This post was originally published on this site

Planning a comfortable retirement requires some serious thought — it also requires math. There’s no simple answer to the question, “How much do I need to save for retirement?”

There are, however, numerous factors to consider when figuring out that “magic” number. Working through the calculations of various expenses and lifestyle choices related to retirement is a far better approach than guessing how much you’ll need, be it $500,000, $1 million, or even more.

Retirement Tip of the Week: Don’t worry about having a concrete number to attain for your retirement savings, at least when you have a few decades to go, but do think carefully about the factors that will eventually dictate how much you need in retirement.

“Knowing your target number, especially when you’re far away, is unhelpful,” said Corbin Blackwell, a certified financial planner at online investment firm Betterment. “It can feel so overwhelming.”

Whether retirement is 30 years away or only 10, there are various lifestyle choices individuals will have to make, including where to live, whether to take on an expensive hobby like traveling the world, or what amount of money (if any) to leave relatives. There are also financial components no one can avoid, such as taxes or health expenses. And then there are the unknowns, such as longevity and unexpected personal and global crises.

Have a question about your retirement, including where to live? Check out MarketWatch’s “Help Me Retire” column

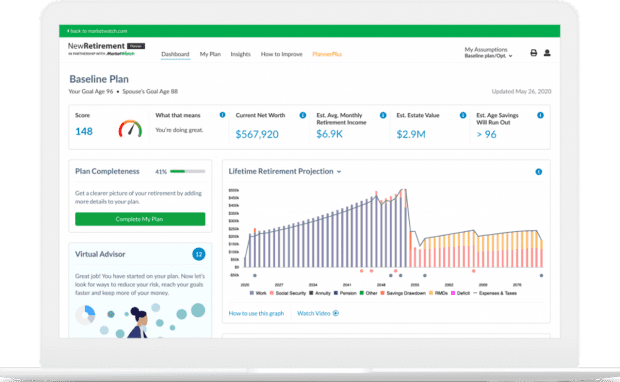

MarketWatch has teamed up with NewRetirement to offer readers a retirement savings planner, which can help people think big picture about their retirement goals. It incorporates many of the numbers future retirees will need to consider, such as: current age and life expectancy; marital status; income; expected Social Security benefits and claiming age; the balances of retirement savings accounts; plus current and anticipated future monthly expenses. The tool then breaks down the timeline until and in retirement, showing at what point the individual will draw down their retirement assets, and how much about they could expect to have or need.

The planner can be even more comprehensive if users share additional details, such as their goals for leaving a legacy, what they plan to do in retirement, or if they’ll be receiving a pension or purchasing an annuity.

There is also a more basic calculator available, which factors in marital status, expected retirement age and anticipated monthly expenses and considers alternatives, such as waiting to claim Social Security until age 70 or downsizing to a less expensive home in retirement. NewRetirement and MarketWatch have other calculators on the site too, including those that break down retirement income, net worth or when to retire.

Naturally, not everyone knows how much they’ll be spending in retirement, if they’ll have excessive health bills and what their housing situation will look like (or even where it will be) — especially when retirement isn’t for a few more decades. Numbers do not hold the same significance without some of these unknowns.

For those who don’t know all of these figures yet, one strategy is to start with where you can, Blackwell said. One solid figure right now is not as beneficial as seeing what you can save and where you can make a difference in your personal finances.

Individuals just starting out in their careers may be constrained by their cash flow, so instead they should try to attain small but meaningful achievements, such as meeting an employer’s 401(k) match, increasing the amount they save in a 401(k) even slightly, contributing a couple of dollars to their individual retirement account or avoiding unnecessary purchases. (Don’t cut out all luxuries or nonessential spending — depriving oneself of small joys isn’t helpful, either).

Online calculators like the NewRetirement one, as well as others financial firms offer (such as Betterment, Fidelity and Vanguard), can help provide an overarching idea of how to plan, but remember, there will be many twists and turns to retirement along the way.

Want more actionable tips for your retirement savings journey? Read MarketWatch’s “Retirement Hacks” column