This post was originally published on this site

Shares of Purple Innovation Inc. were falling sharply in late trading Tuesday after the mattress company posted weaker-than-expected results, with management calling out a “manufacturing backlog.”

The company generated third-quarter net income of $2.1 million, whereas it recorded a loss of $87.0 million a year prior. The company saw an adjusted loss per share of 7 cents, while it posted adjusted earnings per share of 27 cents in the year-earlier quarter. Analysts tracked by FactSet were expecting 15 cents in adjusted earnings per share for the most recent period.

Purple

PRPL,

saw net revenue decline to $170.8 million from $187.1 million a year earlier, while analysts were projecting $198.3 million. The company disclosed that it saw a 9.6% increase in wholesale revenue versus a year prior, though direct-to-consumer revenue was off 15.9%.

Shares were down 27% in after-hours trading Tuesday.

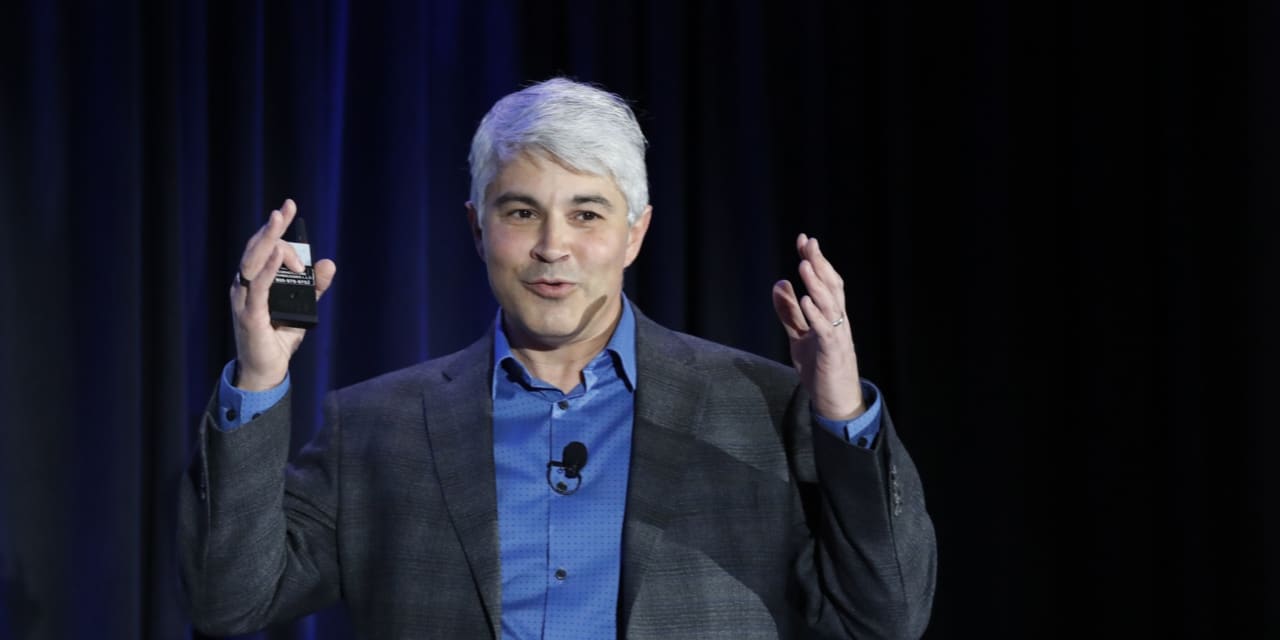

“Our third-quarter results were disappointing, largely driven by impacts from our manufacturing backlog that were longer-lasting than we anticipated,” Chief Executive Joe Megibow said in a release. The company dealt with a “lack of inventory” that impacted sales across its channels.

He further called out “delays in planned wholesale expansion, slower re-acceleration of existing wholesale door productivity, and a more prolonged build-back from the effect of marketing-spend reduction in response to inventory shortages, which in turn also impacted our digital business.”

Purple recently struck a new agreement with Mattress Firm. It has plans to open “270 new wholesale retail doors through the first five weeks of the fourth quarter,” Megibow noted in the release. “Operationally, we will be capitalizing on pricing opportunities while we continue to invest in supply-chain and manufacturing initiatives that will meaningfully improve margins as we head into 2022.”

The company anticipates net revenue for 2021 of $720 million to $740 million, while analysts had been projecting $818 million in full-year revenue prior to the report. Purple also anticipates that rising input costs and a bigger shift toward wholesale business are among factors that could pressure full-year gross margins.

The stock was subject to a double downgrade by Bank of America on Monday.

Purple’s stock has declined 22% over the past three months as the S&P 500

SPX,

has risen roughly 6%.