This post was originally published on this site

President Joe Biden is due to present his infrastructure spending plan on Wednesday, the opening salvo in getting legislation through Congress to fix crumbling roads and bridges.

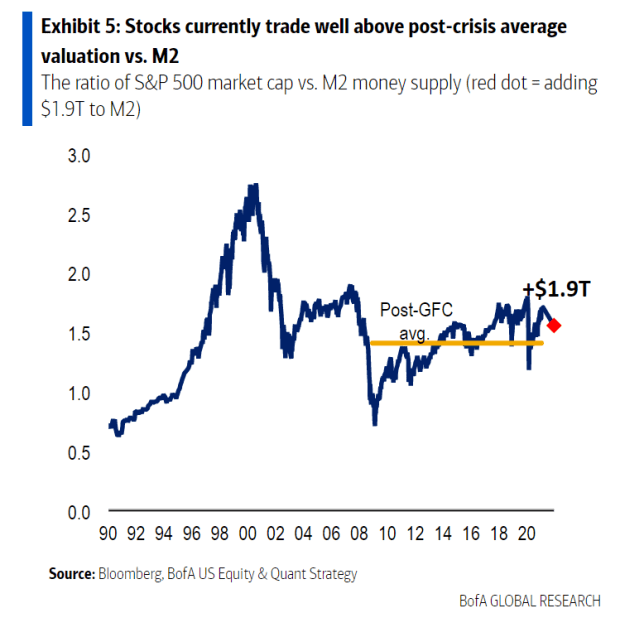

Strategists at Bank of America led by Savita Subramanian say Wall Street already is starting to price in infrastructure spending that could reach $4 trillion. They say the ratio of the S&P 500’s

SPX,

market cap to the M2 measure of money supply is an unusually high 1.7, compared with the average of 1.4 since the 2008 financial crisis.

There is also the downside as well, as the market reacts to likely corporate tax hikes and the rise in the 10-year Treasury

TMUBMUSD10Y,

that lifts corporate debt expenses. “Infrastructure spending is spread out over years, but a corporate tax hike would hit immediately,” they say.

Industrials and materials will likely be the biggest beneficiaries of an infrastructure bill, along with U.S. small-caps, whose sales are highly correlated to U.S. capital spending cycles, the strategists say.

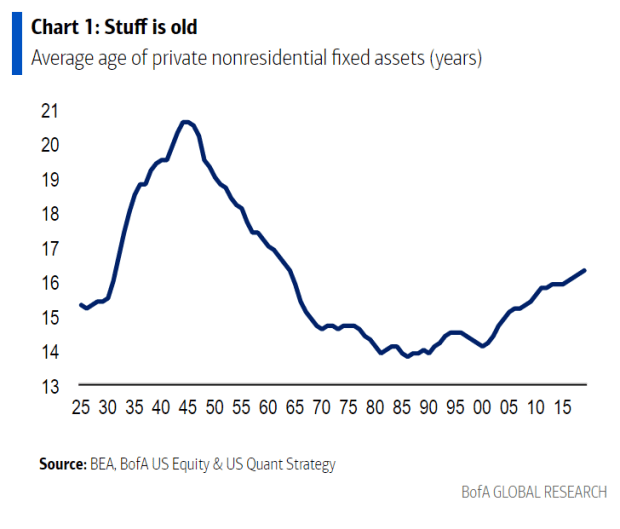

But which ones? The strategists screened S&P 500 companies, back to 1986, to find the highest sales growth sensitivity to the components of U.S. private nonresidential fixed investment.

For the highest sales sensitivity to nonresidential fixed investment in structures, it is a group led by pipeline owner Kinder Morgan

KMI,

exchange operator Intercontinental Exchange

ICE,

oil field equipment operator NOV

NOV,

stock-exchange owner Nasdaq

NDAQ,

and healthcare real-estate investment trust Ventas

VTR,

For the highest sales sensitivity to technology equipment investment, it is pharmaceutical Incyte

INCY,

microchip equipment maker Lam Research

LRCX,

electric utility Centerpoint Energy

CNP,

cloud services company NetApp

NTAP,

and chip equipment maker Applied Materials

AMAT,

The highest sales sensitivity to industrial investment includes some of the same companies: Incyte, biotech Vertex Pharmaceuticals

VRTX,

home-energy technology maker Enphase Energy

ENPH,

Lam Research

LRCX,

and fertilizer maker CF Industries

CF,

The highest sales sensitivity to intellectual property investment were network services provider Akamai Technologies

AKAM,

travel services provider Booking Holdings

BKNG,

internet retailer Amazon.com

AMZN,

network equipment maker Juniper Networks

JNPR,

and network services firm F5 Networks

FFIV,

The strategists also looked at companies that would benefit from reshoring, which include paper and packaging firm WestRock

WRK,

Ventas, CenterPoint Energy, high-tech lender SVB Financial

SIVB,

and natural-gas distributor Duke Energy

DUK,

Waiting for Pittsburgh

Biden is due to deliver remarks in Pittsburgh on infrastructure spending shortly after trading ends, at 4:20 p.m. Eastern. The White House said what is called The American Jobs Plan will include $2 trillion in spending over 10 years and will be fully paid for with $2 trillion in taxes over 15 years, including by hiking the corporate tax rate to 28%, increasing the global minimum tax on U.S. multinationals and establishing what is called a 15% minimum tax on book income. Published reports say the White House will lay out plans for roughly $2 trillion more in spending on education and healthcare in a month’s time.

The economics calendar includes the ADP estimate of private-sector employment, as well as the Chicago-area purchasing managers index and pending-home sales releases.

The Organization of the Petroleum Exporting Countries is meeting, ahead of the larger gathering on Thursday that will include nonmembers such as Russia. OPEC on Tuesday revised lower its estimate of oil demand, citing rising COVID-19 infections and lockdown measures being reimposed.

Apple

AAPL,

rose in premarket trade after UBS upgraded the iPhone maker to buy from neutral, citing hopes of a branded electric vehicle.

BlackBerry

BB,

shares may drop after the security software provider reported weaker-than-expected revenue, which the company blamed on a delay in selling patent licenses.

Athletic apparel maker Lululemon Athletica

LULU,

reported stronger-than-forecast quarterly earnings. Pet-food supplier Chewy

CHWY,

also topped expectations.

Online food delivery company Deliveroo flopped in its first day of trading, with the Amazon-backed company sliding as much as 30% in London trade.

Rep. Matt Gaetz was the top trend on Google after the New York Times reported he is under investigation over a relationship with a 17-year-old.

Want to understand the future of cryptos and NFTs? Register for MarketWatch’s free live event

Steady markets

U.S. stock futures

ES00,

NQ00,

traded in a tight range, after two straight declines for the S&P 500. The yield on the 10-year Treasury was 1.73%.

Random reads

A Tokyo bar has a stock market theme, with drinks named “Margin Call” and “Lehman Shock” and books on value investing.

The Mars rover took a stunning selfie.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.