This post was originally published on this site

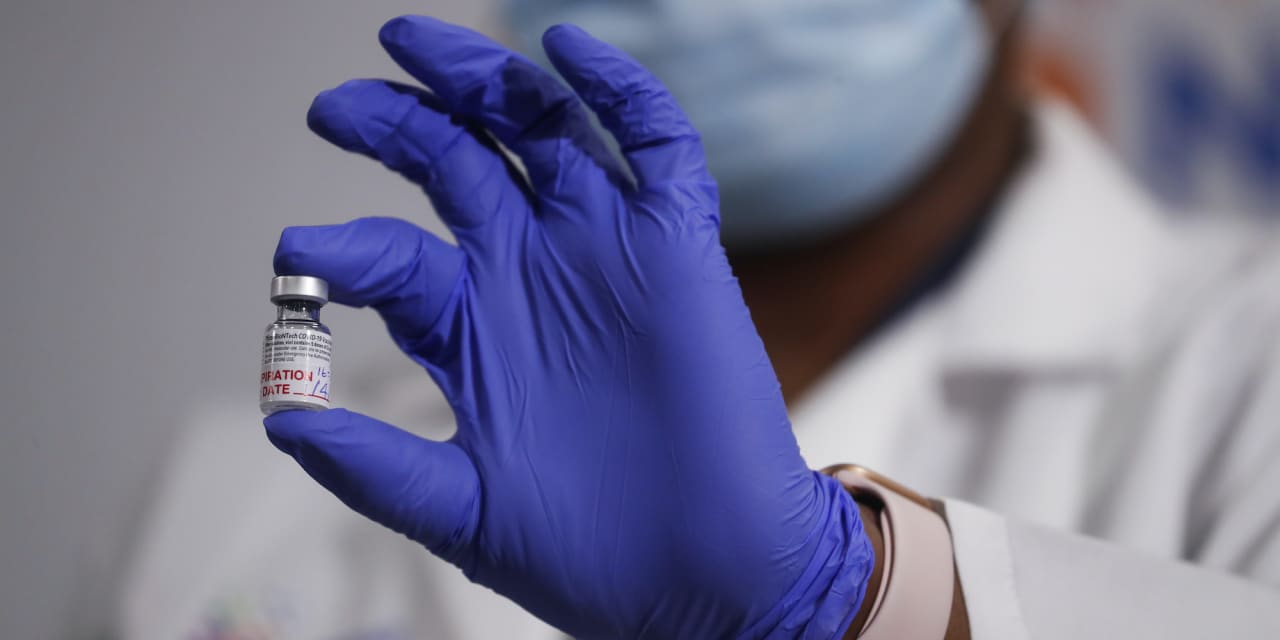

One Medical Chief Executive Amir Dan Rubin denied that his tech-enabled chain of medical clinics had knowingly allowed ineligible clients to receive the COVID-19 vaccine on Thursday, after reports that regulators had halted vaccine distribution to the clinics.

“We strongly refute these gross mischaracterizations. Any assertions that we broadly and knowingly disregard eligibility guidelines are not true and in contradiction to our actual approach,” Rubin said in response to the first question from an analyst in Thursday’s earnings conference call for One Medical’s parent company, 1Life Healthcare Inc. ONEM, -6.38%.

National Public Radio reported Wednesday that employees attempted to warn the company that ineligible patients were receiving the vaccines across the West Coast and were ignored, after two employees told a Forbes reporter earlier this month that ineligible customers in California were receiving vaccines. NPR reported that Washington state had halted vaccine distributions to the clinics, and the San Francisco Chronicle reported that regulators had done the same in the Bay Area, taking back thousands of vaccine doses that had already been distributed to clinics in the company’s home city of San Francisco.

For more: San Francisco reportedly cuts off COVID vaccine doses to One Medical

Rubin listed at least four eligibility “checkpoints” in One Medical’s vaccine process in Thursday’s conference call, and noted that eligibility requirements can vary across states and counties, including difference in neighboring counties’ rules.

“However, it is still possible that some people either misrepresented themselves, abused our trust or booked outside the specific eligibility criteria for their county, maybe even if they were eligible in another adjacent county,” he said. “But, in summary, we believe these articles are a gross mischaracterization of our outstanding work.”

One Medical offers primary-care clinics and online medical services for flat annual fees, and targets largely urban areas and working-age professionals. It has signed up large corporate clients, including Alphabet Inc.’s Google GOOGL, -3.26% GOOG, -3.05%, an investor in the business that has accounted for 10% of One Medical’s revenue in the past and has One Medical clinics at some of its offices.

The parent company of One Medical went public in January 2020 at a price of $14 a share, and has quadrupled that price at times on the public markets. The stock has declined for four consecutive sessions, a total drop of 14.2%, to $48.60, which gives the company a market capitalization of nearly $7 billion.

One Medical IPO: 5 things to know about the primary-care startup

1Life reported Thursday afternoon that it ended 2020 with more than half a million clients, growing 30% from the end of 2019. Revenue grew 37.6% to $380 million for the full year, but losses grew faster, 66.5%, to $89.4 million.

Rubin continued to sell investors and analysts on One Medical’s vaccination opportunity in the earnings presentation, including positive mentions of its role in San Francisco in an investor presentation released Thursday.

“While it is early days in the vaccine rollout, once the vaccine eligibility opens up to broader populations we believe that our multimodal-service model positions us well to continue to support our communities, our members and our employee clients,” Rubin said.