

The market zigs and it zags. Futures on the Dow industrials

YM00,

rose more than 300 points as risky assets gained ground.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was around 1.50%, and oil futures

CL.1,

jumped, as strategists at Goldman Sachs said the pullback from nearly $85 a month early in November was overdone.

Random reads

A lawyer goes viral with her story describing an attempt to rent a car at Hertz

HTZ,

Tesla

TSLA,

hasn’t rolled out the Cybertruck yet, but fans snapped up a $50 Cyberwhistle in the mean time.

Roses? This man went a bit further and built a one-third sized Taj Mahal replica for his wife.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.