This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEC6C09B_M.jpg

Investing.com — The everything rally is back on. Unless you’re AB Inbev, that is.

Shares in the world’s largest brewer fell 5.4% on Thursday, missing out on a broad rally in global stocks, after investors zeroed in on a couple of nasties in the company’s update for the fourth quarter. AB Inbev (BR:ABI) stock was the worst performer in a Euro Stoxx index that was up 0.2%.

They’re now at their lowest level since Pfizer (NYSE:PFE) and BioNTech sparked the big reopening trade with their vaccine news in November, and continuing their long underperformance of rivals Carlsberg (OTC:CABGY), Heineken (OTC:HEINY) and Constellation Brands (NYSE:STZ).

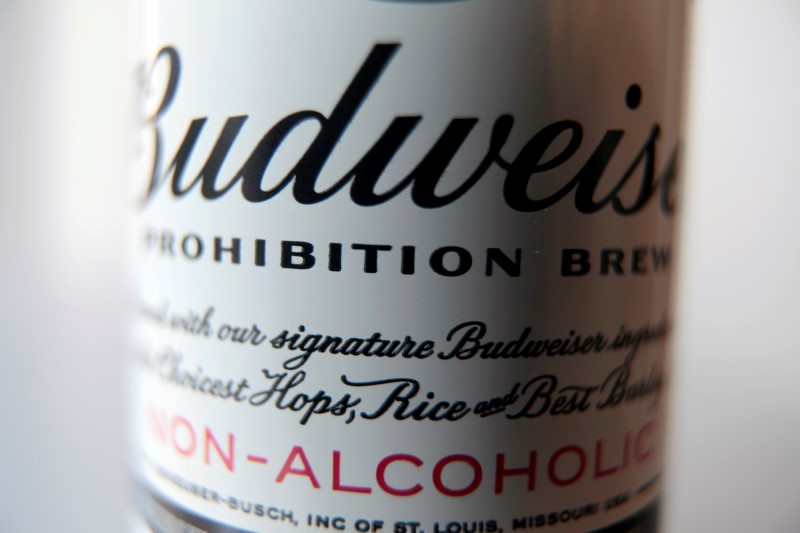

The brewer of Budweiser and Stella Artois actually reported better-than-expected sales for the quarter, with volume growth of 2.7% and revenue growth of 4.5%, pointing to continued success in squeezing more value out of its premium brands.

It also predicted a “meaningful” improvement in both sales and profit in 2021 as the pandemic ebbs.

However, the market was spooked by a sharp increase in input costs in the fourth quarter, and by the company’s warning that an “adverse channel and packaging mix, coupled with transactional FX and commodity headwinds,” will pressure its profit margins in the current year.

The pandemic hit brewers harder than spirits groups last year, given their greater exposure to sales through bars and restaurants. Customers forced to switch to drinking at home were more likely to stock up on wine and spirits than sit down for a multi-beer session with friends on Zoom.

Beer drunk at home comes from cans and bottles, rather than barrels. That means higher packaging and logistics costs per unit sold and lower margins. A high percentage of beer sales goes to the low-wage demographic that has been worst hit by pandemic, making it harder to pass on cost increases.

Such factors, combined with lower overall operating leverage, pushed the group’s cost of sales up by 7.9% in the fourth quarter.

The particular problem with ABI is that it desperately needs to maintain high underlying profitability to service the debt load that it still carries after its merger with SAB Miller. Net debt rose to 4.8 times EBITDA in 2020, the profit measure that ABI’s investors track most closely, from 4.0 times a year earlier. The group’s target is a multiple of 2.

Nor does it help that 44% of the debt on ABI’s balance sheet is in currencies other than dollars, notably in euros. The high share of local currencies in its revenue mix is a natural hedge but the euro is not weakening in real terms the way that the dollar is. The headwinds can be mitigated, but they won’t go away entirely this year.

After Federal Reserve Chairman Jerome Powell spent the last two days reassuring Congress that borrowing costs will stay near zero for another three years, highly-indebted companies – facing a global economic upswing – ought to be those breathing the biggest sighs of relief. Unfortunately for ABI, the sighs are of a very different kind.