This post was originally published on this site

German stocks got off to a lackluster start on Tuesday, opening in the red and falling behind other major European equity indexes, after data showed that industrial production fell unexpectedly in April.

The pan-European Stoxx 600

SXXP,

rose 0.1%, remaining at record high levels, while the FTSE 100

UKX,

in London lifted 0.1%. In Paris, the CAC 40

PX1,

ticked up 0.1%, while Germany’s blue-chip DAX

DAX,

index was 0.1% lower.

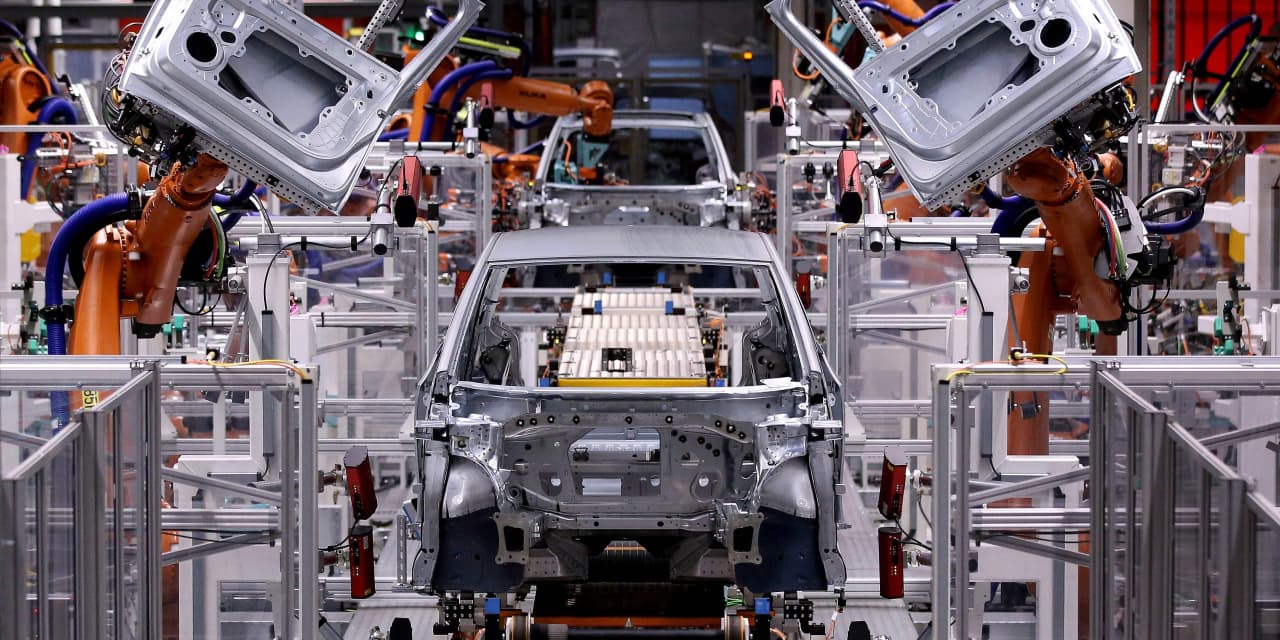

German industrial production, measuring total industrial output from manufacturing, energy, and construction, decreased 1% in April from March, the country’s Federal Statistics Office said on Tuesday. The figures missed expectations for an increase of 0.4%.

While industrial production in Europe’s largest economy fell short of economists’ projections, it represented a 26.4% rise from a year earlier. The statistics office also revised downward the same industrial figures from March from a month-on-month increase of 2.2%, down from the earlier reported 2.5% rise.

Read: German Industrial Production Unexpectedly Fell in April

More broadly, analysts pointed to an unchanged macro picture, with concerns around inflation and the global backdrop of COVID-19 infections — as well as the easing of restrictions in many developed economies — staying in focus.

“Investors’ main concern appears to be over short-term inflation risk and whether rising prices are likely to be transitory in nature, with the main focus on this week’s U.S. CPI [consumer-price index] data for May,” said Michael Hewson, an analyst at CMC Markets.

Hewson noted that European investors’ focus on Thursday was on the German industrial data, as well as the German economic research institute ZEW’s June survey of investor expectations.

Mark Haefele, the chief investment officer of UBS’

UBS,

global wealth management division, said that while the bank remains alert to inflation risks, “we believe the backdrop remains benign for stocks — with benefits most obvious for cyclical parts of the market, including energy and financials. We recently raised the highly cyclical Japanese market to most preferred in our global strategy.”

Plus: The ECB decision is coming. Here’s what analysts expect.

Shares in European airplane manufacturer Airbus

AIR,

ticked up near 0.5%, after the group said it made 50 deliveries in May, up 11% month-over-month. Analysts at Swiss bank UBS said it was a “modest pickup.”

British American Tobacco

BATS,

stock lifted near 1.5%, after the Big Tobacco group upgraded its full-year forecast for revenue growth at constant currencies to above 5%, from a previously guided 3% to 5% range.

Shares in Aviva

AV,

a FTSE 100-constituent, rose 3.5%, as Cevian Capital said the group should return £5 billion ($7.1 billion) to shareholders. The Swedish activist investor announced on Tuesday that it had built a near 5% stake in the insurance giant.

The price of oil was down slightly, with benchmark Brent crude futures having fallen around 0.75% to below $71 a barrel. The European-listed major oil companies fell in tandem, with shares in BP

BP,

Royal Dutch Shell

RDSA,

Eni

ENI,

and Total

TOT,

down.

Cryptocurrency asset bitcoin

BTCUSD,

was down near 4%, to just clear of the $33,000 mark, from above $35,000 on Monday.