This post was originally published on this site

Don’t expect U.S. stocks to mount anything more than an anemic rally in coming weeks. That’s because there’s still too much bullish sentiment. According to contrarian analysis, the most impressive rallies begin when there is widespread pessimism, just as market risk is highest when there is widespread optimism.

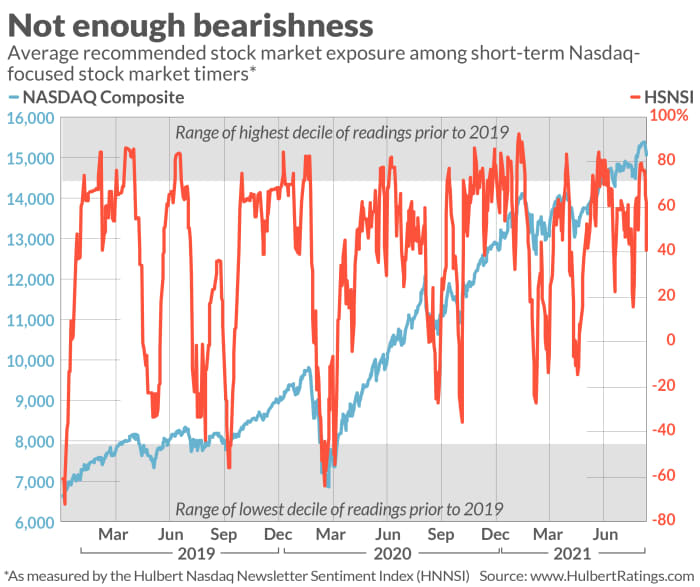

The chart below paints the picture. It plots the average recommended equity exposure level among a subset of Nasdaq-focused stock market timers I monitor (as measured by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI). The HNNSI is my most sensitive barometer of stock market sentiment.

Notice that March of 2020 was the last time that there was widespread pessimism, as defined by the HNNSI being in the lowest 10% of the historical distribution (the lower shaded box in the chart). Over the 18 months since then, in contrast, there have been many occasions in which the market timers were excessively bullish — as defined by the HNNSI being in the highest 10% of the historical distribution (the higher shaded box).

Earlier this month was the most recent such occasion. Since then, the Dow Jones Industrial Average

DJIA,

and the NASDAQ Composite index

COMP,

have both fallen 2%.

This decline provided a good opportunity to assess the strength of the bullishness held by the market timers. It would have been a good sign, from a contrarian perspective, if these timers had reacted to last week’s weakness by running for the exits. That would have suggested that their erstwhile bullishness was skittishly held; that’s far different from the stubbornly-held bullishness that is particularly toxic. But that didn’t happen, as you can see from the chart.

In fact, the HNNSI has carved out a pattern of higher lows in recent months. That means that the average Nasdaq market timer has grown progressively more confident that any decline is nothing to worry about and should instead be treated as a buying opportunity. As a result, the sentiment foundation beneath the bull market is becoming weaker and weaker.

Watch what they do

You may wonder how to square this conclusion with that of a recent Deutsche Bank survey, which found a growing “wall of worry” among 550 global market professionals. Specifically, a majority of them now say that they expect a 5% to 10% market pullback between now and the end of the year.

My explanation: The HNNSI reflects what market timers are doing, as opposed to what they are saying. It’s one thing for an adviser to say where he thinks the market will be at the end of the year, and quite another to increase or decrease his equity exposure level. Though the Deutsche Bank survey doesn’t report the average equity exposure level among the 550 professionals who participated, I’m confident that, on average, they have not significantly increased their recommended cash level.

Over the years, we have found that actions speak louder than words. Average exposure levels tell us more about prevailing market sentiment than opinions, so it behooves contrarians to pay attention to what advisers are doing as opposed to what they’re saying.

Even though a growing number of market professionals may be expressing concern, they appear not to be concerned enough to make big changes to their portfolios. Only when they are that concerned will contrarians become confident that a strong rally is imminent.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com