This post was originally published on this site

Stocks in London pushed higher on Friday, rebounding from a selloff in the U.S. that spread across European markets this week, though shares in a number of major mining companies dragged on gains.

The FTSE 100

UKX,

the index of London’s top stocks by market capitalization, rose 0.7%, with most of its constituents notching gains.

But shares in mining giants Rio Tinto

RIO,

BHP

BHP,

and Antofagasta

ANTO,

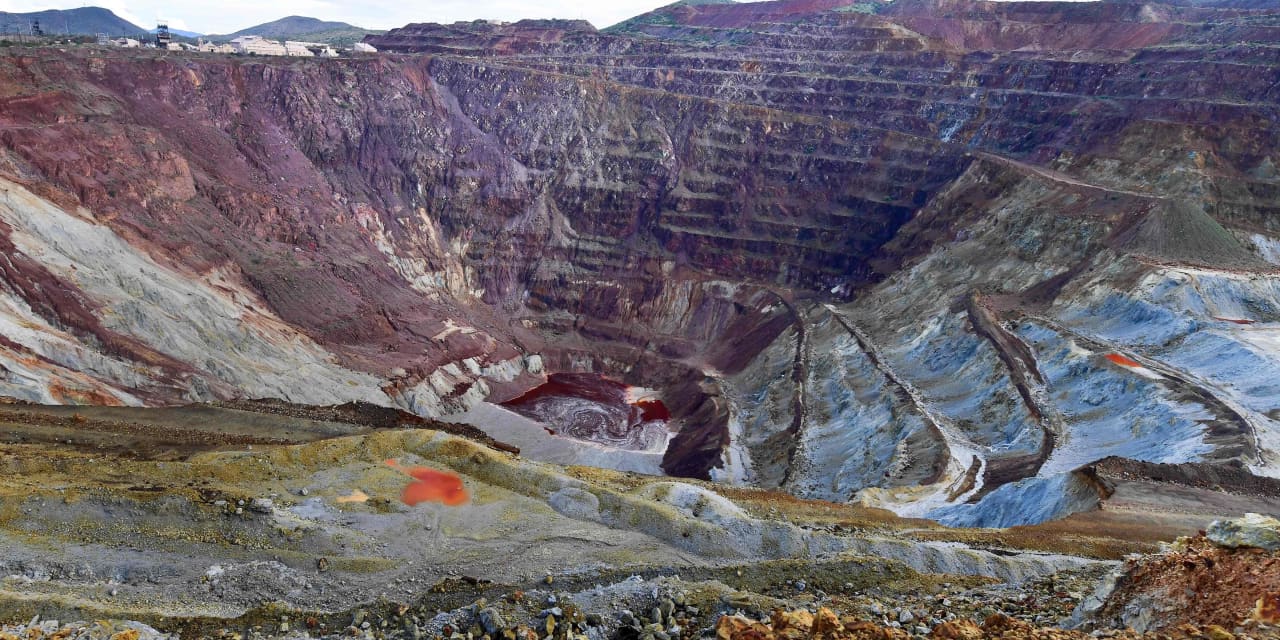

which are all major producers of copper or iron ore, stood out as fallers in London, as there was a decline in the prices of those commodities. Copper futures

HG00,

were down 1% while iron ore futures

TIOK21,

fell 1.5%.

A decline in commodities prices — including benchmark Brent

BRN00,

crude, which fell from near $70 a barrel on Wednesday to below $67 on Thursday, with the price of oil now pushing closer to $68 — came as stocks rallied. Equities across Europe were rebounding from days of declines from the beginning of the week, which were largely driven by U.S. inflation fears.

Wall Street enjoyed a strong rally on Thursday, reversing a near 4% fall on the S&P 500

SPX,

index over the week, with stocks in London playing catch-up on Friday.

“It has been a turbulent week as the scepter of inflation once again spooked investors however it looks like last night’s Wall Street rally is providing a port in a storm for the FTSE 100 as it enjoyed a solid bounce on Friday morning,” said Russ Mould, an analyst at AJ Bell.

Plus: Chip maker Alphawave tumbles on London debut after raising $1.2 billion in IPO

The analyst highlighted the risk from the COVID-19 situation in India, as the U.K. looks to further open up after months of lockdowns and ease travel restrictions.

“Keeping cases of the so-called Indian variant of COVID-19 under control is something the U.K. is facing up to and it is prompting some concern that the next phase of reopening might be delayed, or localized restrictions introduced. This uncertainty could hit the hospitality and travel sectors,” Mould warned.

However, travel and tourism stocks remained resilient on Friday, with shares in airline IAG

IAG,

— which owns British Airways, Aer Lingus, and Iberia — rising, along with low-cost carriers easyJet

EZJ,

Ryanair

RYA,

and Wizz Air

WIZZ,

Hotel operators Whitbread

WTB,

and InterContinental Hotels Group

IHG,

also gained.

Shares in U.K. enterprise software group Sage

SGE,

rose 3.5% — the biggest gainer on the FTSE 100 — after posting half-year results with earnings per share ahead of analyst expectations. The group also guided that its margins would trend upward beyond 2021.

Shares in Sanne

SNN,

a U.K. asset management services group and constituent of the midcap FTSE 250

MCX,

index, soared 21% higher, after its board rejected a £1.35 billion ($1.9 billion) buyout proposal from private-equity group Cinven.