This post was originally published on this site

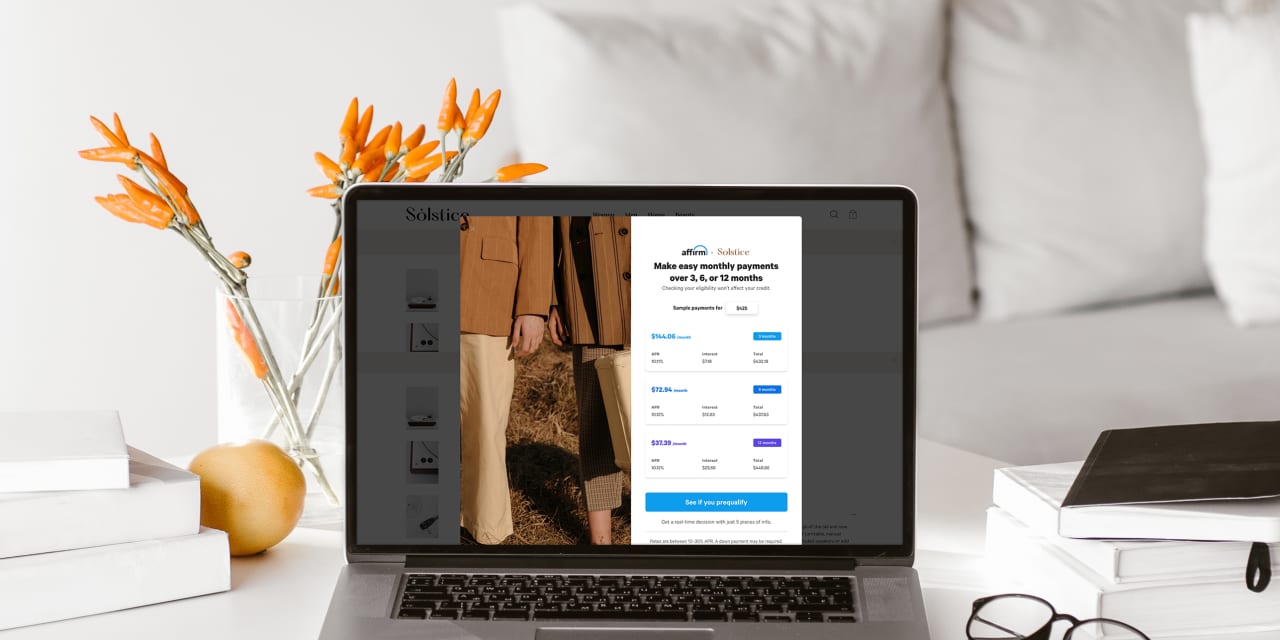

After plunging more than 15% Wednesday, shares of Affirm Holdings Inc. looked to be making up ground in the extended session after the buy-now pay-later company delivered upbeat results and announced that it had “expanded” its relationship with Amazon.com Inc.

The company, which allows users to split payments into installments, generated a fiscal first-quarter net loss of $306.6 million, or $1.13 a share, whereas it lost $3.9 million, or 6 cents a share, in the year-earlier quarter.

The loss figure reflects an $87.0 million increase in stock-based compensation following the company’s initial public offering in January as well as $141.6 million in additional expenses that reflect a changes in the fair value of the of the contingent consideration liability related to Affirm’s

AFRM,

acquisition of PayBright, which are “driven by increases in the value of its common stock.”

Revenue rose to $269.4 million from $174.0 million a year prior, while the FactSet consensus was for $249 million.

Shares of Affirm were up 26.6% in after-hours trading Wednesday after declining 15.4% in the regular session.

The company also noted in its release that it has “expanded” its previously disclosed relationship with Amazon

AMZN,

such that Affirm “will be generally available” in the U.S. on eligible purchases of at least $50.

Through the changed agreement, Affirm will serve as Amazon’s “only third-party, non-credit card, buy now, pay later…option in the U.S.,” the company noted in its release. Amazon will face restrictions around providing installment offerings by other providers until January 2023.

The company had said in its prior earnings release that the deal with Amazon was non-exclusive.

“In conjunction with the amended agreement, Amazon will receive multiple tranches of warrants to purchase shares of Affirm’s Class A Common Stock, some of which are subject to satisfaction of certain performance obligations and vesting conditions,” Affirm further noted.

Affirm recorded $2.7 billion in gross merchandise volume, or the value of merchandise sold on its platform during the September quarter. That marked an 84% increase from the year-earlier quarter, or a 138% bump when excluding volume from “the company’s largest merchant.”

That merchant is presumably Peloton Interactive Inc.

PTON,

which has been the company’s largest merchant in the past, and which Affirm excluded from one of the volume figures it provided last quarter. The maker of connected fitness equipment recently cut its sales forecast.

Affirm saw its count of active merchants grow to 102,000 in the September quarter from nearly 29,000 in the June quarter. A “substantial majority” of the new merchants came from the rollout of Shopify Inc.’s

SHOP,

Shop Pay Installments offering.

The company’s number of active consumers increased to 8.7 million from 7.1 million in the June quarter, while transactions per active consumers came in at 2.3, flat with what it was as of June 30.

For the December quarter, Affirm expects $320 million to $330 million in revenue. Analysts tracked by FactSet were anticipating $296 million in revenue. The company also projects $3.55 billion to $3.65 billion in GMV, while analysts were looking for $3.27 billion.

Affirm shares have more than doubled over the past three months as the S&P 500

SPX,

has gained roughly 5%.