This post was originally published on this site

Which industry historically has been the best inflation hedge? Most investors would say gold and gold mining. The correct answer is health care, according to study I conducted on the performance of 49 industry groups since 1926. I relied on data from Dartmouth College professor Ken French.

Consider the extent to which changes in the Consumer Price Index over the trailing 24 months explain or predict contemporaneous changes in an index of health care stocks. (The statistic I calculated is known as the r-squared: A reading of 100% would mean that changes in the CPI explained and predicted all of the changes in the health care industry, while a reading of 0% would mean that the CPI had no explanatory power.) When focusing on all data since 1926, the r-squared is a statistically significant 23.2%. No other industry group comes close.

Gold GC00, +0.17% is in second place, and its comparable r-squared is 13.6%. (I reached similar results when focusing on just the period since the early 1970s, which is when gold bullion ownership in the U.S. became legal.)

You shouldn’t be surprised that health care beats out other industries in hedging inflation. That’s because demand for health care is relatively immune from inflationary pressures. Except for the most elective of procedures you’re not likely to turn down medical care because of increasing price. Consider how fast the CPI for medical care has increased since the late 1940s (the earliest for which data are available): It has increased by a multiple of 40 over the ensuing seven decades. Over the same period, the regular CPI has increased by a factor of 12. (These rates of increase are equivalent to 5.1% and 3.4% on an annualized basis).

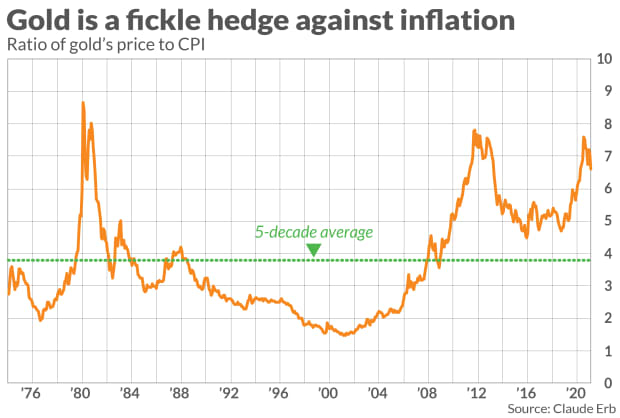

Nor should you be surprised that gold mining shares have not done as well as health care stocks. The relationship between the CPI and gold’s price has been anything but stable or consistent over time, as you can see from the chart below. That’s another way of saying that sometimes gold greatly outpaces inflation and other times in which it significantly lags.

You might be interested to know which industry historically has been the worst inflation hedge. The answer: candy; snacks and soda. The reason is that demand for the products sold by these companies are extremely price sensitive — just the opposite of health care services.

What about the overall stock market, as represented by indices such as the S&P 500 SPX, +0.14% ? I focused on this index’s inflation-hedging abilities in a column several weeks ago, pointing out that most investors fail to appreciate that a stock market index fund is one of the best long-term inflation hedges available. Because of investors’ mistake, however, the broad stock market historically has been a poor inflation hedge over the shorter term of a year or two. It only becomes an excellent hedge when bought and held over periods of several decades.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Why inflation makes holding bonds for the long run riskier than owning stocks

Plus: Value stocks are making a comeback. Don’t get left behind, these analysts say