This post was originally published on this site

Think big tech stocks are too toppy?

Lately, it has been a near daily tug of war when it comes to whether the lofty share prices of highflying technology companies can be justified, particularly as benchmark bond yields

BX:TMUBMUSD10Y

rise from pandemic lows and a greater share of the U.S. population gets vaccinated against COVID-19, spurring hope for a robust economic recovery.

The technology-heavy Nasdaq Composite Index

COMP,

closed down 0.9% Tuesday, while the S&P 500 index

SPX,

lost 0.7% and blue-chip Dow Jones Industrial Average

DJIA,

slumped 0.8%.

Shares of Apple, Inc.

AAPL,

the world’s largest company when measured by market capitalization, fell 1.3%.

But as investors embrace an on-again, off-again love affair with tech stocks, it may be worthwhile to look at how much big companies, not just individuals, have been spending at tech giants like Apple, Amazon.com Inc.

AMZN,

Google parent Alphabet Inc.

GOOG,

Microsoft Corp.

MSFT,

and Salesforce.com Inc.

CRM,

in recent decades.

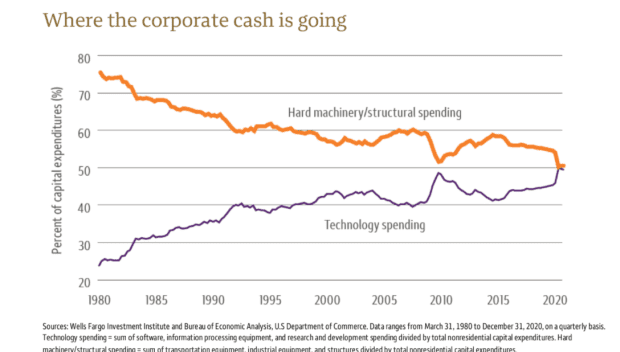

Consider this chart from Wells Fargo Investment Institute, which shows about half of all corporate capital expenditures flowed toward technology in 2020, up from only 24% in 1980.

Technology spending boom isn’t likely going away

Wells Fargo Institute, Bureau of Economic Analysis

As MarketWatch’s Philip van Doorn points out, Apple’s Services category, including cloud storage and backup, digital content and payment services, has growing rapidly to become its second-largest reported business category.

Analysts at the Wells Fargo Investment Institute pointed to the tumult sparked by the pandemic and the Federal Reserves’s quick action in slashing benchmark interest rates to near zero as partial reasons for last year’s record share of corporate cash flowing into technology.

“This allowed many firms to borrow low-cost capital and employ debt in an effort to accelerate growth,” the team wrote in a Tuesday note.

Related: Get ready for stock buybacks to roar back

But the team also pointed to a broader shift over the past four decades in how companies do their work and stay competitive.

“We believe capital expenditures are at an inflection point, with technology spending poised to eclipse hard machinery spending for the first time in history,” the team wrote. “We remain favorable on the Information Technology sector.”

Also see: Should you buy Apple stock? Here are the key numbers to look at now

Read next: The FAANG stocks, in these uncertain times, are expected to rise as much as 35% over the next year