This post was originally published on this site

Expect to see data this month from several clinical trials that are trying to establish if “mixing and matching” different COVID-19 vaccines is safe and effective or if it’s better to get the same booster as the one used in the primary series of shots.

There are two ways to think about the type of COVID-19 booster you can get: in one scenario, you get a homologous booster, which is the same shot you got for the initial series. A heterologous, or “mix-and-match” booster, lets you get a different vaccine based on availability or improved efficacy.

This is an important scientific distinction that will likely be used to further inform how COVID-19 booster shots will be rolled out in the U.S.

“There will be situations for one reason or another where a person may not have the availability to be boosted with the same product that they were originally vaccinated with,” Dr. Anthony Fauci, President Joe Biden’s chief medical adviser, told McClatchy last month.

But analysts say mixing COVID-19 shots could also dampen revenue projections for the vaccine market’s leaders.

“If ongoing mix-and-match trials show that the late entrants’ products are as effective at boosting as the original innovator vaccines themselves, then these companies stand to gain potentially meaningful near-term revenues and will almost certainly take significant share of whatever tail of future COVID vaccine revenue exists,” SVB Leerink analyst Geoffrey Porges told investors this week.

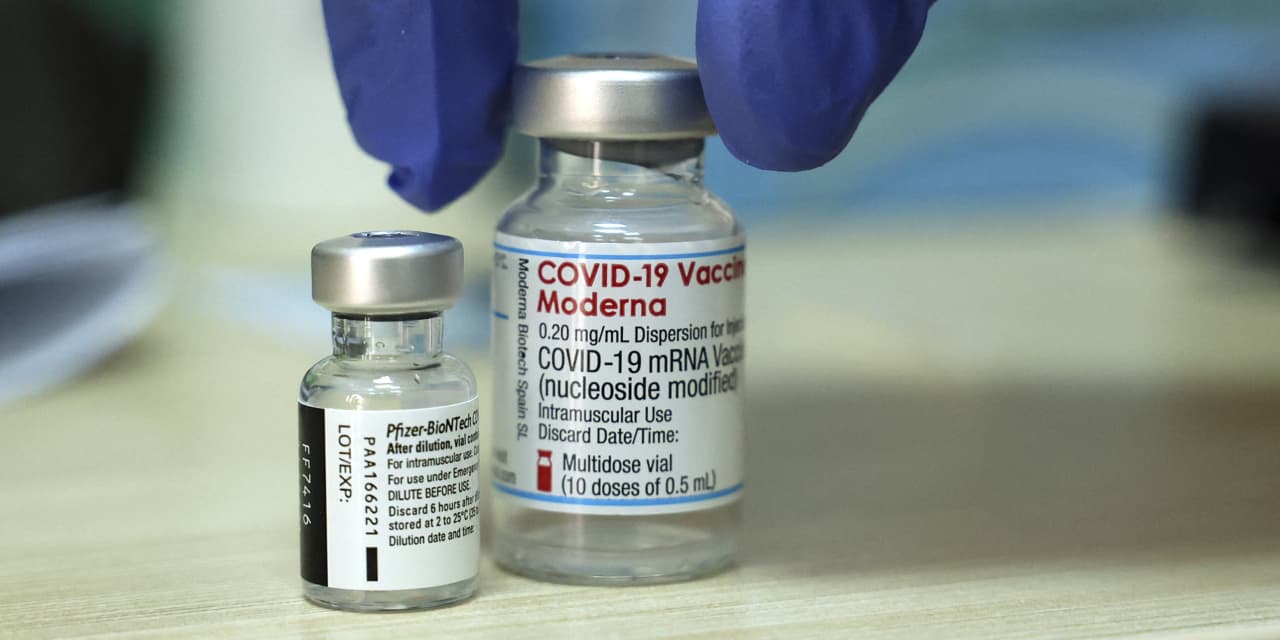

Four COVID-19 vaccine makers — AstraZeneca

AZN,

AZN,

Johnson & Johnson

JNJ,

Moderna Inc.

MRNA,

and Pfizer Inc.

PFE,

the market leaders — are expected to bring in $46 billion in revenue for their COVID-19 shots in 2022.

Roughly $19 billion of the sales generated so far over the past year came from selling the initial doses of their shots.

What to expect from the “mix-and-match” clinical trials

Right now, only recipients of the BioNTech SE

BNTX,

and Pfizer vaccine can get a booster shot (based on their health status, age, and line of work) in the U.S. The people who got the Moderna or J&J shots are still waiting on regulators to decide if they can get a booster.

Those are considered homologous boosters.

But other research is under way assessing whether it’s okay to mix vaccines, and there are already some preliminary studies that indicate mixing vaccines is safe and could prompt a stronger immune response in some cases.

A U.S. study, which is being conducted by the National Institutes of Health and is testing a Moderna booster with other types of vaccines, is expected to make its findings public on Oct. 15 at a Food and Drug Administration advisory meeting assessing J&J’s booster application.

Results are also expected sometime this month from a U.K. trial called Cov-Boost.

A preprint published in June out of the U.K. found that mixing the BioNTech/Pfizer and AstraZeneca/University of Oxford vaccines triggered better immunity than using the AstraZeneca shots alone. Researchers in Germany said, also in June, that mixing the same vaccines as the U.K. could “improve immunogenicity and to mitigate potential intermittent supply shortages for individual vaccines.”

How mixing vaccines can impact revenue projections for COVID-19 vaccine makers

Depending on how the data shakes out, it could have a big impact on the market share held by the leading COVID-19 vaccine makers.

If clinical data shows that it’s safe and effective to use a different type of COVID-19 booster, that could allow some of the smaller companies developing still-investigational shots to gain entry and a slice of market share, according to Porges.

“If mix-and-match boosting is found to be as effective or better than three doses of an mRNA vaccine, PFE and MRNA may capture less of the long tail of COVID vaccine revenues than currently priced in,” he wrote, “and companies like Sanofi, Novavax, Valneva, and Clover Biopharmaceuticals could participate in this market.”

Sanofi

SNY,

SNYNF,

is currently testing the experimental recombinant protein vaccine and booster it developed with GlaxoSmithKline in Phase 3 clinical trials. (Sanofi said Sept. 28 it would stop developing its mRNA shot.)

Novavax Inc.’s

NVAX,

COVID-19 vaccine candidate is expected to soon be submitted to the FDA for authorization.

Valneva SE

VALN,

is a French biotech that is still evaluating its experimental COVID-19 shot in clinical trials, while Clover Biopharmaceuticals is a privately held Chinese biotech with a vaccine candidate in Phase 2/3 trials.

So far this year, U.S.-listed shares of AstraZeneca have gained 18.8%, J&J’s stock has edged up 0.4%, Moderna shares have soared 201.8%, and Pfizer’s stock has gained 13.5%. The S&P 500

SPX,

is up 15.7% in 2021.