This post was originally published on this site

Yields for the 10 and 30-year U.S. Treasurys Wednesday morning slid to their lowest levels at least three months as investors awaited an auction of benchmark debt later in the session and watched trading in Europe, ahead of policy meetings of the ECB on Thursday.

Traders are also focusing on the U.S. May consumer price index report due Thursday that could further help to shape expectations for policy at the Federal Reserve’s meeting next week.

How Treasurys are performing

-

The 10-year Treasury note yield

TMUBMUSD10Y,

1.487%

was at 1.502%, compared with 1.527% on Tuesday at 3 p.m. Eastern Time. -

The 30-year Treasury bond

TMUBMUSD30Y,

2.167%

was at 2.179%, versus 2.208% a day ago. -

The 2-year Treasury note

TMUBMUSD02Y,

0.144%

was yielding 0.149%, compared with 0.151% Tuesday afternoon.

On Tuesday, the 10-year Treasury yield hit its lowest level since March 11, while the long bond touched its lowest yield since Feb. 26, according to data compiled by Dow Jones Market Data.

What’s driving debt market?

For U.S. government debt markets the May reading of the U.S. consumer-price index due on Thursday morning is expected to be the main event of the week. A hotter-than-expected April CPI reading, which showed prices rose 4.2% year-over-year, briefly rattled markets last month.

Since then, inflation jitters have waned, but the CPI data is expected to provide an important test. Signs of unchecked inflation that is sustained could prompt the Fed to quickly halt its easy-money policies and more rapidly scale back its $120 million-a-month asset-purchase program that was installed to help stabilize financial markets during the worst of the coronavirus pandemic in 2020.

Meanwhile, talks between the White House and a group of Republican senators led by W.Va.’s Shelley Moore Capito on an infrastructure package broke down Tuesday, though President Joe Biden is still aiming to reach a deal on the issue with a different group that includes Republican senators.

The U.S. economic calendar is light Wednesday, featuring April wholesale inventories at 10 a.m. Eastern.

Looking ahead, investors are watching for a $38 billion auction of 10-year notes at 1 p.m.

In Europe, investors are betting that the European Central Bank won’t slow the pace of its pandemic emergency bond purchases. Traders will be looking closely for clues about eurozone monetary policy plans and the potential for that to inform the Fed.

Reuters reported on Wednesday that appetite for eurozone debt has been healthy, reflected in auctions from southern European countries: Greece, a €2.5 billion sale on Wednesday and a €10 billion sale of bonds from Italy.

Italy’s 10-year debt

TMBMKIT-10Y,

was yielding 0.816% on Wednesday, versus 0.916% on Monday. Greece’s comparable debt

TMBMKGR-10Y,

was yielding 0.842%, compared with 0.825% to start the week, FactSet data show.

On Tuesday, a report showed job openings in the U.S. soared to 9.3 million in April from a revised 8.3 million in the prior month, the Labor Department said. The data underlines concerns about employers ability to fill jobs despite unemployment that remains high as a result of the COVID-19 pandemic.

What strategists are saying

“For the Fed: it remains about employment in our view. Unlike challenges in the past cycle, the Fed has been very clear about trying to separate tapering from actual rate increases,” wrote Gregory Faranello, head of U.S. rates at AmeriVet Securities.

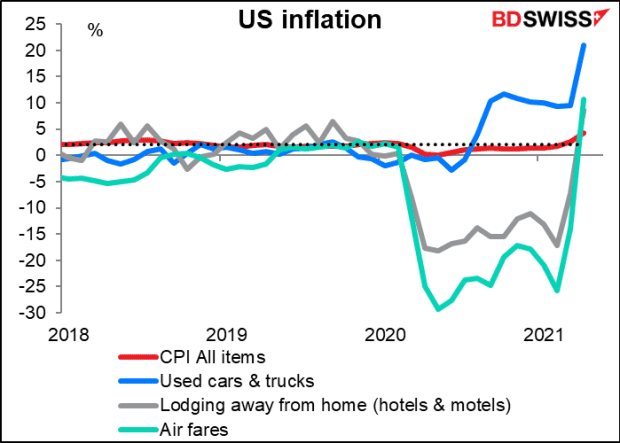

“So far though the story that [the Fed has] been telling seems to be largely correct: the higher inflation is mostly due to temporary supply/demand imbalances that occurred as the economy reopens and people go out and spend their stimulus payments. The poster boy for this phenomenon is used cars & trucks (blue line), writes Marshall Gittler, head of investment research at BDSwiss Group.

BDSwiss Group