This post was originally published on this site

Bets on reflation and a surging post-COVID-19 economy have suffered a setback, but are poised to come roaring back, according to one of Wall Street’s most closely followed quantitative analysts.

“Our view is that the reflation and reopening trade will resume, with yields moving higher and rotation from growth, quality and defensives to value and cyclicals,” wrote Marko Kolanovic, JPMorgan’s global head of macro quantitative and derivatives research, in a Tuesday note.

As stocks initially rebounded from the bear market sparked by the COVID-19 pandemic, investors snapped up shares of tech companies and others seen benefiting from the stay-at-home environment, while stocks of companies more sensitive to the economic cycle were left behind. Growth stocks, shares of companies expected to see earnings and revenue grow faster than their peers, were the beneficiaries. Value stocks saw their long-running underperformance versus growth deepen.

That shifted late last fall as vaccines moved toward approval, sparking outperformance for cyclical stocks, as well as value and small-cap shares. Rising Treasury yields underlined the move, as investors factored in the potential for a surge in inflation, at least over the near term, as the economy reopened, the government spent trillions in fiscal stimulus and the Federal Reserve vowed to maintain extraordinarily loose monetary policy even as the economy runs hot.

But those reflation and recovery trades appeared to run out of steam in recent weeks as yields pulled back from 14-month highs, and rising COVID-19 cases outside the U.S., particularly in India and Turkey, raised worries about the global economic outlook.

Related: Why it may still be early days for the stock-market reflation trade

But now a shift back toward those reopening themes is due, and its likely to outdo its earlier iteration, Kolanovic said.

“With U.S. and Europe cases now declining, the fast pace of vaccination and seasonal tailwinds (Northern Hemisphere), we believe that the reopening and reflation trade will resume with a move that will be bigger than we saw early this year,” he wrote. “COVID-19 recovery this spring/summer will take place in stages with the U.S. recovering first, followed by Europe and finally emerging markets. This will prolong the rotation and prevent yields from rising too fast and destabilizing equity multiples.”

He expects beneficiaries to include the energy, financials, materials and industrials sectors, alongside small-cap stocks and equities with higher-than-average volatility.

J.P. Morgan Quantitative and Derivatives Strategy

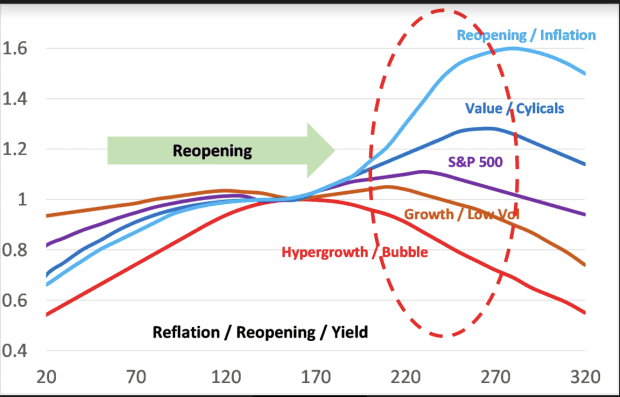

In the chart above Kolanovic and his team used bond yields as a proxy measure of reflation/reopening on the horizontal axis, while the vertical axis measures the performance of various equity-market segments.

“As the COVID-19 recovery takes place, reopening, reflation and inflation themes, and value likely will significantly outperform growth and defensives,” he wrote.

Stocks lost ground in Tuesday’s session, with the Dow Jones Industrial Average

DJIA,

falling more than 250 points, or 0.8%. The S&P 500

SPX,

fell 0.7%, while the tech-heavy Nasdaq Composite

COMP,

dropped 0.9% and the small-capitalization Russell 2000

RUT,

tumbled 2%.