This post was originally published on this site

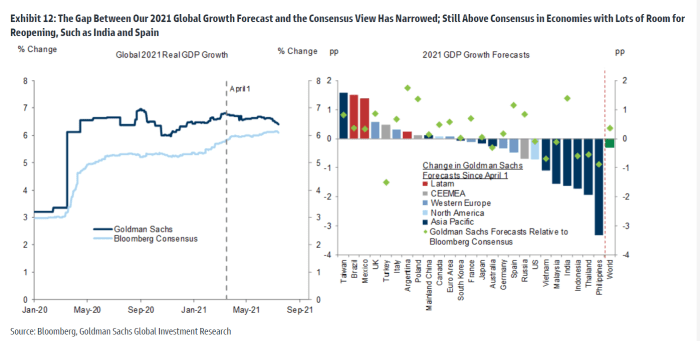

Goldman Sachs has prided itself on its bullish stance on the global economy, with its above-consensus takes doing better than many of its banking rivals to forecast just how resilient consumers and businesses have been.

The gross domestic product data released Thursday show the world’s largest economy, the U.S., has already surpassed its pre-pandemic peak, and Eurostat on Friday reported a stronger-than-forecast 13.7% year-over-year rise in the eurozone economy in the second quarter.

But…

Goldman Sachs economists Daan Struyven and Sid Bhushan explain the bank’s economics team has now become less enthusiastic. They’ve cut economic growth projections for the low-vaccination Asian economies including India and Australia but also the U.S. — even while upgrading Brazil and Mexico forecasts — taking their global growth forecast for this year to 6.4%, which is only 0.3% above the Wall Street consensus.

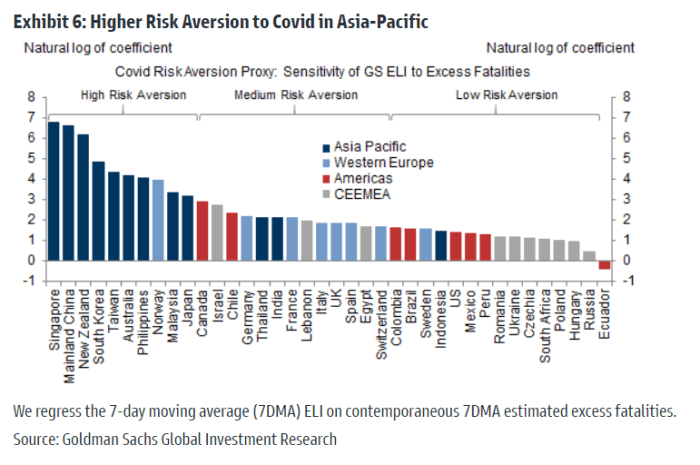

The more transmissible delta strain of coronavirus implies a slower recovery because of renewed outbreaks. The issue isn’t just government restrictions, but also the choices of individuals to limit high-contact services.

“The share of Americans reporting to ‘always avoid’ high-contact activities has decreased, but remains substantial at around 50% for public transportation and large events, and 30% for travel,” they said, citing YouGov data. “A further recovery will require not only rising vaccinations and related medical improvements, but also time for individuals to become more comfortable.”

Related: Here’s the good and bad news from the England ‘Freedom Day’ experiment

And the U.S. is grouped into one of the low-risk aversion countries, based on the restrictions imposed relative to fatalities. “China’s high risk aversion could keep quarantines and travel controls in place for longer, and delay the recovery in tourism economies such as Vietnam, Thailand, and Singapore,” they say.

The pessimism comes amid a new report from the Centers for Disease Control and Prevention, arguing the delta variant as as transmissible as chickenpox.

Amazon misses forecast

Amazon.com

AMZN,

missed sales expectations as CFO Brian Olsavsky said people are going out more and doing things besides shopping. Amazon shares slumped 6% in premarket trade.

Pinterest

PINS,

stock dived 20% in after-hours trade after reporting a decline in U.S. users and not providing third-quarter guidance. Like Amazon, Pinterest said there was an “unwinding of engagement” that had been seen when people were stuck at home.

The earnings slate for Friday includes oil producers Exxon Mobil

XOM,

and Chevron

CVX,

as well as machinery maker Caterpillar

CAT,

Chevon topped earnings estimate as it said it’ll resume a stock buyback program, while Caterpillar shares traded lower after it topped earnings estimates.

The economics calendar includes the second-quarter employment cost index, the June reading of PCE price inflation and consumer spending, and Chicago PMI for July. St. Louis Fed President James Bullard is due to deliver a speech.

The first person convicted in Hong Kong under the new national-security law was sentenced to nine years in prison.

The markets

U.S. stock futures

ES00,

NQ00,

pointed to an ugly start on the Amazon numbers, though the Amazon-free Dow industrials contract

YM00,

outperformed. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.25%.

The Hang Seng

HSI,

closed a turbulent week with a 1.4% decline. Property company Evergrande

3333,

sunk 9%.

The chart

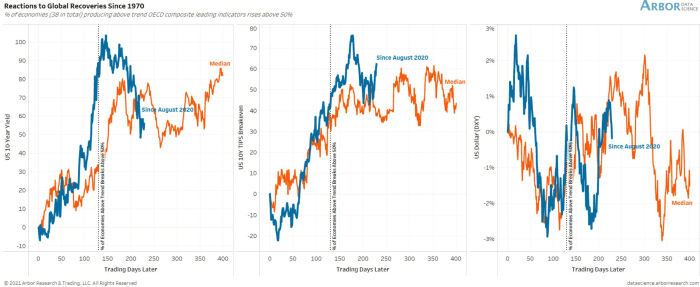

This time it’s… actually pretty similar. Arbor Research examined the performance of bonds and the U.S. dollar during other economic recoveries. The blue lines indicate the current performance more or less tracks what’s happened in previous years. “This historical playbook suggests range-bound conditions over the months ahead,” said Arbor’s Ben Breitzholtz over Twitter.

Random reads

Brazilians revel in snow, though the unusual cold snap threatens key commodities.

An art dealer sold a giant yellow pumpkin made by famed Japanese artist Yayoi Kusama. The trouble is, the dealer never owned it.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.