This post was originally published on this site

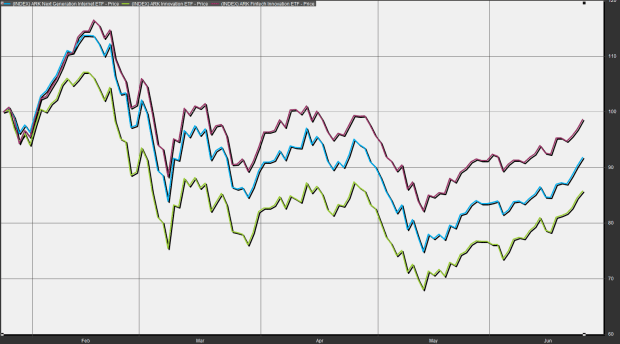

Happy Thursday! Happier if you are in technology funds, which have been the second-hottest sector this month, so far. And Cathie Wood‘s Ark Investment platform, led by her flagship Ark Innovation products, are making a comeback as technology and growth stocks enjoy a resurgence.

We talked to Yasmin Dahya Bilger, managing director and head of ETFs at activist hedge-fund Engine No. 1 about the company’s products and strategy. We also chatted with Rich Lee, head of program and ETF trading for Baird, about the rise of individual investors and the lightly managed products emerging to cater to them.

As per usual, send tips, or feedback, and find me on Twitter at @mdecambre to tell me what we need to be jumping on. Sign up here for ETF Wrap.

Traders of the lost ARK

Remember when Wood said that she loved this setup during a CNBC interview in May, as some of her most popular and coveted investment trends were collapsing and she was doubling down?

Well, a number of Ark funds are back in the black for the year after a powerful June rally. To be sure, they aren’t back to their previous peaks but have enjoyed a mighty rebound.

For example, the flagship Ark Innovation was up nearly 12% in June, at last check, helping it gain 0.5% on the year so far. The fund is up over 80% in the past 12 months.

FactSet

The good and the bad

| Top 5 gainers of the past week | %Return |

|

WisdomTree Cloud Computing Fund WCLD, |

5.8 |

|

Ark Innovation ETF ARKK, |

5.7 |

|

Ark Next Generation Internet ETF ARKW, |

4.6 |

|

3D Printing ETF PRNT, |

4.1 |

| iShares Expanded Tech-Software Sector ETF | 3.6 |

| Source: FactSet, through Wednesday, June 23, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater | |

| Top 5 decliners of the past week |

% Return |

|

ETFMG Prime Junior Silver Miners ETF SILJ, |

-8.1 |

|

VanEck Vectors Junior Gold Miners ETF GDXJ, |

-6.5 |

|

iShares MSCI Global Gold Miners ETF RING, |

-6.4 |

|

VanEck Vectors Gold Miners ETF GDX, |

-6.0 |

|

SPDR S&P Metals & Mining ETF XME, |

-5.9 |

| Source: FactSet |

An ETF for activism

The New York Times described Engine No. 1, founded Chris James, as the little-hedge fund that took down big oil and now that activist fund is kicking off a social-impact ETF.

Bilger told ETF Wrap that the ETF platform isn’t a gimmick for the investor that won a boardroom battle against oil behemoth ExxonMobil

XOM,

“We are a broad impact investment group and we believe that social and environment issues,” which represent its ESG, or environmental, social and governance, focus, “are economic issues and the ETF is another way to bring this” to individual investors, she said.

Transform 500 ETF

VOTE,

is listed on Cboe Global Markets

CBOE,

ETF platform, and Engine No. 1 has joined with digital investment adviser Betterment for distribution of its VOTE fund.

Bilger says there’s more to come on the ETF front too and recognizes that Engine No. 1’s style of investing will be one that requires a lot of politicking with company CEOs and other investors.

“We will only be as successful as we bring other investors with us…and as we create the right coalitions,” she said.

VOTE boasts a comparatively low expense ratio of 0.05%, which means you pay 50 cents for every $1,000 investing. The average expense ratio for a passive fund was 0.19% in 2019, according to Morningstar.

VOTE, which launches with $100 million in seed money, is a bet that individual investors want large-cap investments but with influence on how corporations position themselves in the world.

“This is all we do…use the tools of an active owner to drive economic value,” Bilger said.

Engine No. 1 thinks it can differentiate itself by focusing on a select number of ESG issues each year, including climate, racial equity, living wages and other social issues.

Actively seeking ETFs

Baird’s Lee told ETF Wrap that fund providers are increasingly looking to convert existing mutual funds and investment products into ETFs, with the idea that the growing demand from individual investors will support it. “It’s all about accessibility” Lee said.

He pointed to the launch of a quartet of ETFs from Dimensional Fund Advisors on the Intercontinental Exchange-owned New York Stock Exchange, which were conversions from mutual funds boasting low fees and a tax-efficient wrapper. Dimensional U.S. Equity ETF

DFUS,

Dimensional U.S. Small Cap ETF

DFAS,

Dimensional U.S. Targeted Value ETF

DFAT,

Dimensional U.S. Core Equity 2 ETF

DFAC,

The emergence of more active ETFs or conversions of mutual funds into such products come amid a continued fight for market share in a low-fee environment that almost seems like a race to the bottom to attract a ravenous retail investor.

Lee said that retail investors want “instant gratification and the ETFs offer real-time intraday [net asset value] which you can’t get in a mutual fund.”

Here’s some other thoughts from Lee:

- Active non-/semi-transparent are finding their footing. American Century continued to add to their family of actively managed semitransparent ETF and large asset managers like Putnam also started to roll out non-/semi-transparent active ETF approaches. Though the category remains young in relation to the rest of the ETF universe, there is reason to believe investors will continue to warm to these funds as new strategies come to market.

- Amidst periods of chaos, the market (and the ETF structure) continues to work as designed. “Meme stocks,” a return of volatility, the specter of rising inflation, and so much more…investors have had their hands full when it comes to navigating the markets this year, but through it all, the markets and the “plumbing” that powers the ETF space, has worked exactly as designed.

Moving target?

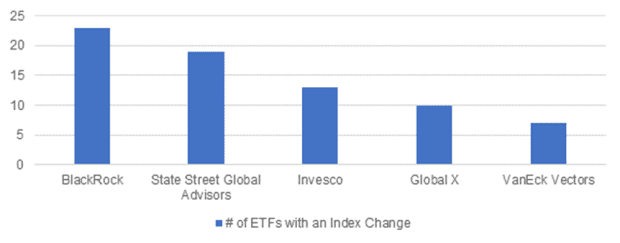

CFRA’s Todd Rosenbluth notes that BlackRock

BLK,

has made the most frequent changes to the benchmarks that its fund are pegged to.

For example, iShares Biotechnology ETF

IBB,

moved from a Nasdaq index to an ICE one this week, and the firm shifted benchmarks of other prominent ETFs in 2021.

“Investors relying solely on past performance when choosing an ETF are incorrectly focused on the old rulebook—not the current one,” Rosenbluth wrote.

Check out the chart:

CFRA

—That’s a wrap!