This post was originally published on this site

European stocks were under pressure on Tuesday, albeit in a week with volumes lightened by the U.S. Thanksgiving holiday, but with investors increasingly concerned about the wave of COVID cases sweeping major economies.

The Stoxx Europe 600 index

SXXP,

fell 0.8% to 481.35, set for its worst one-day session since late September. The German DAX

DAX,

fell 0.7%, the French CAC 40

PX1,

slipped 0.1%. The FTSE 100 index

UKX,

rose 0.3% and Spain’s IBEX 35 index

IBEX,

rose 0.4%. The euro

EURUSD,

was flat at $1.1246.

Investors brushed aside data showing the flash IHS Markit November eurozone composite output index reaching a two-month high of 55.8 in November from 54.2 in October. The survey also indicated that persistent supply bottlenecks and rising COVID cases were clouding the near-term outlook.

Apart from surging cases in countries such as Germany and Austria, which is under a 10-day nationwide lockdown that began Monday, France’s Prime Minister Jean Castex has tested positive and Germany’s health minister, Jens Spahn, warned Monday that by the end of winter, “pretty much everyone in Germany … will be vaccinated, cured or dead.”

That’s as the World Health Organization itself warned that COVID deaths in Europe would hit 2.2 million by March based on current trends.

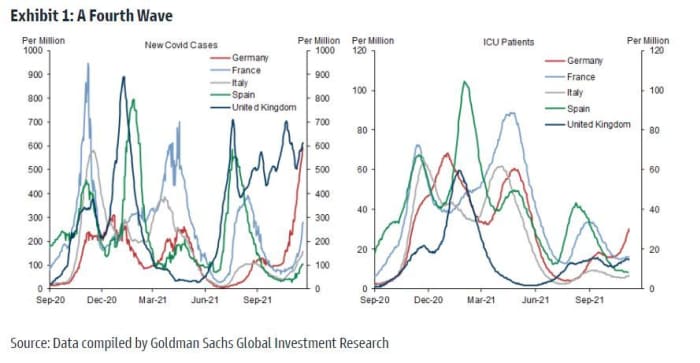

“Continued upward pressure on case growth across Europe through the winter seems likely given the high infectiousness of the delta variant and cold winter weather. At the same time, Europe has significantly higher covid immunity than last winter, which should help protect hospital capacity, especially in the South,” a team of Goldman Sachs economists led by Sven Jari Stehn told clients in a note on Tuesday.

Uncredited

Stehn and the team said economic growth in the euro area will likely take 0.2% percentage points hit in the fourth quarter of this year and first quarter of 2022, and about half as much in the U.K., which has also seen surging COVID cases. The continent will see significant variation, with a harder hit for Germany than for Spain or Italy.

Reflecting U.S. action, technology stocks were under pressure in Europe amid rising bond yields. ASML Holding

ASML,

a heavily weighted Dutch chip group, fell nearly 5%, while German business software group SAP

SAP,

SAP,

down 2%, and in the chip sector, Infineon Technologies

IFX,

stock down 3.4%.

Top performers included retailer Hennes & Mauritz

HM.B,

up 5% and Compass Group

CPG,

up over 4% after the catering contractor reported an increase in pretax profit for fiscal 2021, booked lower costs and returned to the dividend list.