This post was originally published on this site

The price of crude oil has recovered to its highest level in six years — way above break-even prices for U.S. shale producers. A delay in production increases by the OPEC+ group of oil producing nations has underlined the recent price push, but the prospect of a continuing economic recovery for the U.S. and other industrialized nations points to an opportunity for investors.

Below is a list of 20 energy stocks favored by Wall Street analysts, with price targets implying upside of up to 39%.

Read: OPEC+ calls off output talks again Monday, leading crude oil prices to surge

Oil stocks are running behind oil prices

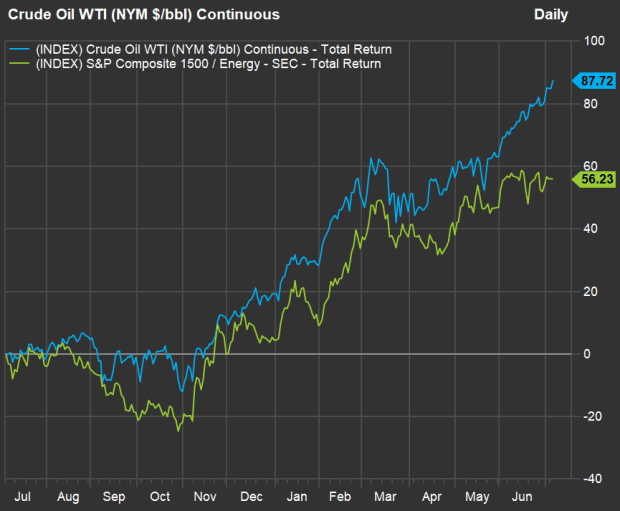

These charts compare the percentage movement for continuous forward-month contracts for West Texas Intermediate Crude Oil

CL00,

to total returns for the energy sector of the S&P Composite 1500 index

SP1500,

:

First, year-to-date moves through 7:25 a.m. ET on July 6:

FactSet

Even with dividends reinvested, the energy sector of the S&P 1500 has lagged the price action for oil. (The S&P Composite 1500 index is made up of the S&P 500 SPX, the S&P 400 Mid Cap Index MID and the S&P Small Cap 600 Index SML.)

Now look at the one-year chart:

FactSet

There’s an argument to be made that oil stocks are way behind the recent price action. West Texas Crude Oil for August delivery

CLQ21,

was trading above $76 a barrel on the New York Mercantile Exchange early on July 6. For U.S. shale oil producers, there’s a critical relationship between the spot price and their production break-even prices for new wells, which ranged between $46 and $58 a barrel according to a survey conducted in March by the Federal Reserve Bank of Dallas. (You can see that report here, with the break-even prices on the second-to-last slide and break-even prices for existing wells on the last slide.)

It’s easy to understand that when West Texas Crude was trading for about $48.50 at the end of 2020, many investors remained shy of oil producers and related stocks.

Read: If you support green energy, you should buy utilities and oil stocks — here’s why

Wall Street’s favorite stocks of oil producers and related companies

To screen for U.S.-listed oil stocks, we began with the S&P 1500, in part because the S&P 500 includes only 22 stocks. Some stocks dropped out of the large-cap benchmark index because their market values declined significantly during the COVID-19 pandemic, but more broadly they have been suffering since oil prices peaked in 2014.

There are 64 stocks in the S&P 1500. We then added the 17 pipeline limited partnerships held by the Alerian MLP ETF, which aren’t included in the S&P indexes. The pipelines are generally considered income plays, but there are some tax complications that should be part of your research before considering them for investment.

Among the screen of 81 energy stocks, 36 have majority “buy” or equivalent ratings among a group of at least five analysts working for brokerage firms, according to data provided by FactSet. Here are the 20 for which consensus price targets imply the most upside over the next 12 months:

| Company | Ticker | Share “buy” ratings | Closing price – July 2 | Consensus price target | Implied 12-month upside potential | Dividend Yield |

| Renewable Energy Group Inc. |

REGI, |

77% | $61.80 | $85.92 | 39% | 0.00% |

| Energy Transfer L.P. |

ET, |

83% | $10.71 | $13.56 | 27% | 5.70% |

| PDC Energy Inc. |

PDCE, |

89% | $46.67 | $58.94 | 26% | 1.03% |

| CNX Resources Corp. |

CNX, |

54% | $13.51 | $17.00 | 26% | 0.00% |

| Pioneer Natural Resources Co. |

PXD, |

81% | $166.74 | $207.38 | 24% | 1.34% |

| Dorian LPG Ltd. |

LPG, |

86% | $13.75 | $17.00 | 24% | 0.00% |

| Bonanza Creek Energy Inc. |

BCEI, |

100% | $49.57 | $61.17 | 23% | 2.82% |

| Devon Energy Corp. |

DVN, |

85% | $29.23 | $36.06 | 23% | 1.51% |

| EQT Corp. |

EQT, |

77% | $21.61 | $26.02 | 20% | 0.00% |

| Penn Virginia Corp. |

PVAC, |

80% | $25.52 | $30.40 | 19% | 0.00% |

| Green Plains Inc. |

GPRE, |

100% | $33.51 | $39.75 | 19% | 0.00% |

| ConocoPhillips |

COP, |

94% | $62.75 | $74.00 | 18% | 2.74% |

| Marathon Petroleum Corp. |

MPC, |

78% | $61.07 | $71.88 | 18% | 3.80% |

| Valero Energy Corp. |

VLO, |

84% | $78.07 | $91.81 | 18% | 5.02% |

| Talos Energy Inc. |

TALO, |

88% | $16.09 | $18.71 | 16% | 0.00% |

| Baker Hughes Co. Class A |

BKR, |

88% | $23.55 | $27.32 | 16% | 3.06% |

| Chevron Corp. |

CVX, |

56% | $106.07 | $122.52 | 16% | 5.05% |

| Enterprise Products Partners L.P. |

EPD, |

96% | $24.59 | $28.33 | 15% | 7.32% |

| EOG Resources Inc. |

EOG, |

69% | $85.77 | $97.11 | 13% | 1.92% |

| Phillips 66 |

PSX, |

78% | $87.90 | $98.94 | 13% | 4.10% |

| FactSet | ||||||

You can click the tickers for more about each company.

Many oil companies have been forced to cut their dividends during the pandemic, but Valero Energy Corp.

VLO,

and Chevron Corp.

CVX,

are among the exceptions. Both have dividend yields above 5%.

As always, ratings and price targets aren’t enough. You need to do your own research and consider any company’s long-term prospects before investing.

More from Philip van Doorn: These 30 stocks are the best dividend income growers among the S&P 500

Also: The 20 best-performing IPOs of the past three years have returned up to 1,477%