This post was originally published on this site

As old trader sayings go, history shows that “never short a dull market” is pretty good advice. But there’s still a case to be made for being cautious with the S&P 500 index trading in “rarefied air,” according to one well-known Wall Street researcher.

When the Cboe Volatility Index

VIX,

“consistently trades below 20, the S&P has done well and suffered no annual drawdowns,” wrote Nicholas Colas, co-founder of DataTrek Research, in a Tuesday note.

The VIX, an options-based measure of expected S&P 500 volatility over the next 30 days, was trading at 16.79 on Tuesday and hasn’t traded above 20 since May 24.

Meanwhile, the stock market has been pretty sleepy, largely trading sideways over the past two months, albeit with the Dow Jones Industrial Average

DJIA,

and the S&P 500

SPX,

near all-time highs.

The adage seems particularly timely, Colas wrote, “because we’re seeing the S&P 500 tiptoe ever closer to fresh highs with little in the way of tradable/shortable pullbacks. That seems somewhat surprising, given all the chatter about inflation, tapering, etc.”

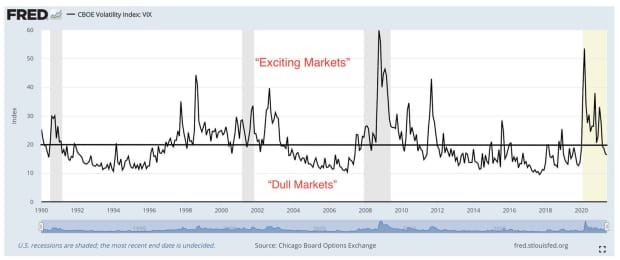

So what does history show? Colas pointed to the chart below tracking the VIX back to the early 1990s and labeling markets when the VIX was consistently below 20 as “dull” and those consistently above 20 as “exciting”:

DataTrek Research

And here’s how the S&P 500 did during the dull period, according to Colas:

- 1992 – 1996: +15 percent compounded annual total return with no down years (although 1994 – when the Fed started raising rates – was close, with just a +1.3 pct total return).

- 2004 – 2006: +10.3 percent compounded annual total return, also no down years.

- 2013 – 2017: +15.6 percent compounded annual total return, and no down years (we’re giving the August 2015 ETF flash crash a free pass – that’s the spike you see in the chart about 3/4s of the way across the time series)

Colas acknowledged that spikes in the VIX above the 40 level have also historically made good buying opportunities, noting that DataTrek has a standing recommendation to start buying domestic equities when the index breaches that level.

Meanwhile, there are legitimate questions about whether the VIX has moved solidly into dull territory or is merely reflecting the “calm before the storm.”

“If one can craft a story about a specific and imminent shock ready to take the stage, then it is reasonable to sell here even if the tape is ‘Dull,” Colas wrote.

The analyst described his view as “more cautious than outright bearish,” noting that history also shows that the S&P 500 rarely rallies more than 10% three years in a row. A year-to-date gain of 12.5% through Monday leaves the market in “somewhat rarefied” territory.

“We’d like to see a ‘Dull Market 5% pullback,’ even if it is not a tradable short opportunity, to allocate capital at better levels,” Colas said.