This post was originally published on this site

Inflation is on the rise in America, but if price pressures were likely to persist, contrary to the Federal Reserve’s expectations, the data would be painting a different picture, one economist argued Friday.

In a note to clients, Daniel Vernazza, chief international economist at UniCredit Bank, highlighted the complicated but interesting chart below:

UniCredit Research

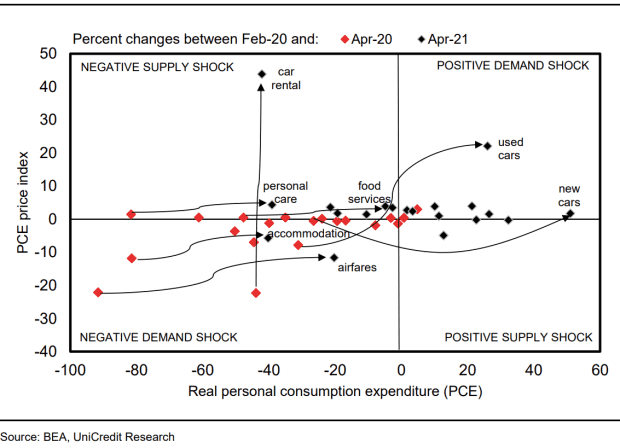

The chart plots the change in prices (vertical axis) against the change in spending (horizontal axis) relative to pre-pandemic levels in February 2020, by industry. It uses the personal-consumption expenditures deflator instead of the consumer-price index because PCE is the Fed’s preferred measure of inflation and to make better comparisons with spending data.

Vernazza explained:

A casual glance of the chart reveals that most items have moved backward and forward along the horizontal axis, implying little price elasticity to changes in demand. The chart also shows that for those service sectors hit particularly hard by the pandemic (such as airfares and accommodation), the reopening of the economy has led to only some normalization of prices, which have still not recovered their pre-pandemic levels.

In contrast, car rental is facing acute supply shortages, causing prices to surge, with spending in the sector remaining well below pre-pandemic levels because of limited supply. For used cars, a combination of expenditure-switching away from public transport and the global shortage of semiconductors for new cars, has pushed up demand and prices.

What’s important to note, Vernazza, said, is that since higher inflation is largely explained by the reopening of the economy and supply shortages, it’s likely to prove temporary, as the direct effects of the pandemic fade and supply adjusts to meet demand.

Opinion: Here’s why higher prices for car rentals, airfares and blouses won’t lead to higher inflation

So what would a more enduring inflation threat look like?

In that case, most of the items would occupy the upper-right quadrant of the chart, reflecting what economists refer to as “demand-pull inflation,” Vernazza said. To date, “this is clearly not the case,” the economist wrote.

Read: The CPI-vs.-PCE debate and other ‘rabbit holes’ to avoid when considering inflation

While inflation jitters rattled financial markets as recently as last month, investor concerns have appeared to wane. Treasurys rallied Thursday, despite another hotter-than-expected consumer-price index reading, sending the yield on the 10-year Treasury note

TMUBMUSD10Y,

below 1.45%.

See: Treasury yields fall despite rising inflation — here are some reasons why

Higher inflation is typically seen as bad news for bonds, eroding the value of the interest payments delivered to holders. Stocks rallied Thursday, with the S&P 500

SPX,

edging to a record close on Thursday, while the Dow Jones Industrial Average

DJIA,

remains not far off its all-time high and rallying tech shares, which are more sensitive to interest rates, pushed the Nasdaq Composite

COMP,

higher.

The Federal Reserve holds a policy meeting next week. While Fed officials have largely stuck to their view that inflation pressures will prove “transitory,” several have also said it’s time to begin thinking about when it would be appropriate to discuss pulling back on asset purchases at the center of its extraordinary monetary policy efforts to support the economy and heal the labor market.

The Tell: Why the bond market might not suffer another taper tantrum when the Fed signals it’s ready to move

And some economists caution that signs of inflationary pressures in more cyclical segments of the economy are beginning to emerge.

“Both rent and owners’ equivalent rent have staged a clear turnaround over recent months, and food-away-from-home prices surged by 0.6%,” said Michael Pearce, senior U.S. economist at Capital Economics, in a note. “It is no coincidence that rents and restaurant prices are rising more rapidly when wage growth is also accelerating.”

Pearce said a continued surge in job openings shows that worker shortages “are real and intensifying.”

Also see: ‘Take this job and shove it’: American workers quit at record levels

“The recent strength of inflation and signs of labor shortages could prompt a handful of hawkish regional Fed presidents to bring forward their projections for rate increases and strengthen calls for tapering asset purchases sooner rather than later at next week’s FOMC meeting,” he wrote. “But we suspect the majority on the committee will stick to the ‘largely transitory’ language and instead emphasize the yawning shortfall in employment from pre-pandemic levels.”