This post was originally published on this site

Happy, Thursday! Inflation continues to be a persistent theme in financial markets. And for a good reason.

A reading of consumer price inflation for June on Tuesday showed that the cost of living leapt by the largest amount since 2008 as inflation spread more broadly through the economy. Meanwhile, the pace of wholesale price increases over the past 12 months rose to 7.3% from 6.6% in May, marking the highest level since the producer-price index was overhauled in 2010, and likely representing one of the highest readings since the early 1980s.

So what does that mean for exchange-traded markets and how can investors play that dynamic as the Federal Reserve Chairman Powell insists that pricing pressures are transitory, or temporary, and that the U.S. central bank has all the tools necessary to beat it back should it prove unwieldy?

Check out: ETFs set to smash a 2020 record of $504 billion net inflows and it’s only July

MarketWatch’s ETF Wrap spoke to Gargi Pal Chaudhuri, head of iShares investment strategy Americas at BlackRock Inc.

BLK,

to glean some key ETF and macro insights from the inflation pro.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre to tell us what we need to be jumping on. Sign up here for ETF Wrap.

How to play inflation

For a bit of context, to say that Chaudhuri is an inflation pro may be a bit of an understatement.

She spent nine years on Wall Street building out U.S. inflation trading desks for Jefferies & Co., growing the institution’s Treasury inflation-protected securities business. In the early 2000s, she was on the trading desk of Merrill Lynch (now a part of Bank of America

BAC,

) making a market in TIPs and Treasurys.

Still, she told ETF Wrap that she’s never had more questions about inflation than she has had in this recent period.

“In 20 years, mostly focused on inflation, I [have] never been asked more questions than I have over the last three or four months…on the higher inflation regime,” she said.

Chaudhuri said that investors are confounded by the lower move for yields that has taken the 10-year Treasury

TMUBMUSD10Y,

market to around 1.33%, as of late-morning Thursday from around 1.7% in May. Inflation is anathema to Treasurys because it chips away at its fixed value.

The iShares pro also said that clients are unsure of how to play the next six months of this phase of the economic recovery cycle from COVID, particularly in light of growing concerns around variants of the coronavirus, which, incidentally, may also be a factor driving some demand for Treasurys, and a stock market that has the Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

trading near records despite some recent softness.

“How should investors and clients position their portfolios in a world that is looking beyond just the restart, ”Chaudhuri said.

The analyst and manager said that iShares 0-5 Year TIPS Bond ETF

STIP,

has become a popular trade among clients and one that she endorses, especially given concerns about inflation. STIP, referring to the ETF’s ticker symbol, has been around since 2010, is up 1.9% on the year, and carries an expense ratio of 0.05%, which means that investors will pay 50 cents annually for every $1,000 invested. She warned, however, that investors should recognize that inflation-protected notes also carry duration risks if yields eventually swing higher.

Chaudhuri also said she expects financials to continue to perform well as the economy improves and as yields head back toward 1.7% and 1.8% toward the end of 2021. The iShares U.S. Financials ETF

IYF,

so far, is up 23% so far this year and over 1% in the month to date, FactSet data show. Its expense ratio is 0.42%.

Although the recent drop in yields has called into question the so-called reflation trade, Chaudhuri says investors should expect value to outperform growth.

“We still like the value trade and a lot of that is based on the view that inflation and growth will be robust in the U.S.,” she said. The BlackRock executive also sees opportunities in small-caps

IJR,

IJR’s expense ratio stands at 0.06%.

She recommends that investors also think outside the U.S., pointing to iShares Core MSCI Europe ETF

IEUR,

as a good diversification play. IEUR costs 90 cents annually for every $1,000 invested.

The good and the bad

| Top 5 gainers of the past week | %Return |

|

VanEck Vectors Rare Earth/Strategic Metals ETF REMX, |

8.7 |

|

Global X Lithium & Battery Tech ETF LIT, |

6.8 |

|

Invesco DB Oil Fund DBO, |

5.3 |

|

United States Oil Fund LP USO, |

5.1 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF PDBC, |

3.1 |

| Source: FactSet, through Wednesday, July 14, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week | %Return |

|

VanEck Vectors Vietnam ETF VNM, |

-5.8 |

|

iShares U.S. Home Construction ETF ITB, |

-4.8 |

|

Amplify Transformational Data Sharing ETF BLOK, |

-4.6 |

|

ProShares Online Retail ETF ONLN, |

-4.6 |

|

SPDR S&P Homebuilders ETF XHB, |

-3.2 |

| Source: FactSet |

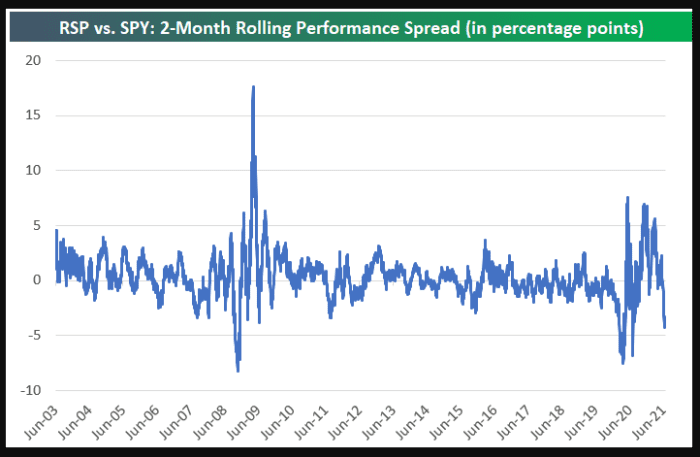

Visual of the week

Bespoke Investment Group

The analysts at Bespoke are spotting some internal weakness in the market as reflected in the underperformance of the popular SPDR S&P 500 ETF Trust

SPY,

versus the Invesco S&P 500 Equal Weight ETF

RSP,

The attached chart shows the rolling 2-month performance spread between RSP and SPY since RSP began trading in 2003.

Bespoke analysts say that there have only been two other periods where we’ve seen the 2-month performance spread turn more negative for RSP versus SPY.

Big Data

On Wednesday, the folks at Defiance ETFs launched the Defiance Next Gen Big Data ETF

BIGY,

on the Intercontinental Exchange

ICE,

-owned New York Stock Exchange’s Arca platform.

Defiance describes the exchange-traded asset as a “rules-based ETF that offers exposure to global companies in data science and analytics who are powering this digital revolution.”

The ETF is based on a proprietary ETF that tracks companies valued at $500 million or more that derive at least a quarter to half of their revenues from the production, storage or processing of large data sets, as ETF.com describes it.

There are a number of competitors aiming at a similar theme but Defiance is looking to offer a fund with cheaper fees. Its expense ratio for the big data fund is 0.45%.

We asked Defiance about the launch and they said that big data goes beyond just funds focused on cloud-based data.

“BIGY is unique in that it gives investors access to companies involved very specifically with data science and analytics,” Sylvia Jablonski, Co-Founder and CIO of Defiance ETFs, told ETF Wrap in emailed comments.

“It is a means to providing opportunities to utilize new and existing data, and discovering new ways to use new data to make a difference in the business operations of many companies across various sectors including healthcare, manufacturing, infrastructure, agriculture to name a few,” the CIO said.

“A lot of the competitive funds out there have relatable products but tend to be focused more on one aspect of this, like cloud for example, Jablonski said.

“Another difference between our fund and others out there, is that we are a passive index based 1940 Act ETF, with lower management fees than those charged by competitors,” she said.

Wise Bitcoin ETF?

Is there a bitcoin ETF, yet?

No!

Earlier this week, the Securities and Exchange Commission delayed its decision on Wisdom Tree’s Bitcoin ETF, asking for additional commentary and adding the provider to a growing list of companies including VanEck and others who have seen the regulator punt on approving a bitcoin

BTCUSD,

fund with an ETF wrapper.

The SEC remains concerned about the possibility of manipulation in the nascent and volatile crypto market.