This post was originally published on this site

Fund managers are increasingly making a “late cyclical” push, according to a closely watched monthly survey released on Tuesday.

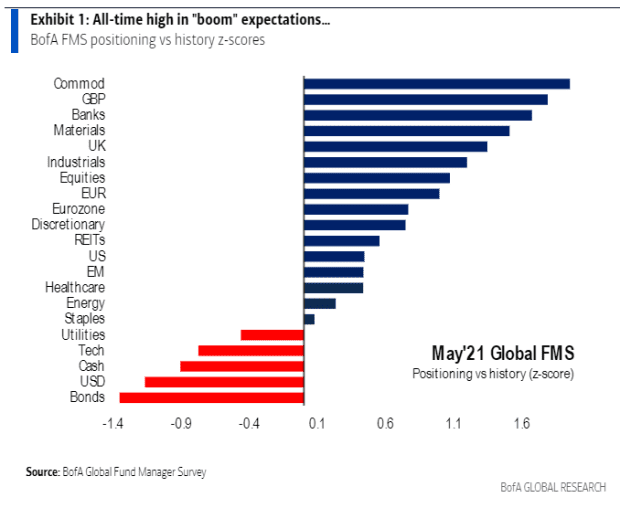

The Bank of America global fund manager survey for May found that investors were increasingly positioned to what it called “boom expectations” — with exposure to commodities, banks, materials, industrials, and U.K. and emerging market assets at highs relative to the last decade.

That makes sense given their economic expectations, with 69% expecting both above-trend growth and inflation, a record high for the survey. Expectations for profits did slip by 6 percentage points, though at 78%, the percent who say global profits will improve over the next 12 months also is near record highs. Expectations for the first interest-rate hike from the Federal Reserve moved to November 2022 from January 2023.

Investors report they are long U.K. stocks, where many of the world’s leading miners including Glencore

GLEN,

BHP Group

BHP,

and Rio Tinto

RIO,

trade, for the first time since July 2012.

Compared with April, though, investors also built up positions into consumer staples. Strategists at Bank of America say these investors are positioned for inflation with a hint of defensives. The percent overweight technology stocks were at 3-year lows.

Inflation was identified as the top tail risk, and 43% said long bitcoin

BTCUSD,

was the most crowded trade.

The survey of 216 panelists with $625 billion in assets under management was conducted between May 7 and May 13.

The S&P 500

SPX,

has gained 11% this year, while the tech-heavy Nasdaq Composite

COMP,

has advanced by 4%. The small-cap Russell 2000

RUT,

has gained 13%.