This post was originally published on this site

The COVID-19 pandemic has not only been disrupting lives and businesses around the world for more than a year, but also the credit ratings of big corporations.

Corporate credit ratings serve as a key measure of creditworthiness, but also can determine borrowing costs. They range from AAA for top-notch companies like Johnson & Johnson

JNJ,

and Microsoft Corp.

MSFT,

to D for defaulted businesses.

Increasingly, credit ratings also can signal a potential path to recovery for industries hard-hit by the prolonged public-health crisis.

Take travel and leisure, a sector that saw half of all investment-grade companies globally drop to high-yield, or “junk,” status during the pandemic, according to a new report from Credit Benchmark.

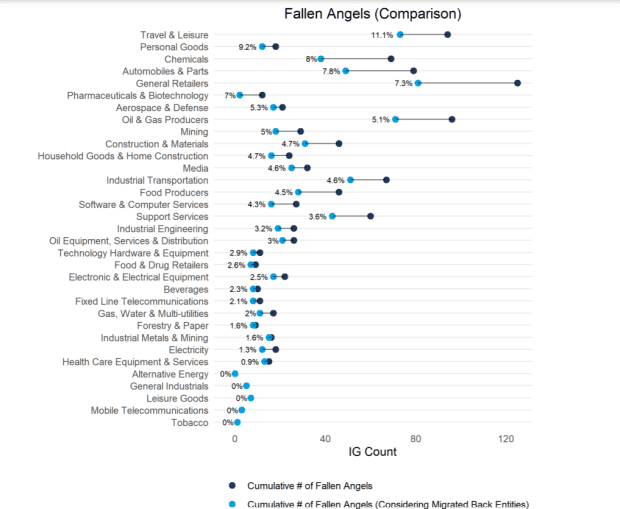

Even as parts of Europe remain in a lockdown to contain the coronavirus, travel and leisure has experienced the highest share of “fallen angels” (at 11.1%) returning to investment-grade status during the crisis, (see chart below).

Fallen angels, rising stars

Credit Benchmark

The report identified 1,051 fallen angels out of 6,895 companies it sampled globally, or about 15% of the total. It found that about 5% migrated back to investment-grade.

Retailers, oil and gas, and the automobile and parts sectors also were volatile on the credit-ratings front in the past year, according to the report, with migrations between the two major brackets now a key focus for investors.

Read: The next rising stars of the debt world? Probably corporate fallen angels

Upgrades and downgrades can make a big difference for a company in terms of its borrowing costs. The average yield on bonds issued by U.S. investment-grade companies now sits in the 2.21% range, whereas it’s nearly double for those in speculative-grade territory at about 4.21%.

Those rates matter, particularly in the past year as cruise companies, including Carnival Corp

CCL,

Royal Caribbean Group

RCL,

and Norwegian Cruise Line Holdings Ltd

NCLH,

have borrowed billions as their ships largely have been idle.

But along with other “recovery” trades, shares of Carnival were up 31.9% year to date Thursday, while those of Royal Caribbean and Norwegian were up about 20%, according to FactSet data.

That compares with the Dow Jones Industrial Average’s

DJIA,

gain of 9.5% for the same period, while the S&P 500 index

SPX,

has advanced 9.1%.