This post was originally published on this site

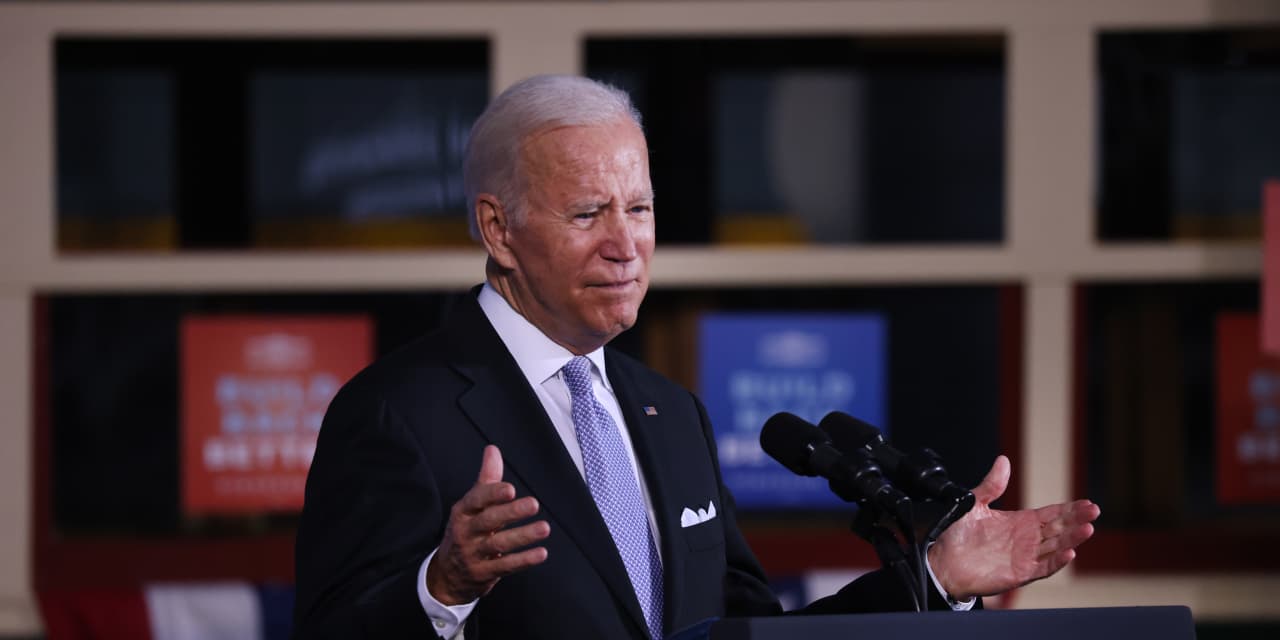

President Joe Biden and Congressional Democratic leaders are reportedly scaling back their visions of tax hikes on the rich and corporations, but whether that ultimately translates into a win for the wealthy is an open question, according to tax experts.

There was a time in the not-too-distant past when top Democratic lawmakers seemed ready to raise the top income tax rate, boost the capital gains rate and increase the corporate income tax rate as ways to raise cash for social safety net programs and massive infrastructure projects.

Now those rate hikes may be on the ropes as Biden aims to reach a deal on a social safety net plan, with zero wiggle room for ‘no’ votes on his side of the aisle.

The White House is weighing other types of taxes to pay for the plan, according to multiple reports. They include a tax on billionaires’ assets and a tax when companies buy back stock.

Sen. Kyrsten Sinema of Arizona is one critical vote and she is reportedly against proposed rate increases that would send the top personal income tax rate from 37% to 39.6% or a corporate income tax rate from its current 21% spot, the Wall Street Journal reported.

Biden has previously called for a 28% corporate rate and the Ways and Means Committee called for a 26.5% rate.

Nothing is final and ideas are subject to change, reports have noted. But what do the latest moves on Capitol Hill indicate?

“There is no doubt that wealthy people are talking Democratic lawmakers into doing things that are not popular with the American public,” said Steve Wamhoff, director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy.

For example, more than half of U.S. adults (59%) said they are bothered “a lot” that wealthy people and corporations don’t pay their perceived fair share in taxes, according to a Pew Research Center poll released in April. Breaking into party affiliations, three quarters of Democrats and almost four in 10 Republicans feel that way, the survey showed.

“It really is an incredible story about very wealthy people and big businesses and corporate interests steering the debate,” he said. “It’s not just this week.”

Earlier this week, the White House backed off a contentious proposal to require banks to tell the Internal Revenue Service about account cash flow amounts in people’s bank accounts above $600. Administration officials are now calling for a $10,000 reporting threshold.

Though the administration said the data would help spot wealthy tax dodgers, critics in the banking sector and elsewhere skewered the idea as an unnecessary, invasive dragnet on just about all households. The new threshold isn’t much of an improvement, some critics maintain.

As for Democrats’ ideas about raising tax rates, Allison Schrager, senior fellow at the right-leaning Manhattan Institute, has her doubts that any rate increases would actually have put the screws to rich taxpayers and corporate balance sheets.

Though rate hikes might seem cosmetically nice “all you’re getting is more distortion and clunkier tax system” that still keeps special breaks, loopholes and deductions intact, she told MarketWatch.

“You have more incentive, the higher the rates are, to find the loopholes,” she said.

What if corporate tax hikes are out?

The people dodging the biggest effects would be shareholders, often wealthy domestic and foreign investors, said Wamhoff. Indeed, corporate equity accounts for 40% of the wealth going to America’s 0.01% wealthiest households, according to a study released Monday that pored through tax data.

“It’s a simplistic fiction to argue we are going to soak the 10 richest people” with a corporate tax hike, said Columbia Business School professor Shivaram Rajgopal. Tax rates can influence various board-level decisions, like the plans to grow the business in the long term, he said.

Additionally, households down the income ladder are also large corporate shareholders, because those stocks are often in their pension funds and nest eggs , Rajgopal noted.

Pensions accounted for 63% of the wealth from the bottom 90% of households, researchers said in the study earlier this week.

Wherever lawmakers come out on the issue of the corporate tax rate, they need to remember that when it comes to tax rules “corporations like stability, the private sector likes stability,” said Rachel Snyderman, an associate director with the Bipartisan Policy Center’s Economic Policy Project.

Tax rules that lurch wildly from one administration to the next can be a challenge — especially amid “a fragile recovery and a labor market that’s still facing widespread shortages.”

Corporate income tax receipts increased by $158 billion from fiscal year 2020 to preliminary fiscal year 2021 numbers, according to the non-partisan Congressional Budget Office’s review of tax receipts. The rise is “in part because of higher corporate profits this year,” the office said earlier this month.

What if some kind of tax on billionaires gets in?

That could still extract some serious cash, to be sure.

The concept for this kind of specially-targeted tax is already floating out there. The Ways and Means Committee calls for a 3% tax on adjusted gross income above $5 million.

If the spending package is going to be trimmed back, University of California, Berkeley economist Gabriel Zucman said a one-time wealth tax could still extract a serious amount of cash.

Zucman, an adviser on tax policies for Sen. Elizabeth Warren when she ran for president, said Wednesday on Twitter

TWTR,

that “a Warren-style” tax could raise approximately $250 billion in a year. That would have a 2% tax kicking in above $50 million and 3% kicking in over $1 billion.

Half the money would come from billionaires, he said.