This post was originally published on this site

As extreme drought and water shortages plague the U.S. West and beyond, water funds have attracted about $35 billion of assets under management, according to a new Morningstar report.

The trend comes as much of California faces voluntary water rationing this summer as drought parches the land, forces some farmers to destroy crops and drains reservoirs. This month, the U.S. also declared the first-ever water shortage for the Colorado River, a key supplier of water and hydropower to households and farms in seven U.S. states and Mexico.

Morningstar examines whether the proliferation of water funds are worth it for investors.

“It is a niche that’s been around for a while, but it is one that continues to grow as concerns about climate-change-induced water shortages, and interest in investing in ways to adapt to or avert them, grow,” Morningstar research analyst Bobby Blue wrote.

The problem for Blue has been that water funds aren’t purely about water. Also, unlike energy and agriculture, none of the 65 open-end water funds tracked by Morningstar actually invest directly in water rights or provide direct exposure to the price of water.

“Rather, they invest in companies that fund managers believe have exposure to the price of water, either through selling it, treating it, or using it as an input,” Blue wrote, adding that this dynamic may give water-fund managers too much wiggle room to decide what fits the bill.

“There are countless ways to justify an investment as influencing clean-water availability, and this flexibility, exercised at the discretion of the manager, leads to a broad investment menu,” Blue wrote.

Blurred lines also make it challenging to keep tabs on how water-centric investments really are, without digging into each portfolio to vet their holdings.

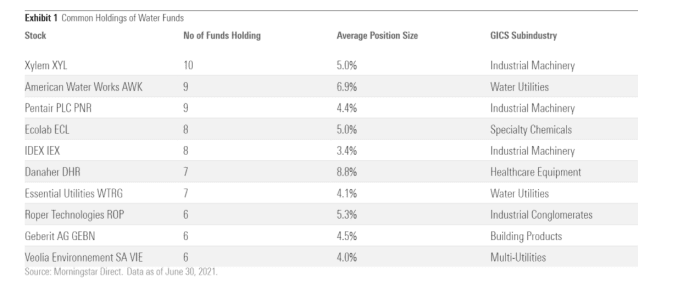

Morningstar did some of that work by tracking the 10 most common holdings in U.S. water funds, which ranged from shares of water treatment and testing company Xylem Inc.

XYL,

to Roper Technologies Inc.

ROP,

a maker of smart water meters for utilities, to the health-care centric Danaher Corp.

DHR,

Popular water fund stocks

Morningstar

Beyond the top holdings, Blue argues that the water connection “gets diluted.”

For example, he found several exchange-traded funds named after water

PHO,

PIO,

that held sizable exposure to shares of Waters Corp.

WAT,

a life sciences company named after its founder, Jim Waters, but with little exposure to the natural resource. Other water fund managers invested in Nike Inc.

NKE,

and Hyatt Hotels Corp.

H,

based on a view that those companies have become water efficiency leaders.

“While that is laudable, these are not water companies,” Blue wrote.

What’s more, despite their “eclectic compositions,” water funds often “come with a hefty price tag” in terms of fees, but while mostly giving “investors plain old equity exposure,” so they often “move in lockstep with broad market indexes.”

Morningstar also found that water funds tended to be poor trackers of the nation’s first benchmark for the price of water. Almost a year ago, investors gained a way to wager on the price of water through the Nasdaq Veles California Water Index futures contract, designed to better balance supply and demand for the commodity and hedge price risks.

“This is uncommon for sector funds,” Blue wrote, adding that at this juncture “it is doubtful you need a water fund.”