This post was originally published on this site

How much higher can oil prices climb this year? Try $75 a barrel.

That is according to the latest forecasts from the commodities team at Goldman Sachs, which sees global benchmark Brent oil hitting that level by the third quarter, $10 above their prior forecasts, and $70 by the second quarter. Those gains will be driven by long-dated prices and steep backwardation — when futures prices are below spot prices — the team said.

“We now forecast that oil prices will rally sooner and higher, driven by lower expected inventories and higher marginal costs — at least in the short run — to restart upstream activity,” said the team — Damien Courvalin, Callum Bruce, Jeffrey Currie and Huan Wei — in a note to clients dated Sunday.

“We further believe that this additional rally will be supported by the current repositioning for a reflationary environment with investors turning to oil, buying a lagging real asset that benefits from a stimulus-driven recovery and has demonstrated an unmatched ability to hedge against inflation shocks,” the team added.

Hopes of an economic recovery from the pandemic, driven by rollouts of COVID-19 vaccines, have been pushing investors out of the perceived safe haven of bonds and into commodities and other assets. The yield on the 10-year Treasury note TMUBMUSD10Y, 1.350% reached 1.372% on Monday, after gaining 14.5 basis points last week. U.S. stock and European equities fell.

While off their recent highs as Texas and other U.S. states thawed from an intense and rare deep freeze, oil prices remain at levels not seen in more than a year, with April West Texas Intermediate crude futures CLH21, +3.06% at $59.69 a barrel, and May Brent BRNK21, +2.80% at $62.70 a barrel.

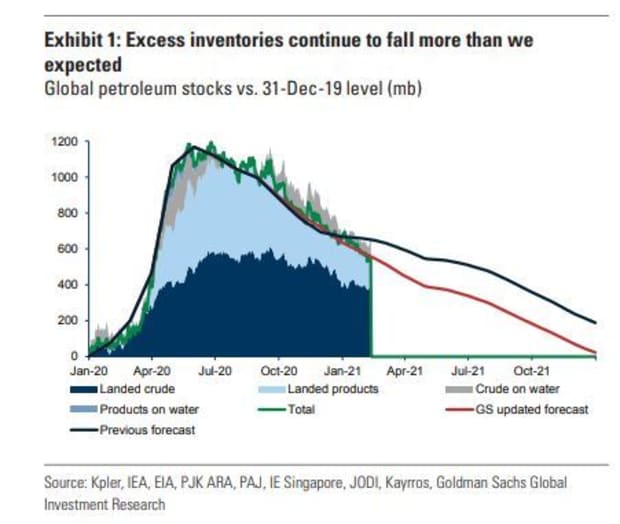

As for the fundamentals supporting prices, the team sees “better-than-expected demand and still-depressed supply once again creating a larger deficit than even we expected in January and February.” Starting in the spring, the oil deficit will likely widen as not even ramped up OPEC+ production (Organization of the Petroleum Exporting Countries and other producers such as Russia) can keep up with the bank’s “above consensus demand recovery forecast.” As well, it expects a recovery for Iran’s exports to take months.

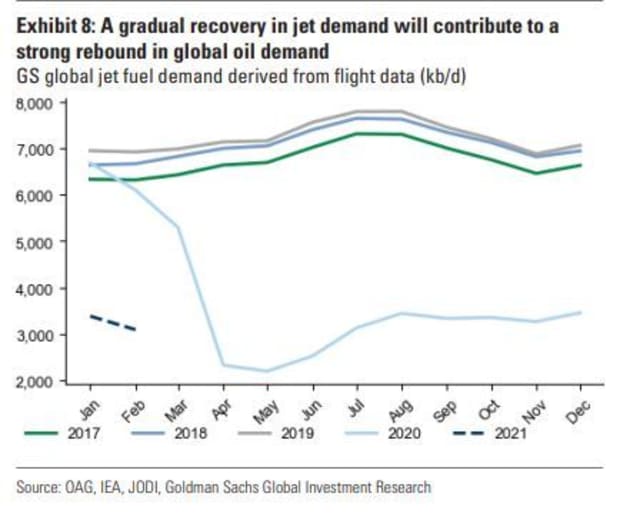

As vaccinations and warm weather drive jet demand, Courvalin and the team expect overall global demand to reach 100 million barrels a day by late July 2021 vs. August 2021 previously, predicts the team.

As for investors, they suggest positioning for those higher prices via either a front-month rolling index “to capture a cross-asset high 10% level of annualized positive carry,” or a long December 2021 Brent futures position that they first suggested in August, which “still offers a compelling entry point given recent producer hedging flow.” Carry represents return, in this case positive, that can be expected in the next year assuming unchanged spot and valuation prices.