This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEB280F6_M.jpg

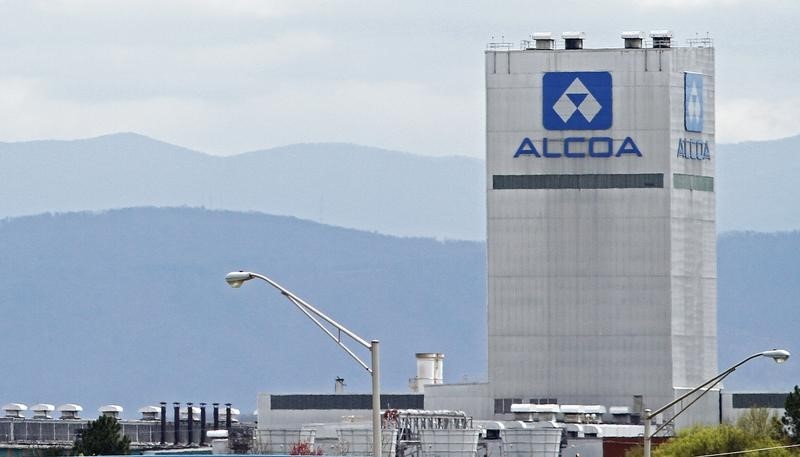

The company reported $1.76/share in earnings, or $2.05 on an adjusted basis, both a sequential improvement and a reversal from losing money in Q32020. Its revenue growth was driven by a sequential increase of 13 percent in the average realized third-party price of primary aluminum, another reminder of commodity price inflation over recent months.

Alcoa’s quarter produced $352M in cash flow, and the company also called out its improved balance sheet, with no debt maturities until 2027.

Alcoa CEO and President, Roy Harvey, said, “The strategic work we’ve been implementing across our Company has helped us effectively capture the benefits from very strong market fundamentals and deliver another excellent quarter with record profitability. Today, Alcoa is stronger and better poised for the future, and we plan to continue our positive momentum and consistently deliver value through the commodity cycle.”

It could be with this in mind that the company instituted a dividend and buyback program. While the quarterly dividend starts at $.1/share, or an annual yield of .7% at the post-earnings share price, the $500M share buyback may be meatier, as it would cover roughly 4.75% of the shares outstanding if executed at the current price.

More significant to investors may be the company’s comments: “Based on our view of markets and expected cash flows, we believe these programs can be sustained through the commodity cycle,” Harvey said. CFO William Oplinger added, ““The share repurchase program will be financed by operating cash flows and cash on hand, as the balance sheet has continued to strengthen with proportional adjusted net debt is at its lowest level since the inception of our Company in 2016.”

Peers including Constellium Nv (NYSE:CSTM) (+2.4%), Kaiser Aluminum (NASDAQ:KALU) Corporation (2.75%), and Arconic (2.5%) are trading up on the news.