This post was originally published on this site

Halfway through the year, Wall Street is going way worse than a simple portfolio of the investments it hated most back in January.

As usual.

At the start of January I found the seven investments that were the least popular and most despised by the big money crowd who run the world’s pension funds and endowments. These were cash

GBIL,

bonds

BNDW,

energy stocks

IXC,

consumer staples stocks

KXI,

real-estate investment trusts

REET,

and British

FLGB,

and Japanese

FLJP,

stocks.

This was based on what these big money honchos—they manage about half a trillion dollars of other people’s money—were saying in the latest industry surveys. These weren’t just the assets the Brooks Brother crowd happened to despise, but the ones they were actively avoiding. Their clients’ portfolios were significantly underinvested in all seven.

I pointed out that you, me and the family dog could invest in all seven through low-cost exchange-traded funds available from any online brokerage account. And I suspected these seven investments, as a group, would probably turn out to be pretty good places to hold your money in 2021—for the simple reason that the big money was avoiding them, so the prices were already comparatively low.

(Oh, and these people likely went to the same schools and all think alike, so when they change their minds they’ll probably do so all at once, driving up the price.)

That’s how it usually works.

And so it’s proving.

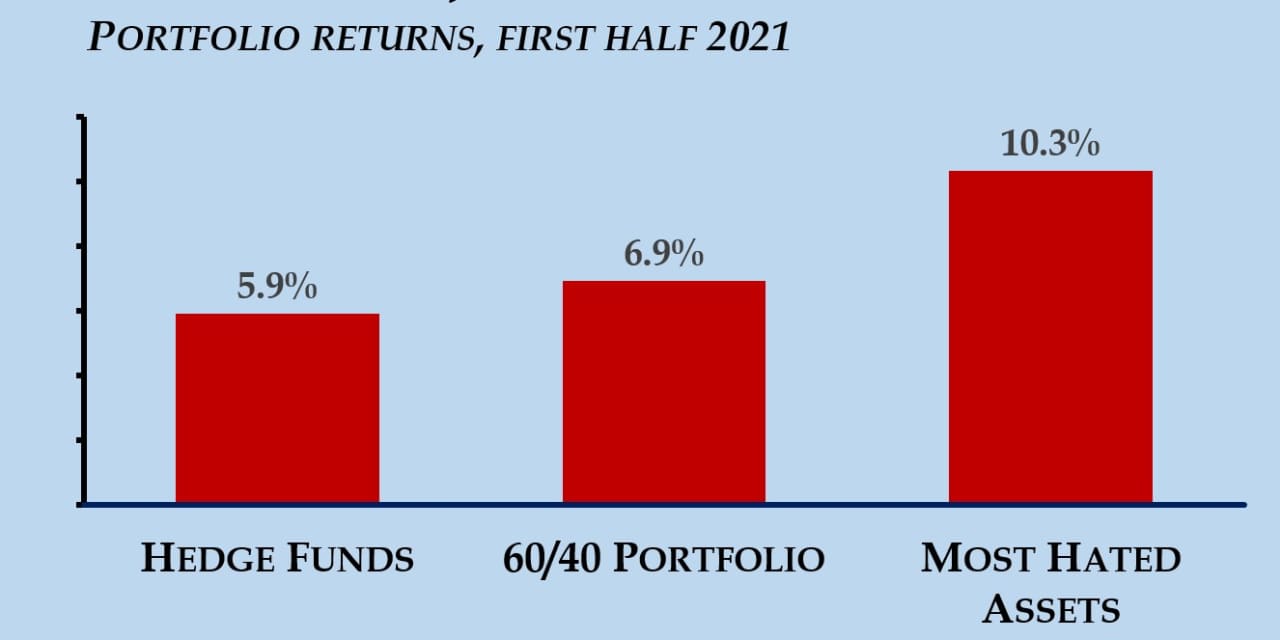

Through June 30 a simple portfolio of these seven investments have crushed the competition.

They’re up 10.3% in aggregate, helped by a blowout 35% return from global energy stocks.

A benchmark portfolio of 60% global stocks and 40% global bonds: Less than 7%.

And Cathie Wood’s ARK Innovation

ARKK,

: Just 3.3%.

Oh, and of course hedge funds have done even worse (as ever). The HFRI Asset-Weighted Index of industry returns has earned 5.9% so far this year.

The hedge funds have proved incredibly lucrative for the people actually…er…running the funds. But that’s a story for another day.

The HFRI “Fund of Funds” Index, which monitors the racket whereby hedge-fund managers charge the suckers a bunch of fees, and then other people charge them even more, is up less than 5%.

When I finally hang up my pen I’m planning to go into business running a “fund of fund of funds,” because why should other people get all the fun and easy money?

Sure, it’s easy for someone to find a portfolio that’s doing well by taking on a lot of risk. But this year’s most-hated portfolio is the opposite of risk. It’s 14% cash and 14% bonds, and the rest was allocated across a bunch of diverse and low-risk assets, like two major developed stock markets (Tokyo and London), real estate, and consumer staple stocks like Coca-Cola

KO,

Nestlé

NSRGY,

and Procter & Gamble

PG,

I’m still willing to bet that this portfolio will bank a better return for the full 2021 than the average hedge fund or even a balanced portfolio of global stocks and bonds. But the most recent survey found that the least popular assets among the world’s top fund damagers (sic) are now British and Japanese stocks (as in January) plus utilities.

So if London, Tokyo and the iShares Global Utilities ETF

JXI,

beat the Street in the second half, don’t expect to knock me down with a feather.