This post was originally published on this site

Online retailing behemoth Amazon

AMZN,

easily beat first-quarter earnings forecasts, benefiting both from e-commerce as well as cloud-services demand — joining fellow technology megacaps Alphabet

GOOG,

Apple

AAPL,

Facebook

FB,

and Microsoft

MSFT,

in trumping sell-side earnings estimates.

Wasn’t the reopening of the economy supposed to hurt the tech giants? It doesn’t look like it so far, and that might be the biggest development this earnings season — that consumers are deciding to stick with their COVID-19 pandemic behavior even as vaccinations increase and restrictions are lifted. Corporate America also seems to be betting that consumers will stay online — the average advertising revenue growth of Alphabet, Facebook, Snap

SNAP,

Pinterest

PINS,

Twitter and Amazon was 55% in the first quarter, according to The Information, a tech news site.

“As we emerge from the pandemic, we expect to see many of the digital behaviors adopted by consumers in lockdowns to stick. Consequently, the tech megacaps that once again exceeded expectations in their earnings this week remain high quality options for investors,” says Nicholas Hancock, a tech, media and telecommunications analyst at Carmignac, a French fund management firm.

The cynics toward the tech giants have been wrong time and again, says Jani Ziedins, who writes the Cracked Market blog. “So much for fear of expensive, overbought, and every other cynical criticism thrown at these stocks. These companies keep doing what they are good at and it is little wonder their stock prices keep going up,” he writes.

“While this latest pop makes them even more expensive, high almost always gets even higher. Stick with what has been working and no doubt in a few weeks and months, people will be kicking themselves for not buying at these levels,” he advises.

Personal income may have surged

Expect a stunning jump in personal income for March — consensus expectations are for a 20% increase — alongside inflation and consumer spending data. Shortly after the open, data on the Chicago-area purchasing managers index and consumer sentiment will be released.

In the eurozone, gross domestic product fell by 0.6% in the first quarter, dragged down by a 1.7% retreat in Germany. Chinese economic data largely missed expectations.

Twitter

TWTR,

shares fell 12% in premarket trade, as the social-media service guided for worse current-quarter revenue than analysts anticipated. NIO

NIO,

the Chinese electric-vehicle maker, reported stronger-than-expected results.

Microvision

MVIS,

the laser-scanning technology company that has been popular with individual investors, may slide after reporting a worse-than-expected loss on smaller revenue than anticipated.

Chinese regulators summoned online financial services companies, including Tencent

700,

and JD.com

JD,

and told them to strengthen antimonopoly measures.

U.S. stock futures ease

After the 25th record close for the S&P 500

SPX,

on Thursday, U.S. stock futures

ES00,

NQ00,

drifted lower.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.65%.

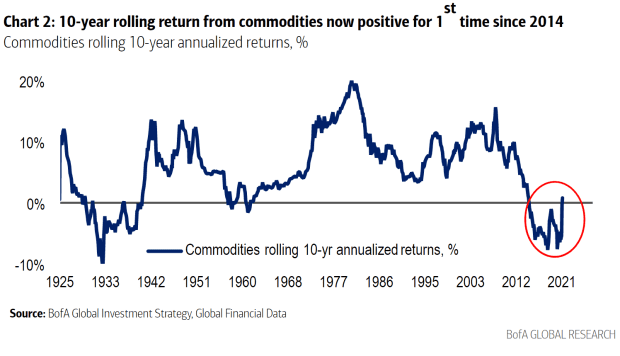

The chart

For the first time since 2014, the rolling 10-year return from commodities is now positive. The trade of 2021, says Bank of America strategist Michael Hartnett, has been long copper

HG00,

— up 28% — and short the 30-year Treasury

TMUBMUSD30Y,

which has fallen 14%.

Random reads

The woman who returned Lady Gaga’s dogs was among five people arrested in connection with the dognapping and shooting of the pop’s singer’s dogwalker.

Here’s an unusual eBay listing — Queen Elizabeth II’s former gold-plated Nintendo Wii is up for sale.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers