This post was originally published on this site

The Ark Innovation ETF has been a top performer. But there are always pullbacks, or worse, for any investing approach.

The Ark Innovation ETF ARKK, -6.19% holds 52 stocks of companies selected by Cathie Wood, founder and CEO of ARK Invest, that are involved with innovation in various technology, products or services.

The actively managed exchange traded fund was established on Oct. 31, 2014.

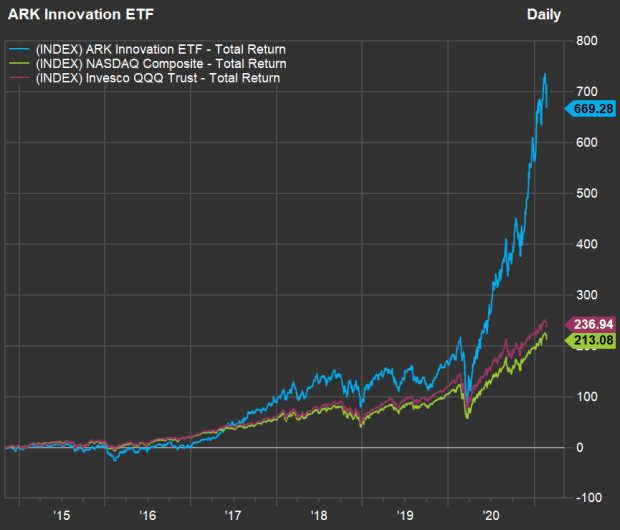

Here’s how it performed from inception through the close Feb. 22, 2021, compared with the Nasdaq Composite Index COMP, -2.16% and the QQQ Trust QQQ, -2.01%, which tracks the Nasdaq-100 Index NDX, -1.94% :

The ARK Innovation ETF took flight last year. (FactSet)

But ARKK’s shares were down as much as 12% in early trading Feb. 23, and were down as much as 18% from their close a week earlier (Feb. 16).

Fear of inflation, as evidenced by rising interest rates, has led to outperformance of value stocks and a decline for the Nasdaq Composite Index COMP, -2.16% over the past three weeks.

Read: If you think it’s time to shift to value stocks, here are Wall Street’s favorites

As of the close Feb. 22, the ETF’s largest holding was Tesla Inc. TSLA, -5.59%, which made up 8.3% of the ARKK portfolio, followed by Roku Inc. ROKU, -7.09%, with a 7.2% weighting, Square Inc. SQ, -6.26%, at 5.5%, Teladoc Health Inc. TDOC, -7.09%, at 5.1%, and Baidu Inc.’s BIDU, -7.89% American depositary receipts, at 3.9%.

Here’s how all five of those stocks were performing as of 11 a.m. ET on Feb. 23:

Here are the 20 worst performers among ARKK’s holdings over the past week: