This post was originally published on this site

Online traders are placing a better-than-not likelihood on Federal Reserve Chairman Jerome Powell serving a second four-year term starting next year, although this week’s attack on him by U.S. Senator Elizabeth Warren has somewhat dented his chances.

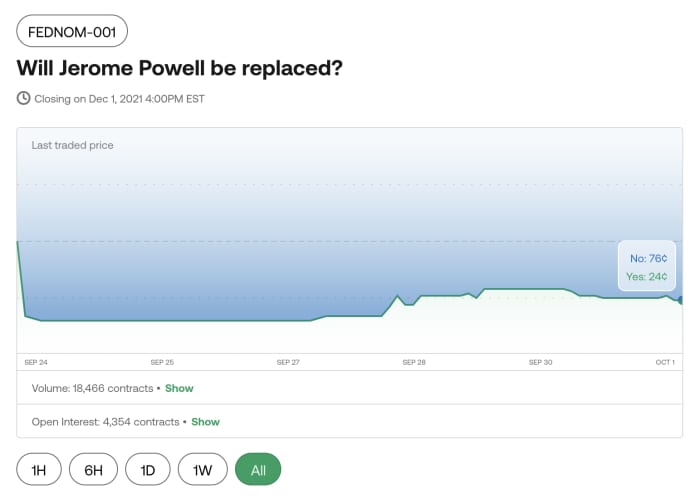

In response to the question of whether Powell will be replaced, 76% of traders said “no” and 24% said “yes” as of Friday, according to the online trading platform Kalshi. That compares with 83% of traders who said “no” and 17% who said “yes” on Tuesday morning, before Warren’s comments. More than 18,000 contracts were traded on the anticipated outcome, with each contract pegged to one dollar and percentages expressed as cents.

Kalshi

Questions about Powell’s future have been swirling this week, including after Warren called the Fed chairman “a dangerous man” and said she would oppose any move by the Biden White House to give him a second four-year term, starting next February. Uncertainty about the makeup of the Federal Reserve’s voters in the next one or two years was one of the reasons behind the recent runup in Treasury yields, like the 10-year rate,

TMUBMUSD10Y,

which hovered around 1.47% on Friday.

Read: Lost in the Din of D.C.—Sen. Warren’s Opposition to a New Powell Term as Fed Chief

“The market reacted strongly to comments by Senator Elizabeth Warren,” with the probability of Powell’s replacement jumping as much as 9 percentage points to 26%, a new high, said Luana Lopes Lara, co-founder and COO at Kalshi. “With the Democrats flexing their political power with the bipartisan infrastructure bill, it’s possible that Warren’s words could hold water with the West Wing. In short, Powell’s re-nomination has never been in greater jeopardy.”

Kalshi is the CFTC-regulated financial exchange funded by Sequoia Capital; Charles Schwab, chairman of Charles Schwab Corporation

SCHW,

; and Henry Kravis, co-chairman & co-CEO of KKR & Co.

KKR,

among others. The poll’s findings come as Treasury yields moved lower on the day, while the Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite indexes

COMP,

closed solidly higher Friday, but booked weekly losses.