This post was originally published on this site

Hello, again! We’ve got crypto on the brain this Thursday. Blame Cathie Wood‘s ARK Invest and 21Shares, which announced earlier this week that they were throwing their collective name into the ring among about a dozen or so prospects aspiring to get a bitcoin

BTCUSD,

fund into an ETF wrapper.

All the breathless anticipation for a bitcoin ETF, made us wonder why the Grayscale Bitcoin Trust

GBTC,

hasn’t had an easier go at it than rivals, who are aiming to launch an exchanged-trade fund that is more accessible to average investors. So, ETF Wrap asked Grayscale Investments CEO Michael Sonnenshein to talk about the process a bit.

We’ll get into what he said and his view on the subject of a bitcoin ETF.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on. Sign up here for ETF Wrap.

The Grayscale ETF

Grayscale, which launched in 2013, is a monolith among funds pegged to crypto and Sonnenshein reiterated that the trust is “100% committed to converting,” and said that the provider remains “in very close dialogue with regulators.”

However, it isn’t clear if Grayscale has submitted a public application or prospectus to complete a conversion, which it can also do confidentially. Sonnenshein wouldn’t say precisely where Grayscale is in the process other than to say “our hat is very much in the ring.”

Sonnenshein gives the impression that the fund’s eight-year record as a fund and its status as a Securities and Exchange Commission reporting entity, which comes with regular reporting requirements, gives it an advantage versus competitors in the race toward an ETF.

“Becoming an SEC reporting company that was an intense process…and something that I think that is, generally speaking, not appreciated enough.”

“That brought the product just one major step closer to becoming an ETF,” he said.

The SEC has already delayed a decision on ETF provider VanEck’s proposed bitcoin product, citing questions about market manipulation and whether any single market participant would have “the ability to buy or sell large amounts of bitcoin without significant market impact.”

Sonnenshein said that the threat of manipulation is still front and center for the SEC and notes that market infrastructure in the crypto world may also need to improve its systems to allow for better communication and the ability to call out potential acts of manipulation taking place in the market.

“Some of that framework does not exist” he noted. That is not to say that it won’t eventually, to be sure.

GBTC holds the equivalent of some 654,600 bitcoin and is currently listed on the OTC, or over-the-counter, market.

For its part, Sonnenshein said that there are two other things that Grayscale needs to do get closer to ETF status like shifting from its current OTC home to a larger exchange like the Nasdaq

NDAQ,

or the Intercontinental Exchange

ICE,

-owned New York Stock Exchange.

The trust would also need to be able to facilitate the creation and redemption of shares via authorized participants, which is considered an integral element that makes ETFs less expensive, and more transparent and tax efficient than, say, mutual funds.

State Street and Invesco

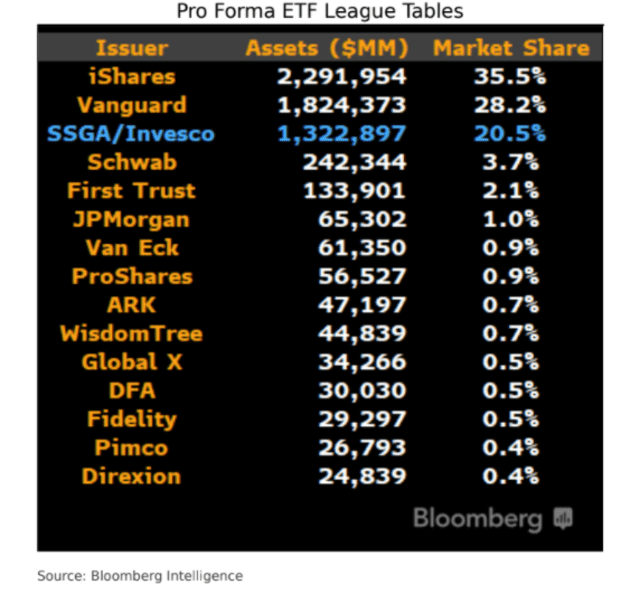

Chatter of a potential merger between State Street’s asset-management arm and

Invesco, reported by Bloomberg late last year have led to speculate about what such a combination might mean for the ETF business.

It could create the third-largest provider with assets of over $1 trillion, behind BlackRock’s iShares and Vanguard,

A record for first half

The first half of 2021 saw a record $466 billion in inflows to ETFs, according to Matthew Bartolini, Head of SPDR Americas Research at State Street Global Advisors. That outpaced the previous first-half record of $242 billion in 2017.

Here are some of the highlights from Bartolini:

- For the 11th month in a row, cyclical sectors (+$2.4 billion) beat defensives (+$581 million).

- Growth ETFs had their best month ever while outgaining value.

- Bond ETFs took in $20 billion in June and are on pace to break 2020’s full year record.

- Led by active fixed-income strategies, active ETFs took in $6.6 billion in June, their sixth highest and the 15th month in a row with inflows—a record streak.

- With over $3 billion of inflows in June into ESG ETFs, those focused on environmental, social, and governance, have now surpassed the notable milestone of more than $100 billion in assets under management

- Treasury-inflation Protected funds had the second-most flows, taking $3 billion. This is their 14th month in a row with inflows.

The good and the bad

| Top 5 gainers of the past week | %Return |

|

Invesco Solar ETF TAN, |

9.1 |

|

Amplify Transformational Data Sharing ETF BLOK, |

6.8 |

|

ARK Innovation ETF ARKK, |

5.9 |

|

SPDR S&P Semiconductor ETF XSD, |

5.7 |

|

First Trust NASDAQ Clean Edge Green Energy Index Fund QCLN, |

5.4 |

| Source: FactSet, through Wednesday, June 30, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week | %Return |

|

U.S. Global Jets ETF JETS, |

-5.0 |

|

VanEck Vectors Oil Services ETF OIH, |

-4.3 |

|

ETFMG Prime Junior Silver Miners ETF SILJ, |

-4.2 |

| VanEck Vectors Junior Gold Miners ETF | -3.7 |

|

Global X MLP ETF MLPA, |

-3.6 |

| Source: FactSet |

Is there an ETF for that?

Innovator Capital Management launched the Innovator Defined Wealth Shield ETF on Cboe Global Markets

CBOE,

on Thursday. The ETF is meant to serve as a bond alternative, with benchmark 10-year Treasury yields

TMUBMUSD10Y,

hovering at 1.50% but analysts are increasingly pointing to the possibility of a return to the 2% range (and higher) as the world reopens from the COVID pandemic and the U.S. economy kicks into higher gear. That means holding on to bonds could be a risky proposition since yields move inversely to price.

BALT

BALT,

referring to the fund’s ticker symbol, is aiming to compensate investors for the risks in bonds and inflation, especially when factoring in for fees.

The fund is representative of products that promise a set buffer against the downside, in exchange for a ceiling on the upside of your returns, to smooth out stomach-churning market volatility.

Such products, and those like it, have come more into vogue with the Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

hovering around records and bond prices are also punching higher but are expected to eventually cool.

It is important to note that BALT doesn’t provide investment income and isn’t meant to mimic a money-market fund but it is intended to “provide a large buffer (15-20% on a quarterly basis) against loss, with a defined upside cap before fees and expenses, benchmarked to the price return of the SPDR S&P 500 ETF Trust

SPY,

Many strategists recommend using such ETFs within the framework of a broader strategy.