This post was originally published on this site

Bond markets may be shrugging off concerns about the spike in the cost of living in the U.S., but higher prices at the pump, for used cars and at grocery stores inflict a “direct hit” to lower-income households, warns BlackRock’s Rick Rieder, CIO of global fixed income.

“That problem is that inflation in daily necessities is disproportionately felt by lower-income cohorts,” wrote Rieder, who oversees several key funds at the $2.6 trillion fixed-income asset manager, in a Thursday note, following the release of a second “blockbuster” monthly of inflation data.

The consumer price-index for May surged to a 13-year high of 5%, its highest level since 2008, when the cost of oil hit a record $150 a barrel.

Surging prices largely have been attributed to the U.S. economy more fully reopen from the pandemic. The Federal Reserve expects the trend to be temporary, making it more willing to tolerate price swings while it seeks to stoke a more robust economic rebound and labor market recovery in the wake of the coronavirus pandemic.

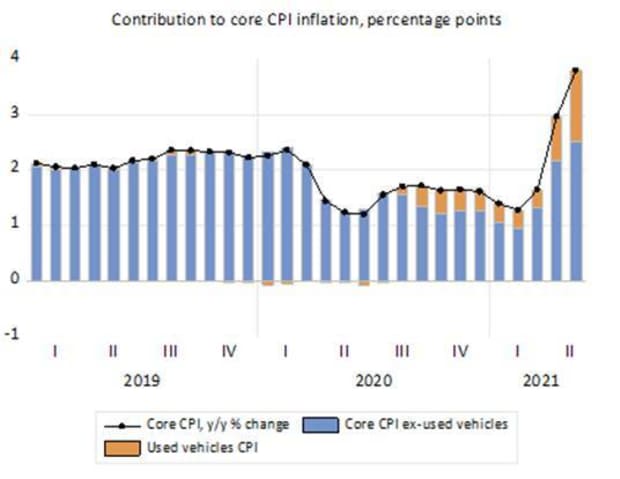

Rieder noted that a key catalyst of recent CPI gains has been skyrocketing used-car prices, which shot up another 7.3% in May, or 30% from a year ago.

Used cars and soaring CPI

BlackRock

“It’s become abundantly clear that certain parts of the economy don’t have sufficient product inventory to supply the demand at current prices and the data illustrating this today is overwhelming,” he wrote, while pointing to supply-chain disruptions that have roiled the auto sector during COVID.

Related: Shortages of chips and parts aren’t denting appeal of auto bonds

But Rieder also stressed that “used car inflation, or gasoline prices 56% higher over the past year (and 8% higher than pre-Covid levels), are a direct hit to lower income households, especially as they attempt to re-enter the job market.”

BlackRock ranks as the world’s largest asset manager. That no doubt adds heft to what the firm’s top asset managers say about financial conditions and the economy. But BlackRock has been far from alone in expressing concern about the Fed’s new policy to let inflation, at least temporarily run, above its 2% target.

For now, the biggest part of the U.S. bond market has shrugged off fears that the recent surge in inflation might have staying power. The yield on the 10-year Treasury note

TMUBMUSD10Y,

on Thursday briefly rose after the May CPI data release, but was last traded around 1.48%, its lowest since early March.

U.S. stock benchmarks were hovering near records Thursday, with the Dow

DJIA,

S&P 500 index

SPX,

and Nasdaq Composite Index

COMP,

all heading higher.

“In our view, the pursuit of inflation merely for inflation’s sake poses a very real problem: That problem is that inflation in daily necessities is disproportionately felt by lower-income cohorts,” Rieder wrote.

Read Next: Why the Fed’s focus on those hardest-hit by the pandemic matters for markets