This post was originally published on this site

Wouldn’t it be funny if investors bailed on Charles de Vaulx’s mutual fund at exactly the wrong moment?

De Vaulx, a near-legendary figure among conservative, so-called ‘value’ investors, finally threw in the towel on IVA World a couple of months ago. The reason: Value investing has been doing so badly for so long that investors had finally given up.

But here’s the twist. Since the fund closed, by my quick calculations, De Vaulx’s stock picks have been booming.

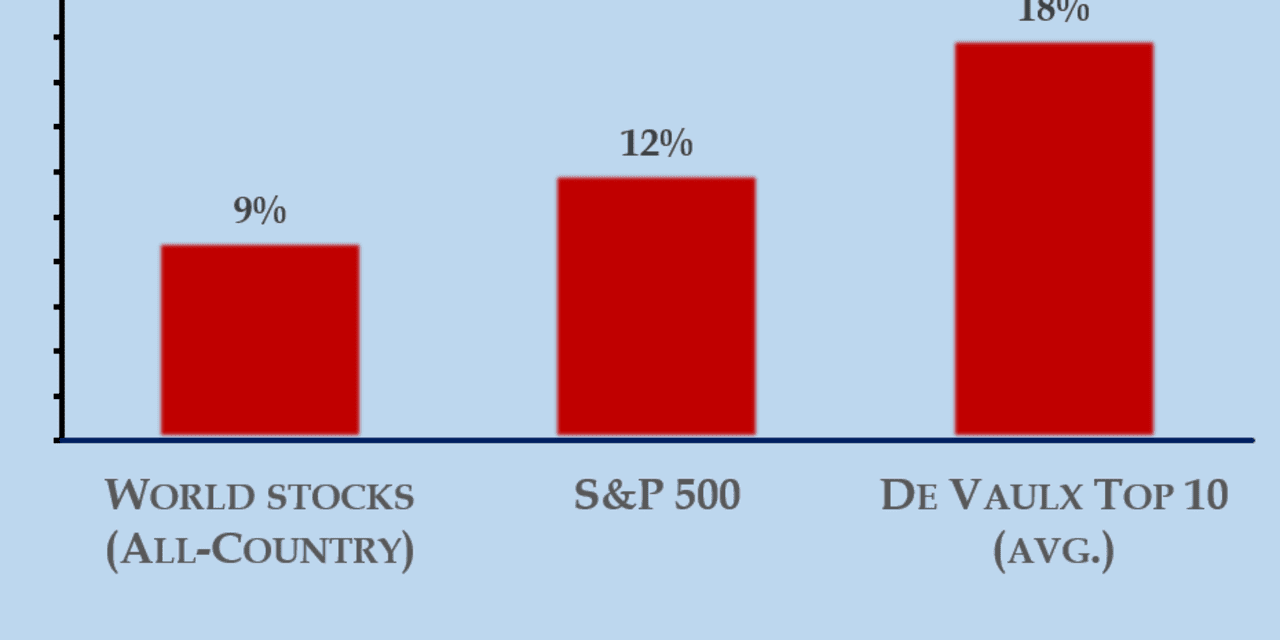

Since the end of January his ‘top 10’ stockholdings, which are disclosed on his website, have risen by an average of 18%

That’s seven points better than the S&P 500

SPX,

and twice as much as the MSCI AC World index

892400,

Admittedly IVA World included plenty of cash as well. On the other hand, since the end of January a benchmark lower-risk portfolio like Vanguard Balanced Index Fund

VBINX,

is only up about 5%.

Maybe it’s nothing. Maybe it’s just a short-term blip. But there’s another possibility, and it has compelling interest for all of us trying to save enough to retire.

De Vaulx’s closure of his fund, after a terrible 12 years for ‘value’ investors generally, could be one of those things you often see at the bottom of a market cycle. I remember a previous generation of value investors getting fired, or going out of business, at the peak of the dot-com bubble in early 2000.

It turned out to be exactly the right time for smart investors to bail from overpriced, dynamic, exciting ‘growth’ stocks and switch into low-price, stable, boring and typically very profitable ‘value’ stocks.

I also remember the bottom of the gold market, not long afterward. I was reporting in London, and there were very few gold market analysts even left in work. Most had retired, quit, or been laid off. The few still in work uniformly told me they expected gold prices to keep falling.

Gold was $260 an ounce at the time. Since then it’s gone up, oh, about 500%.

De Vaulx is only one manager. But he has a stellar reputation as a value investor, hunting for cheap stocks that trade for low multiples of their current earnings, or less than their notional liquidation value. When he launched his own firm, in the teeth of the 2008 market crash, he was flooded with applications. He had so much demand, he had to shut the doors to new investors within a couple of years.

Now he has so few takers for value investing he’s shut the business.

The experts still debate whether ‘value’ stocks typically produce higher overall returns over the long-term than more expensive, ‘growth’ stocks. An endless stream of dense academic papers, thick with Greek letters and various forms of financial astronomy (or astrology), debate the issue. There may be a simpler answer. Maybe value is likely to beat growth if you buy value stocks when they are wildly out of fashion and particularly cheap. The reverse is also true.

So in early 2000, when everyone wanted growth stocks and nobody wanted value, it turned out to be an excellent moment to sell down your Growth fund and move money into your Value fund.

Seven years later the cycle had gone the other way. Value had boomed. Growth had crashed. I remember around 2007 going to a financial industry dinner in Boston. I got talking to Jeremy Grantham, the famous (and generally bearish) chairman of GMO and one of the most-watched gurus in the money world. At the time he was predicting the financial collapse that was just about to happen. But he added that growth stocks looked like something of a bargain (at least in relative terms). They were so out of favor, and so unloved, that it was a buyer’s market.

Since then the Vanguard Growth

VUG,

ETF, to take a simple example, has earned about 500%. The Vanguard Value

VTV,

ETF: Less than half that.

It is an established fact that markets are driven by herd behavior and the more something seems to succeed, the more other people want to jump on board.

In 2019-20, growth outperformed value by an even wider margin than we saw during the fiasco of 1999-2000. The swing in fashion became so extreme that one of the best Value investors in the business gave up. If this turns out to mark another turning point, it would be par for Wall Street’s dismal course. Something for us to think about if we’re thinking of dumping any Value funds in our 401(k) after years of dull performance.